PHOTO

Foreign investors withdrew large amounts of money from Japanese stocks last week, hit by worries about U.S. interest rates as the Federal Reserve's latest policy statements indicated that monetary policy would remain tighter for longer.

Data from Japanese exchanges showed foreign investors disposed of a net 1.26 trillion yen ($8.44 billion) worth of stocks in the week ended Sept. 22, marking the biggest weekly outflow since March 17.

They sold a net 913.17 billion yen of cash equities and 340.1 billion yen of derivatives through the week.

The Fed held interest rates last week but projected an increase by year-end, saying monetary policy is likely to be significantly tighter through 2024 than previously thought.

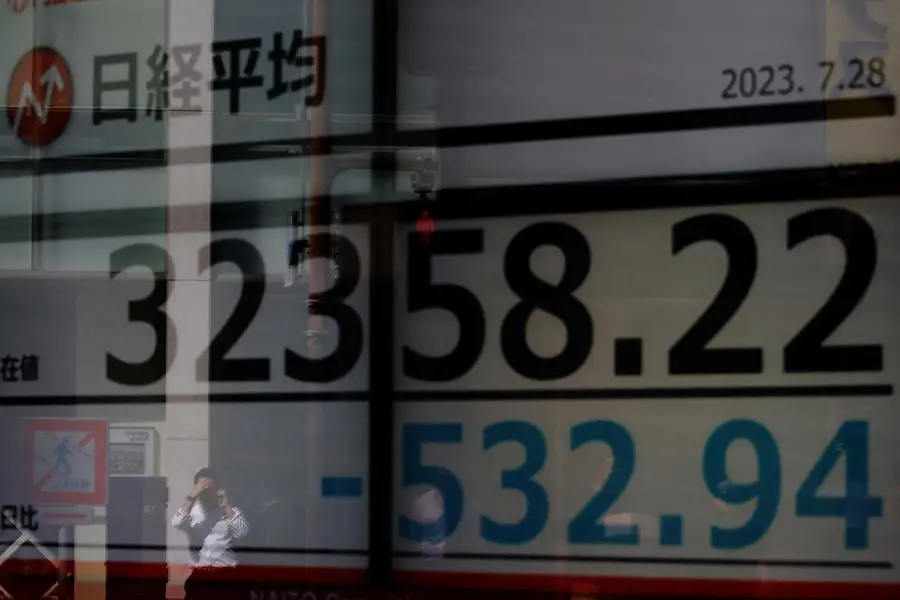

The Nikkei lost 3.37% last week, posting its worst performance since Dec. 23, 2022. The broader Topix index also shed 2.15%.

Foreign investors have still accumulated about 7.15 trillion yen of Japanese shares so far this year, compared with about 2.98 trillion yen worth of net selling last year.

Meanwhile, overseas investors offloaded a net 2.03 trillion yen of long-term Japanese bonds in the week ended Sept. 22, the biggest amount in eight weeks, according to data from Japan's Ministry of Finance.

They also exited about 619.8 billion yen of short-term debt securities.

On the other hand, Japanese investors sold a net 544.4 billion of long-term overseas bonds after four weeks of net purchases in a row. However, they secured about 2.5 billion yen of short-term securities.

Japanese investors withdrew 6.2 billion yen out of foreign equities, the first weekly net selling in four weeks. ($1 = 149.3000 yen)

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Janane Venkatraman)