PHOTO

Saudi Arabia's stock market put in a creditable performance in 2018, finishing the year 8.4 percent higher, which is a considerable outperformance of both the MSCI World market (down 10.4 percent) and MSCI Emerging Market (down 16.6 percent) indices.

Yet the total value of stocks traded in the market during the year actually declined by 16.2 percent to $185.6 billion, according to data from KAMCO Research, and although it ended the year with over $1 billion more of foreign capital invested, this was after a tumultuous fourth quarter when $1.89 billion of capital flowed from the kingdom's markets following the international backlash resulting from the murder of journalist Jamal Khashoggi in a Saudi consulate in Istanbul in early October.

Foreigners had piled into Saudi markets earlier in the year on the back of announcements by index compilers FTSE Russell (in March), MSCI (in June) and S&P Dow Jones (in July) that the kingdom's stock market would be upgraded to their respective emerging market indices in 2019.

Charles-Henry Monchau, managing director of Dubai-based Al Mal Capital's investment management division, argued that although the level of both volumes and liquidity on the Saudi market had “always been pretty good”, this is expected to increase in 2019.

“The key change from the event would be in the amount of stock owned by foreign investors. Currently it is around 1 percent, (excluding the strategic stakes),” Monchau said in an emailed response to questions from Zawya.

“Furthermore, we expect stocks to be more deeply researched on fundamentals,” he said, adding that factors other than investor flows will determine the direction of the market, including oil revenues, the global interest rate cycle, any further impact from the so-called ‘expat exodus’, and the success of job creation efforts for Saudi nationals.

When it comes to how individual stocks performed in the kingdom last year, Mohamad Al Hajj, head of MENA Strategy at EFG Hermes, said that petrochemicals companies and banks performed well, but that this could partly be attributed to phenomena outside the kingdom.

"Petchems and banks were definitely top performers in Saudi and that's not a surprise because if we look at the MSCI Saudi inclusion list, 70 percent of the index is banks and petchems," Al Hajj explained in a telephone interview last week.

"Also, they happened to be the sectors where we saw the best earnings growth in Saudi Arabia last year. Banks were driven mainly by rising interest rates in the U.S. and petchems were driven by product pricing, oil prices etc, so these were global factors. The local domestic story didn't see decent earnings growth," he argued.

Saudi Industrial Export Co, which set up companies in the UAE and Jordan late last year, was the top-performing Saudi stock last year. Its shares trebled in value as turnover rocketed in the first nine months of the year to 91.8 million riyals ($24.5 million), compared to 12.2 million riyals in the first nine months of 2017.

Riyad Bank was the next-best performer, buoyed in no small part by the announcement of the company's proposed merger with Saudi Arabia's second-biggest bank, National Commercial Bank, in December. Nama Chemical Company, a company which produces caustic soda, was the third-best performer.

Many of the stocks that performed poorly were stocks in sectors relying on domestic demand, with several impacted by the so-called “expat exodus” which has seen hundreds of thousands of expat workers either send families home or leave the kingdom entirely as more levies are imposed and as some job categories become available only to Saudis with a view to boosting employment among nationals. The real estate and construction sectors have been hard hit, for instance, both by dwindling demand for rental properties and the departure of large numbers of skilled workers.

"Generally, non-oil GDP growth is still very muted, so that will impact the construction and real estate sectors," Al Hajj said.

The three worst-performing stocks were Wafa Insurance, fixed line and broadband services provider Go Telecom and Dallah Healthcare.

Mazen Alsudairi, head of research at Al Rajhi Capital, told Zawya in an emailed response to questions that Dallah Healthcare had witnessed an increase in expenses through the opening of a new hospital, and that such facilities usually take at least two years to break even. He also said that private healthcare providers were having to offer discounts to insurance firms to boost volumes as a result of the decline in expat numbers. “Other hospitals which expanded have also seen similar impact,” Alsudairi said.

Analysts remain optimistic for the Saudi stock market for 2019, helped by slightly stronger macroeconomic fundamentals, with the International Monetary Fund (IMF) forecasting in October that the kingdom's GDP growth will edge up to 2.4 percent next year, from a predicted 2.2 percent this year.

Jaap Meijer, head of equity research for Dubai-based Arqaam Capital, said that it remains overweight on both Saudi and Kuwaiti stocks for the first half of 2019, as it expects more index-driven investor flows, slightly looser fiscal policies with the Saudi government boosting spending and for banks to be able to continue improving net interest margins, so long as rate rises continue in the United States (Saudi monetary policy moves in lockstep with the U.S. Federal Reserve due to the riyal's peg to the U.S. dollar).

“After the first MSCI index phase of May, we would expect Saudi to be trading at a massive premium to other EMs, and the rest of the MENA region,” Meijer explained via email, but he said that if rate rises were to slow or pause then Egyptian equities may look a better bet.

“We expect KSA EM inclusion over seven phases for MSCI and FTSE to be the main event of 2019, at least until H1, with an expected $20 billion of passive inflows expected to come into the market, combined with a multiple of that in active money,” Meijer said.

AlSudairi said that he was also “optimistic about the market in general”.

Although he said that current sentiment was “tepid” due to falling oil prices, he believes that oil is trading below long-term, sustainable levels.

“A recovery will add to the optimism and help the market in 2019 along with the actual inclusion into MSCI S&P and FTSE EM indices. On the fundamental earnings front, we may see only moderate improvement as the overall economic situation is gradually improving,” Alsudairi said.

He also warned that “certain heavyweight stocks” are already trading at a significant premium to historical multiples. But he added that “on the whole, we expect a good year for TASI as more passive funds flow in the market”.

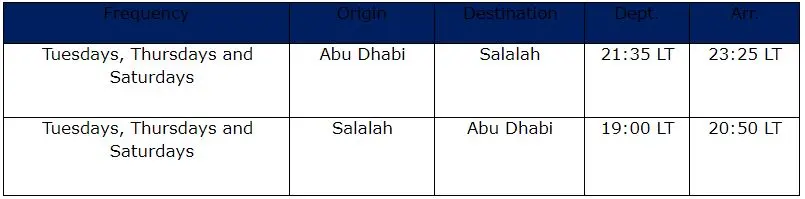

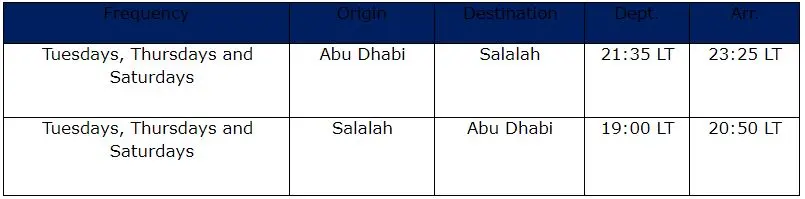

GCC stock markets, value traded 2017-18 (Source: KAMCO Research)

Biggest gainers

1. Saudi Industrial Exports: 200.33%

2. Riyad Bank: 58.31%

3. Nama Chemicals: 56.76%

Biggest fallers

1. Wafa Insurance: -62.25%

2. Atheeb Telecom: -45.03%

3. Dallah Health: -44.54%

Click on the links below to see how other Gulf markets fared.

(Reporting by Michael Fahy; Editing by Shane McGinley)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019