PHOTO

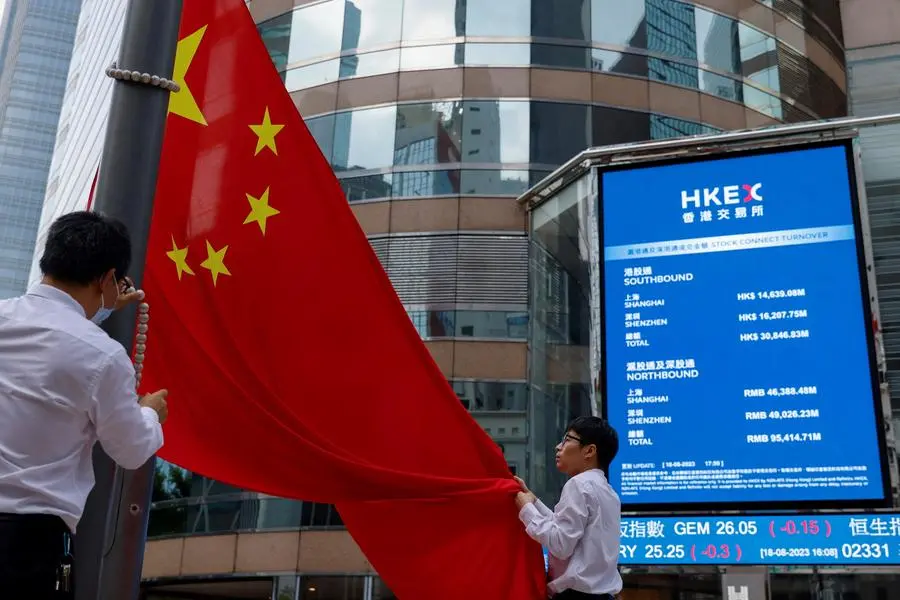

SHANGHAI: China's blue-chip stocks and Hong Kong shares rose on Thursday, tracking Asian markets higher on growing expectations that the U.S. Federal Reserve will likely cut interest rates in September.

Expectations of Fed rate cuts in September rose after data this week hinted the U.S. labour market was easing. The Euro advanced ahead of the European Central Bank policy meeting, in which a rate cut is widely expected.

Also helping sentiment was a private sector survey released on Wednesday that showed China's services activity in May accelerated at the quickest pace in 10 months. Staffing levels expanded for the first time since January, pointing to a sustained recovery in the second quarter.

** At the midday break, the Shanghai Composite index was down 0.08% at 3,062.93 points.

** China's blue-chip CSI300 index was up 0.37%, with its financial sector sub-index lower by 0.19%, the consumer staples sector down 0.43%, the real estate index down 0.95% and the healthcare sub-index down 0.62%.

** Chinese H-shares listed in Hong Kong rose 0.51% to 6,575.51, while the Hang Seng Index was up 0.59% at 18,533.22.

** The smaller Shenzhen index was down 1.15%, the start-up board ChiNext Composite index was weaker by 0.17% and Shanghai's tech-focused STAR50 index was down 0.21%.

** Hong Kong's Hang Seng Tech Index rose 1.3%.

** Around the region, MSCI's Asia ex-Japan stock index was firmer by 1.21% while Japan's Nikkei index was up 0.64%. (Reporting by Shanghai Newsroom; Editing by Janane Venkatraman )