PHOTO

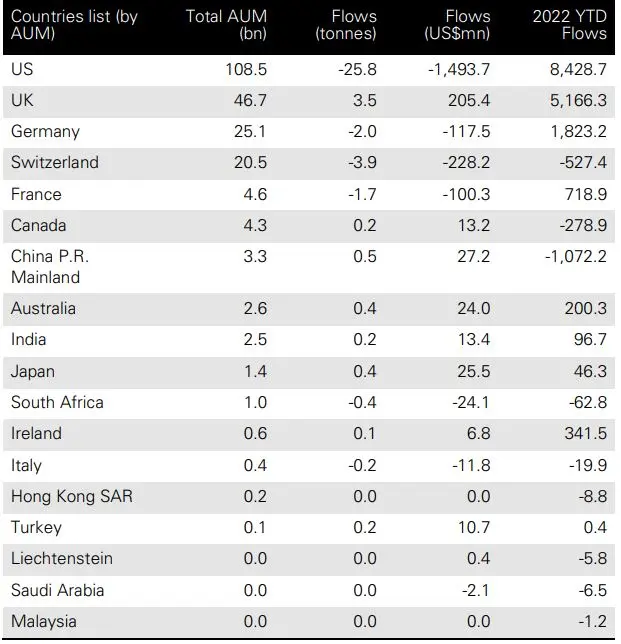

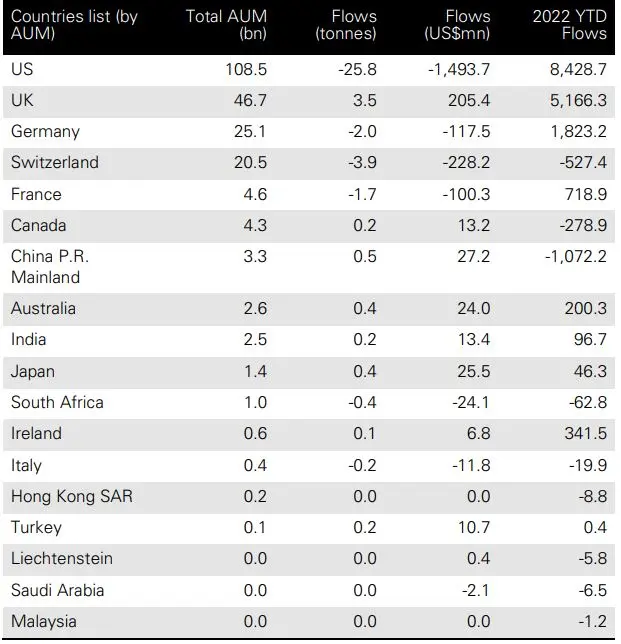

Investments in gold exchange-traded funds (ETFs) slowed down in Saudi Arabia and other markets last month amid high interest rates and stronger US dollar, but year-to-date global demand remained strong, according to the latest data from the World Gold Council (WGC).

Funds in Saudi Arabia fell by $2.1 million in June this year, registering year-to-date flows of 6.5 tonnes. In US dollar terms, Saudi's decline in ETF flows were lower compared to other major markets like the United States, Germany, Switzerland, Italy and France.

Overall, global gold ETF demand remained strong despite the outflows last month, according to WGC in its report.

Global gold ETFs fell by 28 tonnes or $1.7 billion in June, but global holdings still registered a 6 percent year-to-date growth, bringing the total at the end of June to 3,792 tonnes or $221.7 billion.

Funds in North America and Europe accounted for a huge chunk of the recent outflows. North American holdings dropped by 26 tonnes, with outflows dominated by the largest and most liquid US funds.

"While the recent flows were enough to push Q2 into net outflows of 39 tonnes, year-to-date net inflows remained positive," the report said.

Intense focus on the future pace of interest rate increases and a stronger greenback are the "primary headwinds" for investing in the precious metal, the World Gold Council noted.

In terms of inflows, North American and European funds attracted the lion's share of investment. During the first half of the year, US fund holdings rose by 133 tonnes ($8.1 billion) and European funds added 119 tonnes ($7.5 billion).

In other regions, which include the UAE, South Africa and Turkey, among others, funds went up by a marginal 2 tonnes.

"Asia was the only region to see net outflows over the first half of 2022, declining by 16 tonnes, with Chinese funds the main contributor," the world Gold Council said.

(Reporting by Cleofe Maceda; editing by Seban Scaria)