Over the past few years, the UAE has emerged as a favourite regional destination for foreign capital inflows with the share of foreign direct investment (FDI) on a steady rise, a UAE newspaper has commented.

In an editorial on Tuesday, Gulf News said, "Foreign capital flows into a country consist of two main components such as the FDI and foreign portfolio investments. While FDI comes from direct foreign investments in green field ventures, start-ups, angel funding, venture capital, private equity investments and through mergers and acquisitions." Foreign portfolio investors take exposure to UAE asset classes through investments in equity of local companies or through bonds and sukuks of local sovereigns, government related entities and or corporates.

Clearly, the FDI component of foreign capital inflow stands out as a measure of long-term investor confidence in an economy as this class of investors take a longer term view on their return on investment, anchoring it on future political and economic stability of the country.

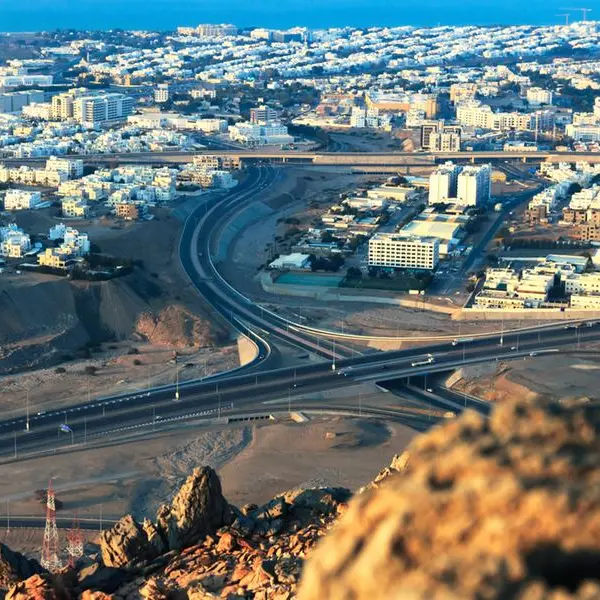

"Undoubtedly, in the UAE, elevated FDI is driven by the friendly business environment, excellent infrastructure, predictable economic policies, and political stability," added the editorial comment, noting that forecasts point to higher levels of FDI inflow into the UAE 2022 and 2023, thanks to investment-friendly political and economic reforms in the recent years.

To attract more investment into the UAE, the authorities have recently allowed the creation of special purpose companies for acquisition or mergers. Other changes to the commercial companies’ law include allowing branches of licensed foreign companies to transform into UAE commercial firms and eliminating nationality requirements for members of companies’ boards of directors and 100 per cent foreign ownership.

Also, privatising non-strategic government related entities (GREs) and enforcing competition laws and regulations on all entities would attract more FDI.

Foreign portfolio investments are relatively short term in nature and are susceptible to market volatility and cyclical factors. However, data for the past few years show foreign portfolio investment inflows have been fairly strong and sticky.

Strong fundamentals of local corporates, financial institutions and GREs make their debt and equity attractive to foreign investors.

Large financial buffers in the form of official reserves and sovereign wealth funds, solid returns, dollar-pegged currency make UAE’s sovereign debt and bonds and or sukuk issues from GREs superior to riskier securities in other emerging markets.

"In addition, underlying fundamentals such as better credit ratings, marked improvement in corporate governance standards are sure to keep foreign portfolio investors enticed," concluded the Dubai-based daily.

© Copyright Emirates News Agency (WAM) 2022.