PHOTO

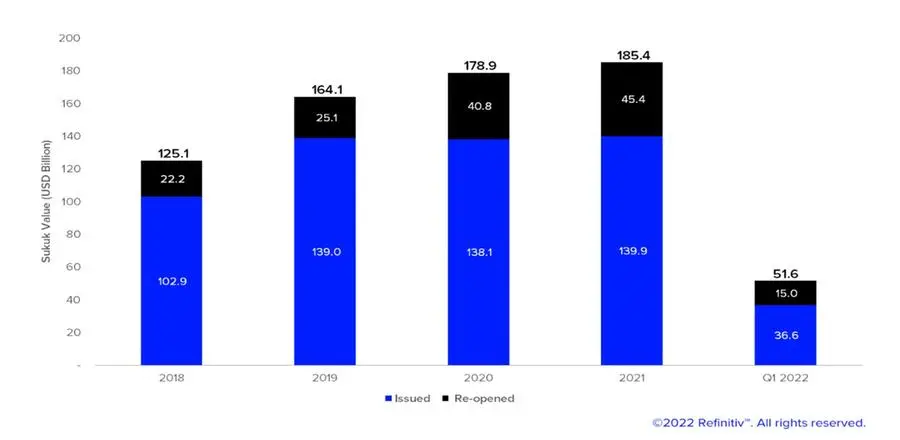

Sukuk issuance had a stronger than usual start to the year, based on the considerable momentum it had built up in 2021. Total sukuk issuance reached a total of $51.6 billion in Q1 2022, compared to $43.4 billion issued in Q1 2021, according to global data provider Refinitiv.

Sukuk Historical Issuance 2018–Q1 2022

Chart source: Sukuk Now app on Refinitiv™ Eikon

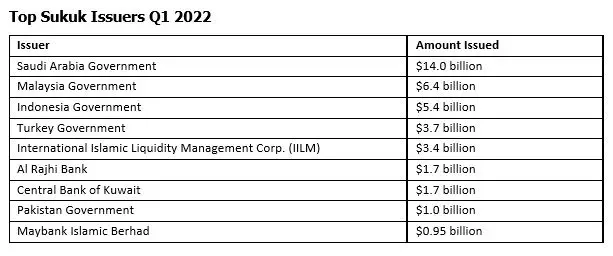

A boost came from sukuk issued by Saudi-based entities, which amounted to $17.9 billion in Q1 2022, outpacing issuances from market leader Malaysia for the first time. Sukuk issuance from Saudi Arabia nearly doubled from $9.3 billion in Q1 2021.

The Saudi government ramped up issuance through its domestic sukuk program despite higher oil prices that reached their highest level since the global financial crisis of 2008, amid rising demand for debt from highly rated issuers. The sovereign raised $14 billion during Q1 2022, up from $3.7 billion during the same period in 2021. This included a $7 billion in sukuk in March, issued with the purpose of consolidating domestic public debt under the sukuk program.

Source | Sukuk Now app on Refinitiv™ Eikon

Short-term Sukuk Outlook Remains Divergent

At the start of the year, while some market opinions were optimistic on sukuk growth, the general outlook was dampened by continued economic recovery and expectations of higher oil prices reducing government financing needs in core sukuk markets. However, as these developments actualized during the first quarter, their impact on sukuk issuance activity proved to be relatively muted compared to conventional bond markets.

The outlook for sukuk issuance in 2022 remains divergent. The burst in issuance momentum during Q1 is expected to wind down over the rest of the year as GCC government funding needs reduce in the short term.

Recent market commentary for Fitch Ratings’ Islamic Finance Group noted: “Downside risks stem from possibly higher oil prices reducing sovereign funding needs, funding diversification plans not being followed, complexities related to compliance with the standards of Accounting and Auditing Organization for Islamic Financial Institutions, political risks, interest-rate hikes and lower global investor appetite for EM debt.”

Alternatively, demand for sukuk, especially from Islamic banks, will likely be a considerable driver for sukuk issuance. The supply of sukuk in 2021 was estimated to have fallen short of demand by $178 billion, according to the 2021 Sukuk Perceptions and Forecast Study by Refinitiv.

Already robust demand will receive a boost from higher oil revenues introducing new liquidity into banking systems in core Islamic financial markets. Investors are also concerned that the Fed’s approach to interest rates is “too hawkish” and would keep yields relatively low in the short term, creating attractive opportunities for sub-investment grade sukuk issuers to tap the market.

Earlier in February, the Turkish government issued $3 billion in international sukuk, its first since the lira crash of 2021. The sukuk sold at 7.25 percent, slightly below initial guidance of 7.5–7.625 percent, and racked up an order book of $10.75 billion. Similarly, Pakistan, which is facing falling foreign exchange reserves, issued a $1 billion dollar-sukuk in January which attracted over $3 billion in bids. The sukuk sold at 7.95 percent after the sovereign was able to negotiate pricing down from a benchmark rate of 8.25–8.375 percent.

For more insights and analysis on the sukuk market size and trends, please visit Refinitiv Workspace/Eikon app, Sukuk Now.

(Reporting by Jinan AlTaitoon editing by Seban Scaria)