PHOTO

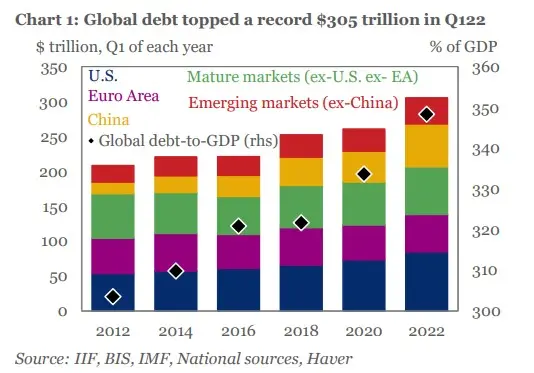

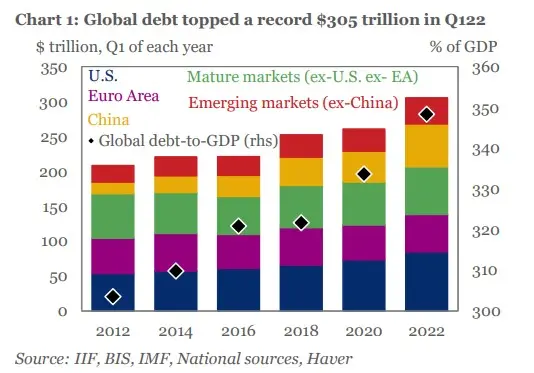

Global debt has increased by $3.3 trillion in Q1 2022 to a new record of over $305 trillion, largely driven by the world’s two largest economies, China and the US.

While China’s debt rose by $2.5 trillion in Q1, the US added $1.5 trillion. However, total debt in the Euro Area declined, the Institute of International Finance (IIF) said in its Global Debt Monitor Report.

The rise was mainly driven by corporate (ex-financials) and general government borrowing, with debt outside the financial sector now topping $236 trillion—up nearly $40 trillion since the onset of the pandemic.

Debt in Emerging Markets (EMs) are now approaching a record $100 trillion.

"As the ripple effects of the Russia-Ukraine war continue to disrupt global economic activity, growth is expected to slow significantly this year, with adverse implications for debt dynamics," the report noted.

Reflecting the surge in inflation, global debt-to-GDP ratio declined for the fourth consecutive quarter in Q1 2022. The drop was more evident in mature markets. At more than 348% of GDP, global debt is some 15 percentage points below its peak in Q1 2021, the IIF noted.

While the rising inflation will continue to help reduce debt ratios in general, sovereign and corporate borrowers that have less FX and short-term debt may benefit most from rising inflation, at least in the near term, IIF said, adding, as central banks move to curb inflationary pressures, higher borrowing costs will exacerbate debt vulnerabilities.

The impact could be more severe for those EM borrowers that have a less diversified investor base.

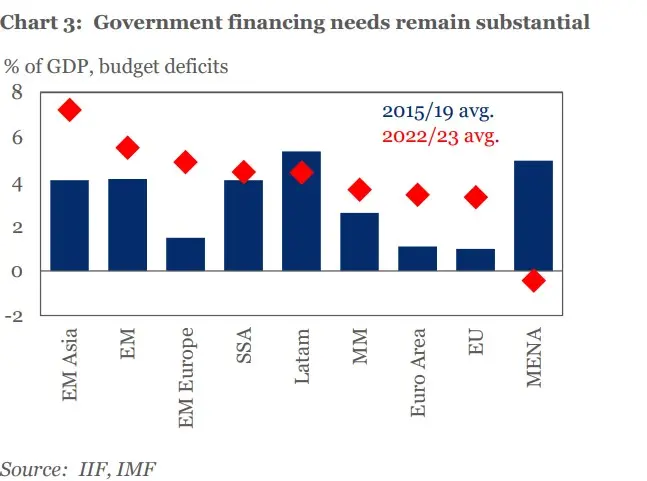

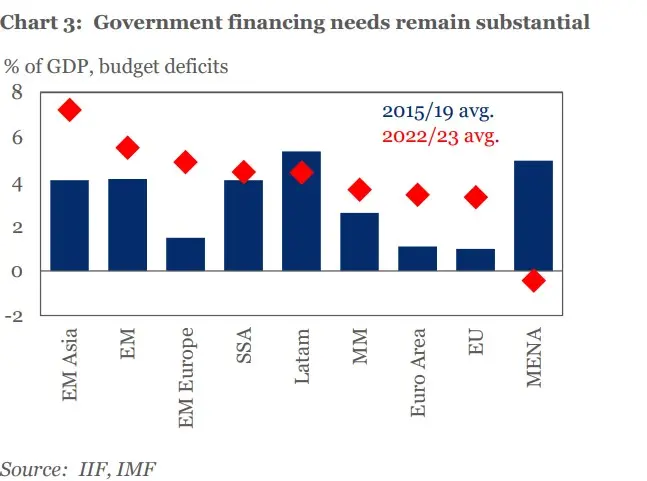

Due to rising borrowing costs, the sovereign balance sheets still remain under pressure, the IIF said. Global government debt has risen by 14 percentage points ($17.4 trillion) to 103% of GDP in Q1 2022, since the beginning of the pandemic.

"With government financing needs still running well above the pre-pandemic levels, higher and more volatile commodity prices could force some countries to increase public spending even further to ward off social unrest," said the IIF.

With rising levels of debt in the emerging markets, governments are facing the issue of lack of debt transparency, which results in higher borrowing costs and less access to private capital markets for borrowers.

"The lack of timely disclosure of public debt obligations, very limited coverage of contingent liabilities (including SOE liabilities) and the extensive use of confidentiality clauses are the major impediments causing information asymmetries between creditors and debtors," said the IIF report.

(Reporting by Seban Scaria; editing by Daniel Luiz)