PHOTO

The COVID-19 pandemic has given added impetus to the inclusion of ethics and sustainability within business and investment decisions around the world, but a lack of consistent standards for sustainable Islamic financial products has contributed to a reverse in issuance of green sukuk.

In recent years, as with conventional markets, environmental, social and governance (ESG) considerations had been growing in importance within Islamic finance, with the inherently ethical nature of Shariah-compliant finance complemented by the sustainable financial practices being increasingly enacted in developed markets. Green bonds and sukuk in particular, as well as financing linked with sustainability, had become increasingly common in markets other than the developed countries where they originated.

GREEN SUKUK ISSUANCE TUMBLES WHILE GREEN BONDS SOAR

Sustainable bonds have seen explosive growth in recent quarters. Sustainable bond issuance now accounts for a tenth of global debt capital markets, having surged to $1 trillion in 2021, while sustainability-linked loans hit $717 billion, triple their previous record according to Refinitiv.

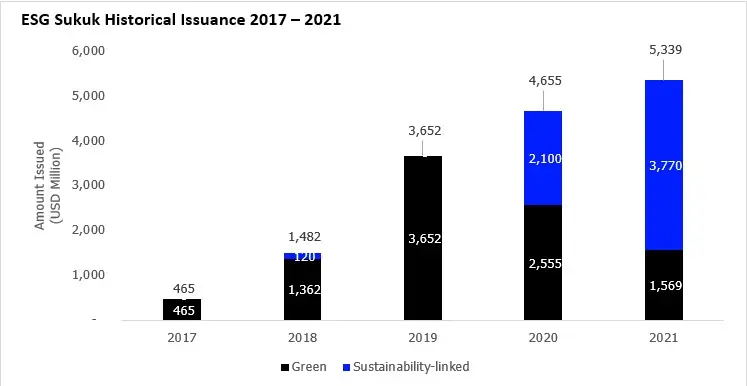

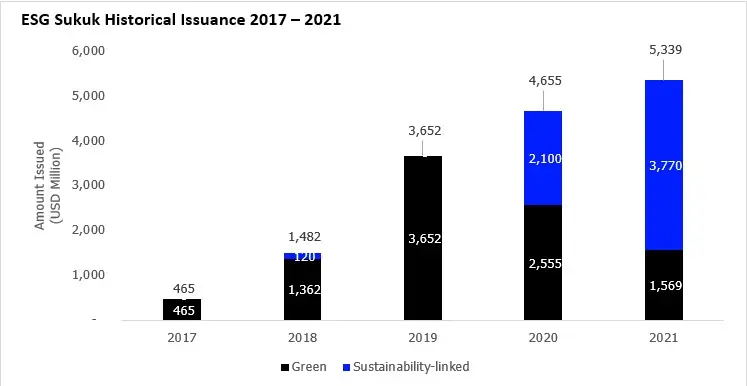

Issuance of sustainability-linked sukuk, which barely existed before the pandemic, also surged in 2021, to $3.77 billion from $2.10 billion the year before. But green sukuk reversed course. Just $1.57 billion worth of green sukuk were issued in 2021, compared with nearly $2.56 billion the year before.

The decline has been put down to high issuance costs, limited opportunities for funding decarbonization projects in some Muslim-majority countries, and above all, a lack of common standards within and between markets.

The rapid growth in ESG inclusion in both conventional and Islamic financial products has been so strong in recent years that financial authorities in many OIC jurisdictions have been developing their taxonomies and regulatory frameworks to create the common standards needed. This would provide greater clarity for investors to better understand just how sustainable their investments are and for both investors and businesses to be able to assess their exposures to threats such as climate change. The need for greater standardization of terms is just as pressing in conventional sustainable finance, where there are currently more than 600 ESG provisions around the world, according to EY.

MALAYSIA FORMALIZES ESG-SHARIAH LINK THROUGH VALUE-BASED INTERMEDIATION

Some Islamic financial markets are faster than others in instituting the necessary regulatory frameworks and taxonomies for Shariah and ESG financial products and services.

