PHOTO

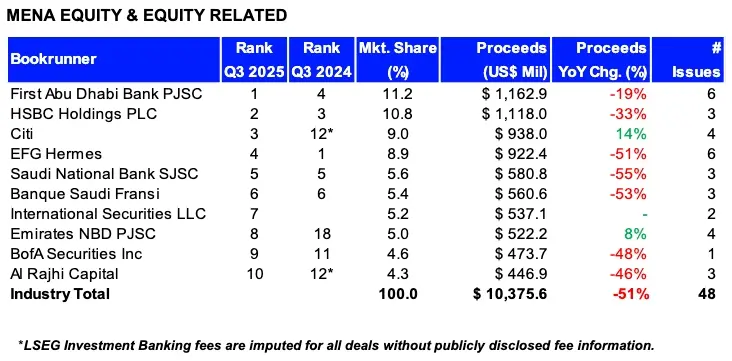

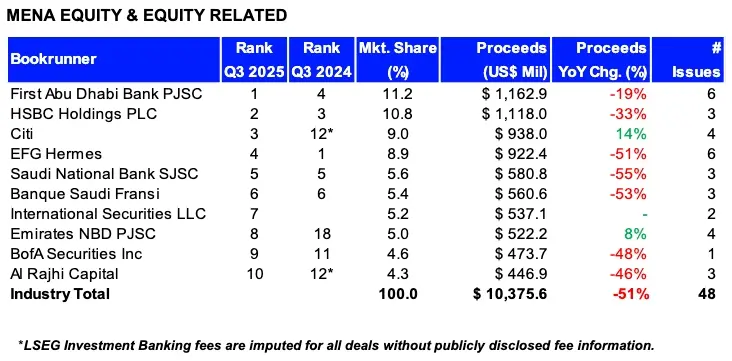

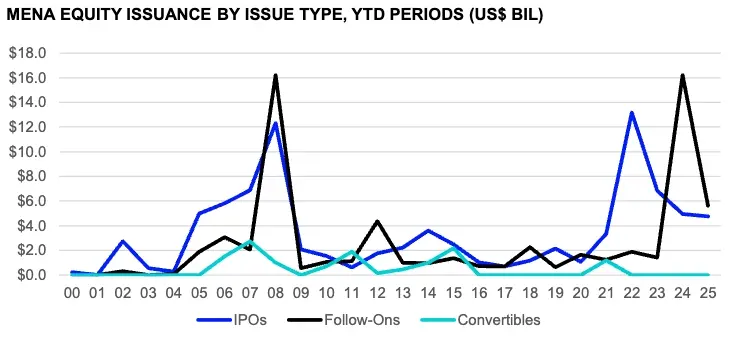

Equity and equity-related issuance in the MENA region reached $10.4 billion in the first nine months of 2025, a 51% drop compared to the same period last year, according to LSEG data.

Despite the decline in total proceeds, deal activity remained robust, with the number of transactions up 12% year-on-year, the data showed.

In the ECM underwriting league table, First Abu Dhabi Bank emerged as the top bookrunner with an 11.2% market share, followed closely by HSBC at 10.8%. Citi posted a 14% year-on-year increase in proceeds, reaching $938 million, making it one of only two top-ten bookrunners to record growth.

“This year has been exceptionally busy for us, and we still have at least one more deal expected to close before year-end. Based on current momentum and pipeline discussions, 2026 is expected to be even busier,” said Rudy Saadi, Managing Director and Head of MENA ECM at Citigroup.

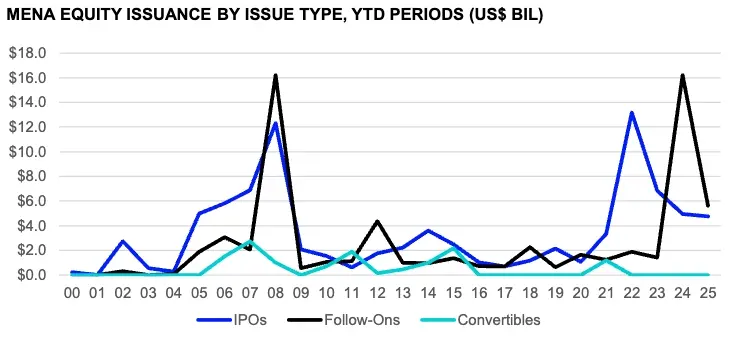

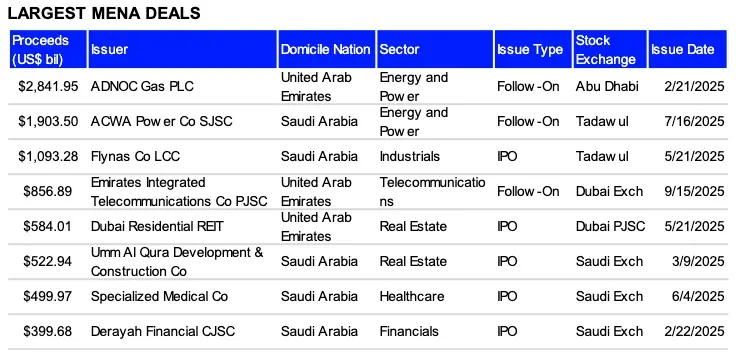

IPOs accounted for 46% of total issuance, while follow-on offerings made up 54%. A total of 36 IPOs were recorded—six more than last year and the highest nine-month tally since 2008—raising $4.8 billion, a modest 4% dip from 2024.

The standout IPO was Flynas, the Saudi low-cost airline, which raised $1.1 billion in its May debut on Tadawul, making it the region’s largest IPO this year. In Q3, Dar Al Majed Real Estate Co led listings with $335.8 million.

Follow-on offerings brought in $5.6 billion, driven by ADNOC Gas’ $2.8 billion share sale in February and ACWA Power’s $1.9 billion rights issue in July.

In terms of volume, the UAE led with $5.22 billion, a 58% year-on-year increase, while Saudi Arabia’s volume fell 74% to $4.49 billion.

“The UAE and Saudi Arabia remain core markets for us—and for any international or regional bank. These economies have the deepest capital pools, most liquid exchanges, and the most sophisticated investor base in the region,” Saadi said. “We’re also seeing growing interest across the wider GCC, which bodes well for Middle East equity capital markets.”

By sector, energy & power dominated, raising $3.5 billion and accounting for 33% of total proceeds, followed by industrials with an 18% share.

(Reporting by Brinda Darasha; editing by Seban Scaria)