PHOTO

Mega deals in energy, technology and artificial intelligence (AI) will continue to influence M&A transactions in MENA this year as sovereigns in the region continue to diversify their economies.

The region saw a strong 2025, posting a 154% year‑on‑year jump in announced M&A value to a record $193.1 billion, according to LSEG Deals Intelligence.

“The M&A landscape will continue to bring certain sectors into focus, including energy, artificial intelligence and digital infrastructure. This is a given, considering countries in the region are aiming to establish themselves as leaders in this space and become globally relevant,” Ahmed Salem, JP Morgan’s co-head of Investment Banking for MENA, told Zawya.

The $55-billion acquisition of US gaming giant Electronic Arts (EA) by a consortium led by Saudi Arabia’s PIF was last year’s biggest MENA transaction; JP Morgan led the debt financing and advised the consortium.

The volume of M&A deals announced in MENA last year jumped 19% to an all-time high of 1,380 across industries and sectors. JP Morgan was ranked second in the LSEG league tables, with 17 deals valued at $62.6 billion. Goldman Sachs ranked first and Rothschild & Co was placed third, with 27 and 29 deals, respectively.

Salem attributed the strong dealmaking to national champions or cash-rich wealth funds increasingly co‑investing or investing directly, with some shifting toward buyouts over venture and growth equity.

One of 2025’s biggest national champion-led deals were the $40-billion sale in October of US tech infrastructure firm Aligned Data Centres to a consortium comprising AI Infrastructure Partnership (AIP), BlackRock’s Global Infrastructure Partners and the UAE’s Mubadala-backed MGX.

Even as MENA outbound M&A dealmaking totalled $101.2 during 2025, with LSEG calling it an all-time record, some regional mega-deals failed to materialise. For example, Abu Dhabi National Oil Company (ADNOC) walked away from a $19-billon offer for Australia’s Santos, which would have been one of the largest energy deals of the year. JP Morgan was one of the advisors on the deal.

“Even though some mega acquisitions did not conclude, they give the market an indication of the level of ambition that we are starting to see across the region,” said Salem.

Capital flows

According to LSEG data, deals involving a MENA target reached $80.5 billion in 2025, up 164% year-on-year.

“Some of the regional players are not just investing outbound all the time. They are also focusing on monetisation initiatives that have created IPO and follow-on equity opportunities or in some cases have resulted in full exits,” Salem said.

Hani Deaibes, JP Morgan’s co-head of Investment Banking for MENA highlighted the growing role of the private sector in M&A, pointing to the January 2025 Gulf Data Hub (GDH) deal. KKR took a stake in GDH and pledged to invest more than $5 billion in GCC data infrastructure.

“These are family businesses, born in the UAE, which are demonstrating they can be great success stories while attracting premium capital into the region. This [GDH deal] was an example of a top-tier investor investing in a local business,” Deaibes said.

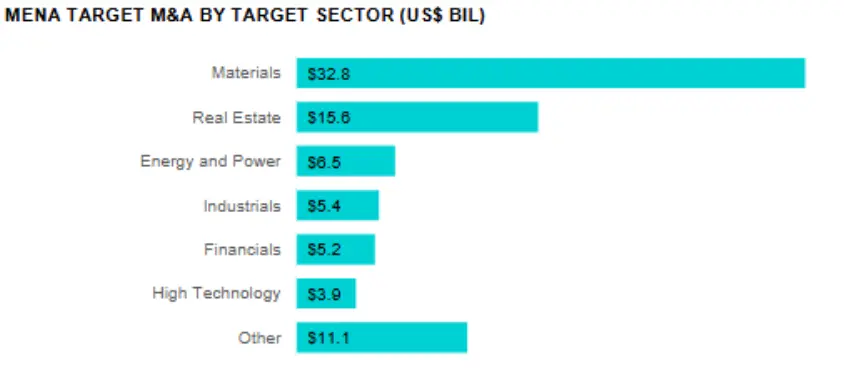

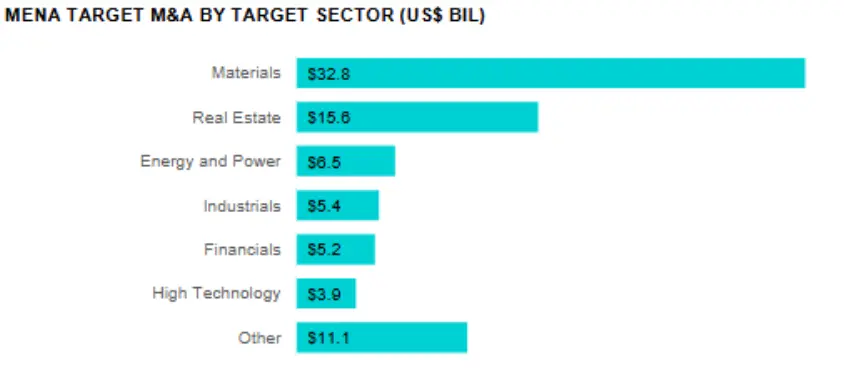

While LSEG data highlights materials as the most active sector of 2025, accounting for 41% of MENA target M&A by value – boosted by the ADNOC and OMV merger of chemicals firms Borouge and Borealis – the real-estate and energy sectors rounded out the top three sectors by value, even as the financial and tech sectors saw the greatest number of deals.

2026 outlook

Geopolitical headwinds, including threats of prolonged US–Iran tensions, have made markets jittery in recent weeks, but many analysts and bankers expect any long-term impact to be contained.

“As we enter a period where we may see pressure on oil again, we are significantly better prepared than during the last downcycle. We are optimistic, both from a fiscal perspective and from the potential implication for deal activity, which will be more resilient,” Deaibes said.

According to Salem, market cyclicality in the M&A and ECM markets are commonplace. “If you ask us whether we will see another mega deal like EA, it is possible, yes. We don’t see a reason for activity to slow down, as the region still has a lot of untapped potential and ambitions to be achieved.”

(Reporting by Bindu Rai, editing by Seban Scaria)