HSBC UAE PMI™

Latest data highlighted weaker but still strong growth at UAE's non-oil private sector companies in February. The overall slowdown was driven by milder expansions in output, new orders and new export business. Purchasing activity also rose at a slower pace during the month, contrasting with a faster rate of job creation. Meanwhile, downwards pressure from lower fuel prices manifested itself in February's survey data, with the rate of purchase price inflation easing to a four-and-a-half year low.

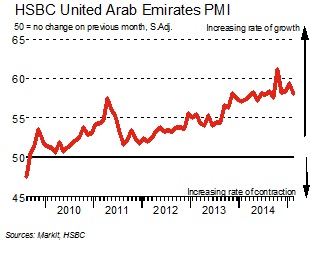

Adjusted for seasonal influences, the headline HSBC UAE Purchasing Managers' Index™ (PMI) - a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy - dropped to a five-month low of 58.1 in February, having posted the highest reading since last October at the start of 2015 (59.3). That said, despite cooling since January, the rate of non-oil expansion remained sharp in the context of historical data.

Activity in the UAE's non-oil private sector rose at a weaker pace in February. However, the latest increase was marked overall and stronger than the average observed for 2014. Robust demand conditions were reported to have boosted output growth during the latest survey period.

Anecdotal evidence of improving demand was reflected in February's survey data, as new orders continued to rise at a steep rate. That said, despite remaining comfortably in growth territory, the respective index weakened to an 18-month low. Foreign orders also increased more slowly, with the latest expansion the least marked since last October.

Higher new work intakes and subsequent production requirements led to a further rise in purchasing activity in February. The pace of expansion was strong overall, albeit weaker than seen in the previous month. Stocks of purchases continued to rise solidly as a result.

Employment in the UAE's non-oil private sector increased for the thirty-eighth successive month in February, supported by ongoing growth of output and new business. Moreover, the rate of hiring picked up to a four-month high.

However, a further by-product of stronger order books was higher backlogs of work. The latest rise in work outstanding was solid overall and the tenth in as many months, thereby marking the longest sequence of backlog accumulation since the survey began in August 2009.

Meanwhile, total input costs faced by firms operating in the UAE's non-oil private sector rose at the slowest pace in three months in February. Data suggested that the overall easing was mainly driven by the weakest increase in purchase prices since August 2010. Concurrently, staff costs continued to rise at a moderate pace.

Muted cost pressures, alongside increased competition, led to the first reduction in selling prices in five months.

Comment

Commenting on the UAE PMI™ survey, Philip Leake, Economist at Markit said:

"Activity in the UAE's non-oil private sector continued to rise strongly in February, helped by robust growth of new business. That said, the rates of expansion slowed since January. Nonetheless, the outlook for the UAE remains bright, with employment rising at a faster pace and cost pressures easing as a result of lower fuel prices."

Key points

- PMI slips to five-month low, but still signals robust growth

- Slower expansions in output, new orders and new work from abroad

- Falling fuel prices lead to weaker rise in overall input costs

Historical Overview

For further information, please contact:

HSBC

Simon Williams, Chief Economist,

HSBC Middle East & North Africa

Telephone +971-4-423-6925

Email simon.williams@hsbc.com

Ahmad Othman

Media Relations

Tel: +971 4 423 5628

Email ahmadothman@hsbc.com

Markit

Philip Leake, Economist

Telephone +44-1491-461-014

Email philip.leake@markit.com

Joanna Vickers, Corporate Communications

Telephone +44-20-7260-2234

Email joanna.vickers@markit.com

The HSBC Purchasing Managers' Index™ is based on data compiled from monthly replies to questionnaires sent to purchasing executives in approximately 400 private sector companies, which have been carefully selected to accurately represent the true structure of the United Arab Emirates economy, including manufacturing, services, construction and retail. The panel is stratified by Standard Industrial Classification (SIC) group, based on industry contribution to GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the 'Report' shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the 'diffusion' index. This index is the sum of the positive responses plus a half of those responding 'the same'.

The Purchasing Managers' Index™ (PMI™) is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers' Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times index inverted so that it moves in a comparable direction.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series. Historical data relating to the underlying (unadjusted) numbers, first published seasonally adjusted series and subsequently revised data are available to subscribers from Markit. Please contact economics@markit.com.

HSBC:

HSBC is one of the world's largest banking and financial services organisations. With more than 6,200 offices in both established and emerging markets, we aim to be where the growth is, connecting customers to opportunities, enabling businesses to thrive and economies to prosper, and, ultimately, helping people to fulfil their hopes and realise their ambitions.

We serve around 52 million customers through our four Global Businesses: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. Our network covers 74 countries and territories in Europe, the Asia-Pacific region, the Middle East, Africa, North America and Latin America.

Listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges, shares in HSBC Holdings plc are held by about 216,000 in 129 countries and territories.

About Markit:

Markit is a leading global diversified provider of financial information services. We provide products that enhance transparency, reduce risk and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies. Founded in 2003, we employ over 3,000 people in 10 countries. Markit shares are listed on NASDAQ under the symbol "MRKT". For more information, please see www.markit.com

About PMIs:

Purchasing Managers' Index™ (PMI™) surveys are now available for 32 countries and also for key regions including the Eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.markit.com/economics

The intellectual property rights to the HSBC UAE PMI™ provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit's prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information ("data") contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. HSBC use the above marks under license. Markit is a registered trade mark of Markit Group Limited.

© Press Release 2015