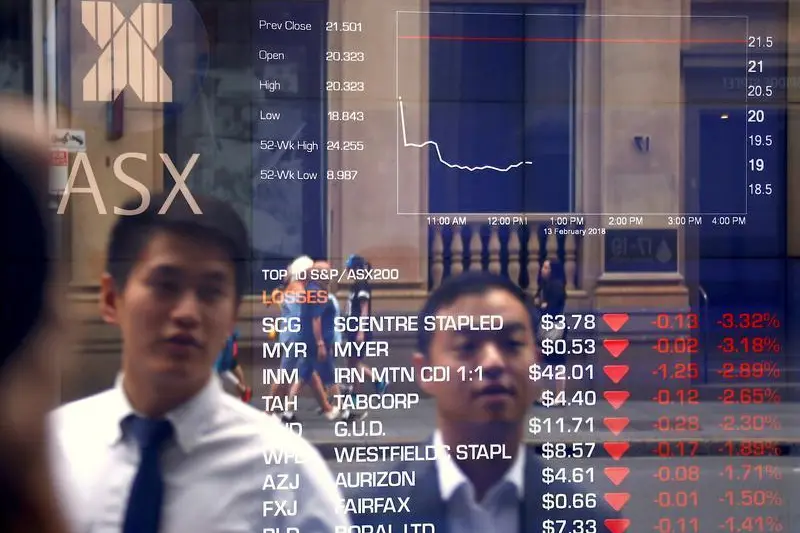

PHOTO

Australian shares snapped a three-day winning streak on Friday, starting the last month of the year on a negative note, as technology firms and banks weighed, while investors assessed their monetary policy easing bets after a benign U.S. inflation print.

The S&P/ASX 200 index fell 0.17% to 7,075.40 points after closing 0.7% higher on Thursday. The benchmark gained 4.5% last month, its best month since January.

Overnight, U.S. inflation data showed signs of cooling demand in the world's largest economy, which further strengthened expectations that the Federal Reserve's interest rate hiking campaign was over, boosting the possibility of rate cuts early next year.

"Growth and inflation in the U.S. slow enough to enable the Fed to ease would help set the conditions for the RBA (Reserve Bank of Australia) to also cut, particularly given the synchronous nature of the current global economic cycle," analysts at ANZ said in a note.

On the domestic front, banking stocks shed 0.1%, with Westpac and Commonwealth Bank of Australia both dropping about 0.5%.

Information technology stocks declined nearly 1.1%, after having their best day in over nearly three weeks on Thursday.

Sector majors Xero and Wisetech Global slumped 1.9% and 1%, respectively.

Gold stocks cut a four-day rally, dropping about 0.4%, as bullion prices declined overnight on a firmer dollar. Among top gold miners, Northern Star Resources lost 2.3% and Evolution Mining fell 1.2%.

"There is a little bit of selling around in resources in commodity stocks... but it is kind of end of week book squaring after a pretty big run in November," said Henry Jennings, senior analyst at Marcustoday.

Across the Tasman Sea, New Zealand's benchmark S&P/NZX 50 index ended 0.329% higher to finish the session at 11,367.51 points.

The Reserve Bank of New Zealand's deputy governor Christian Hawkesby warned that persistently high core inflation "left little room for error" around monetary policy, days after the central bank kept its official cash rate unchanged. (Reporting by Aaditya Govind Rao in Bengaluru; Editing by Mrigank Dhaniwala)