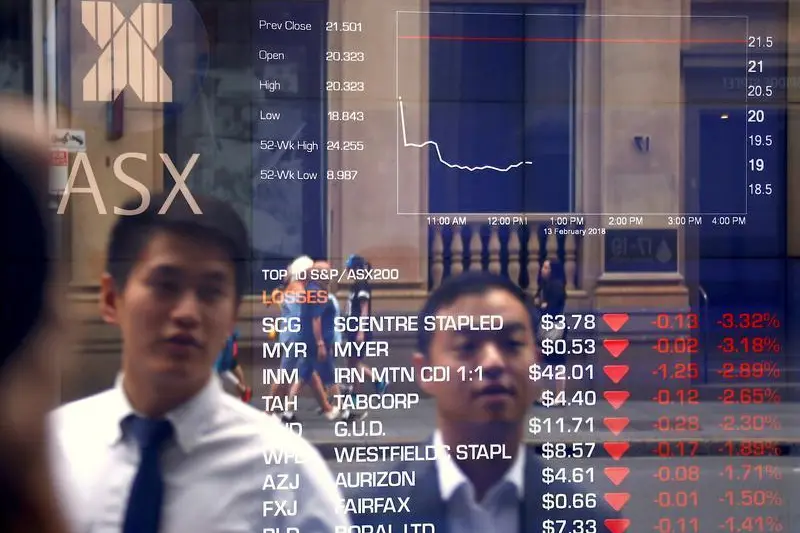

PHOTO

Australian shares fell marginally on Tuesday, weighed by financial stocks as investors eyed the upcoming vote on the U.S. debt ceiling. However, a in gain in miners helped cap losses.

The S&P/ASX 200 index was down 0.1% at 7,209.3 at the close of trade.

Markets were largely muted as investors waited for the U.S. markets to open to get some more clarity on larger sentiments and news on debt ceiling, said Brad Smoling, managing director of Smoling Stockbroking.

A handful of Republican lawmakers said they would oppose a deal to raise the United States' $31.4 trillion debt ceiling, a sign that the bipartisan agreement could face a rocky path through Congress before the U.S. runs out of money next week.

Narrow margins in the House of Representatives and Senate mean moderates from both sides will have to support the bill for it to pass.

The real test is how markets interpret the debt ceiling deal. The market can take solace from there, calm down and start to rally, or there may be some adverse reaction from some foreign investors that are holding U.S. dollars and assets, Smoling added.

Local investors are also waiting for Australia's April inflation print due on Wednesday.

In Sydney, Financials became the biggest laggard on the benchmark, falling 0.35%. The "big four" banks were down between 0.1% and 1.5% at close.

Energy stocks further took away 0.7% from the local bourse as mixed messages from major producers clouded the supply outlook of oil.

Tech and real estate stocks lost 0.1% and 0.9% respectively.

Capping losses, miners rose 0.2%, with behemoths BHP group Ltd and Rio Tinto Ltd closing up.

New Zealand's benchmark S&P/NZX 50 index fell 0.5% to 11,878.71. (Reporting by Nausheen Thusoo in Bengaluru; Editing by Varun H K)