The first concerted, nationwide effort to embed ESG within the Islamic finance industry was the release of guidance on “value-based intermediation” (VBI) by Malaysia’s central bank, Bank Negara, in 2018. The aim was to move development of the Islamic finance industry away from technical questions of how to mirror various aspects of conventional finance and towards how to build on the ethical values inherent within Shariah principles. Today, the Islamic finance industry in Malaysia is expected to integrate VBI principles in both its conduct and practices, in line with ESG principles and UN Sustainable Development Goals.

In 2020, $2.2 billion of VBI-aligned financing was channelled by Islamic banks in Malaysia to around 235,000 accounts. Of this, 95.6 percent catered to green finance. Around a third of all Islamic banking institutions’ deposits and investment accounts are now VBI-aligned. To further the integration of ESG with Islamic finance in Malaysia, Bank Negara is developing a Climate Change and Principle-based Taxonomy to provide a common language the industry can use to support the transition to a low-carbon economy.

Beyond reframing the goals of Islamic finance, the industry in Malaysia is also helping to reshape the wider financial system there through the Sustainable and Responsible Investment Sukuk Framework and through VBI, with Islamic banking subsidiaries pushing sustainability agendas across the entire financial group.

INDONESIAN SOVEREIGN GREEN SUKUK HIGHLIGHTS STRENGTH OF DEMAND

Another market which has made concerted efforts to bring together sustainability and Islamic finance is Indonesia, which issued the world’s first sovereign green sukuk in 2018. This sukuk too was oversubscribed, attracting huge interest from around the world, and Indonesia has followed this up with further green sovereign sukuk, including a $3 billion sukuk wakala launched in May 2021. These sukuk have financed projects in renewable energy, sustainable transportation, waste to energy and waste management, and climate resilience for Indonesia’s vulnerable regions.

Indonesia has so far issued four such sukuk under its Green Bond and Sukuk Framework, developed in 2018 to finance or refinance projects that contribute to the country’s objectives of reducing greenhouse gas emissions, adapting to climate change, and preserving biodiversity.

DEMAND SURGING IN GCC BUT CLARITY STILL LACKING

Malaysia’s alignment of sustainability with Islamic finance and Indonesia’s hugely successful sovereign green sukuk issuances highlight the need for stepped-up regulatory efforts in other jurisdictions to clarify rules and taxonomies.

Demand for ESG and Shariah-compliant investment products within the GCC region is already evident, and a growing number of such products are becoming available, such as the $1.3 billion green sukuk issued by the Saudi Electricity Company in September 2020, which despite its size was heavily oversubscribed. The Saudi-based Islamic Development Bank also raised $2.5 billion through green and sustainability targeted sukuk issuances in March last year.

But more needs to be done at government levels for this market to reach its full potential. A key criterion of investment is trust, and without absolute confidence in the ESG or Shariah credentials of a product, which could be provided by clearly drawn rules and definitions, the market will continue to be held back.

Besides developing the regulatory background for Islamic ESG products, governments in the GCC could also develop this market by providing more incentives, following, for example, the lead of the Malaysian government, which pays the cost of third-party checks for issuers of SRI green bonds.

PUSHING STANDARDIZATION OF GREEN SUKUK

Still, though country-level efforts are sometimes falling short, there are moves beginning to standardize terms and regulations at a more global level. In order to coordinate international efforts to unlock the potential for green and sustainable sukuk and thereby direct investment towards reducing greenhouse gas emissions and mitigating the impacts of climate change on the most-affected countries, a High Level Working Group on Green Sukuk was convened in November 2021 by the Islamic Finance Council UK, the UK Treasury, Indonesia’s Ministry of Finance, Islamic Development Bank, London Stock Exchange and the Global Ethical Finance Initiative (GEFI).

The Working Group’s aim is to assist in setting global standards, to identify and address existing challenges, and to ensure green and sustainability sukuk are highlighted at future COP summits.

The formation of the International Sustainability Standards Board (ISSB) during COP26 in Glasgow in 2021 was another initiative to develop standards to meet investors’ needs.

With initiatives such as these, particularly if regulatory authorities in key Islamic finance regions such as the GCC step up their efforts, the potential for green Islamic financial instruments may be more fully realised and the UN’s Sustainable Development Goals reached.

(Reporting by Redha Al Ansari; editing by Seban Scaria)