PHOTO

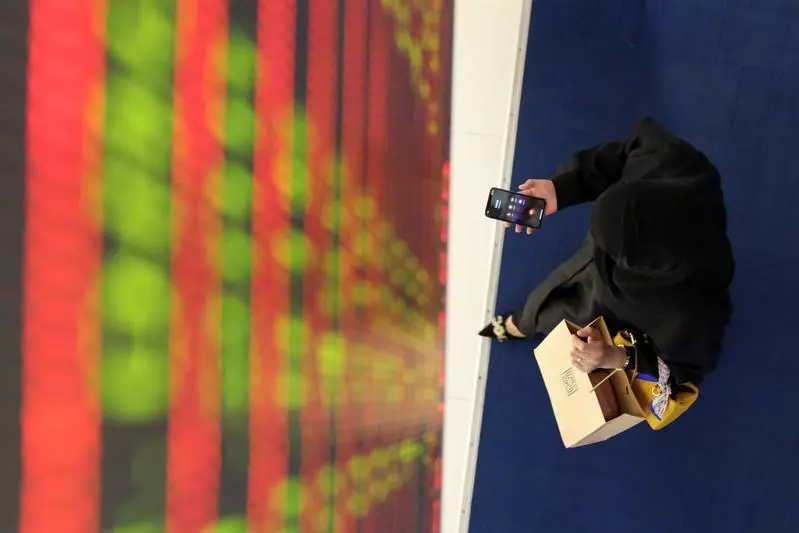

Most major stock markets in the Gulf fell in early trade on Thursday after weaker-than-expected U.S. GDP data and under- pressure from lower oil prices.

The U.S. economy contracted in the first quarter, largely because of a surge in imports as businesses sought to avoid expected tariffs.

U.S. President Donald Trump's tariff policies are likely to push the global economy into a recession this year, a Reuters poll found.

Saudi Arabia's benchmark index declined 0.7%, hit by a 0.6% fall in Al Rajhi Bank and a 1.4% decrease in Saudi Telecom Company.

As the region's major source of income, weaker oil prices weighed.

They extended losses on Thursday. A steep decline was triggered the previous session by the U.S. data and indications that Saudi Arabia, the world's biggest crude exporter, is prepared to raise output and expand its market share, in a potentially significant policy shift.

Dubai's main share index lost 0.6%, with Commercial Bank of Dubai retreating 6.1%, on course to snap four sessions of gains.

In Abu Dhabi, the index edged 0.1% higher, supported by a 0.4% rise in International Holding Company.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Rachna Uppal)

Reuters