PHOTO

Bond issuance in MENA has totalled $125.9 billion year-to-date (YTD), marking a 20% increase compared to the same period last year. Issuance volume jumped 27%, the highest nine-month tally on record, according to data from the London Stock Exchange Group (LSEG).

HSBC secured the top spot in the MENA bond bookrunner ranking by LSEG’s Investment Banking Review for the first nine months of 2025, with $13.2 billion in related proceeds and a 10.5% market share. Standard Chartered ranked second, followed by JPMorgan, Citi, and Goldman Sachs.

“We have a big on-the-ground presence in the UAE and in Saudi Arabia, which in turn provides us with deep and multi-year relationships with clients. [Our] superior capabilities are attested to by the large number of repeat mandates that we win yearly,” said Nour Safa, Managing Director, Head of MENA Debt Capital Markets at HSBC.

Saudi Arabia was the most active issuer nation during the first nine months of 2025, accounting for 54% of total bond proceeds, followed by the UAE (26%), and Qatar (9%).

“Saudi Arabia’s share of total bond proceeds, at 54%, is in line with the same percentage seen last year. However, the remainder of the supply has shifted, with issuances from countries that had been quieter in prior years, such as Kuwait and Oman,” Safa said.

Kuwait returned to the international debt markets in October, marking its first sovereign bond issuance in eight years, while Oman returned to the market, for the first time since 2021.

The regional DCM landscape this year has seen new trends emerge, including overwhelming subscriptions and tight spreads.

“Issuers have managed to achieve milestone results with record tight spreads and very healthy oversubscriptions. In some cases, curves have also been flattened. For example, Abu Dhabi paid just 8bps across its 3- and 10-year tranches, while Kuwait paid flat across 3- and 5-year maturities,” Safa said.

“Asian participation has been very strong in regional paper in 2025. It is much higher than compared to prior years. This comes on the back of Asian investors trying to diversify their holdings away from home and seeing the GCC as a safe haven instrument,” she added.

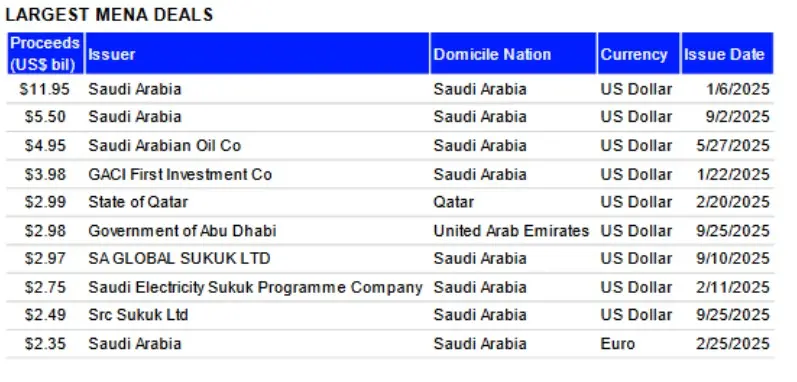

The largest MENA DCM deals so far include two Saudi sovereign issuances in January and September, which raised $11.95 billion and $5.50 billion, respectively, followed by Saudi Aramco’s $4.95 billion transaction in May.

While financial issuers accounted for 58% of proceeds raised during the first nine months of 2025, Government & Agencies accounted for 25%, according to LSEG data.

Saudi Arabia is likely to maintain its lead in the DCM landscape of the region owing to its funding requirements to sustain Vision 20230, which aims to reduce the kingdom’s dependence on oil. The kingdom’s DCM activities have outpaced ECM by three times as the PIF along with Aramco and the Saudi Electricity Company (SEC), the kingdom’s utilities giant, have turned to capital markets to fulfil funding needs, Moody’s said.

Aziz Al Sammarai, Assistant Vice President at Moody’s Ratings, said, “We expect continued growth in hospitality, retail and tourism; manufacturing and mining; and real estate, boosted by financial investments.”

“As the transformation deepens, the credit quality of the companies we rate will increasingly diverge as they continue to borrow to fund investment, with strategic clarity, disciplined execution and prudent financial policies [being] key credit differentiators,” he added.

Islamic bonds

Islamic bonds in the region raised $48.2 billion during the first nine months of 2025, 28% more than last year’s total, setting an all-time record. Sukuk account for 38% of total bond proceeds raised in the region, compared to 36% last year at this time.

According to LSEG data, HSBC and Standard Chartered each hold an 8.1% market share in the MENA Islamic bonds league table, with proceeds reaching more than $3.9 billion. Standard Chartered leads with 42 sukuk issuances year-to-date, followed by HSBC with 34, Emirates NBD with 37, Dubai Islamic Bank with 35, and JP Morgan with 30.

The top sukuk issuances so far include Saudi Arabia, which raised $2.97 billion through a dual-tranche US dollar-denominated sukuk in September 2025, marking its final dollar funding exercise of the year and its first sukuk compliant with AAOIFI standards. This was followed by Saudi Electricity Company (SEC), which raised $2.75 billion through a dual-tranche sukuk issuance in February 2025.

“GCC sukuk now account for 51% of total supply, up from 46% in 2024. We've already surpassed record volumes in MENA bond and sukuk markets and expect further growth this year,” Safa said.

(Reporting by Seban Scaria; editing by Daniel Luiz)

![<p>“We have a big on-the-ground presence in the UAE and in Saudi Arabia, which in turn provides us with deep and multi-year relationships with clients. [Our] superior capabilities are attested to by the large number of repeat mandates that we win yearly,” said Nour Safa, Managing Director, Head of MENA Debt Capital Markets at HSBC.</p>\\n](https://static.zawya.com/view/acePublic/alias/contentid/8edbc5e0-247f-4fdc-8633-3d2861bdf3f4/1/jgr_6527-jpg.webp?f=3%3A2&q=0.75&w=3840)