PHOTO

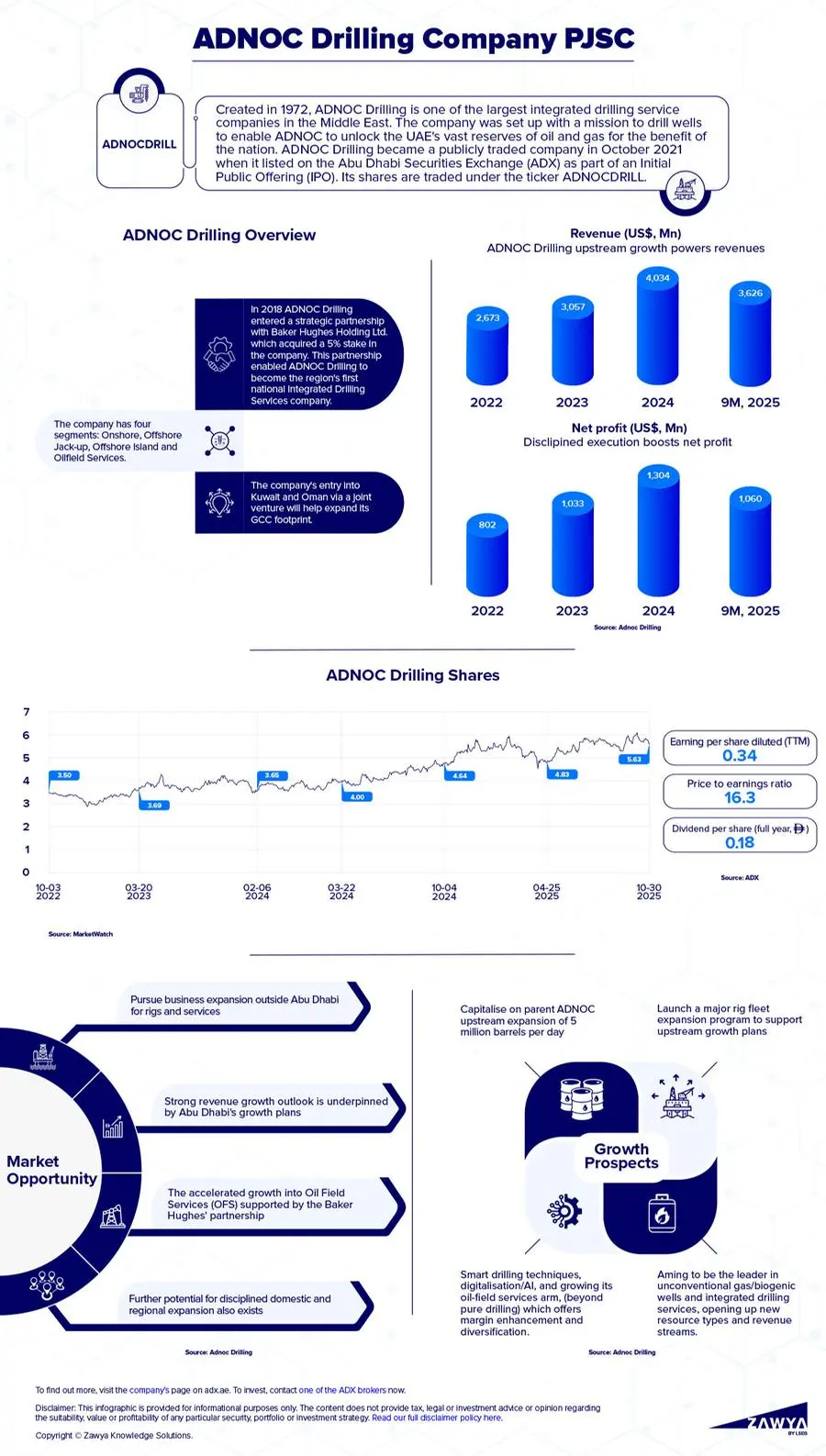

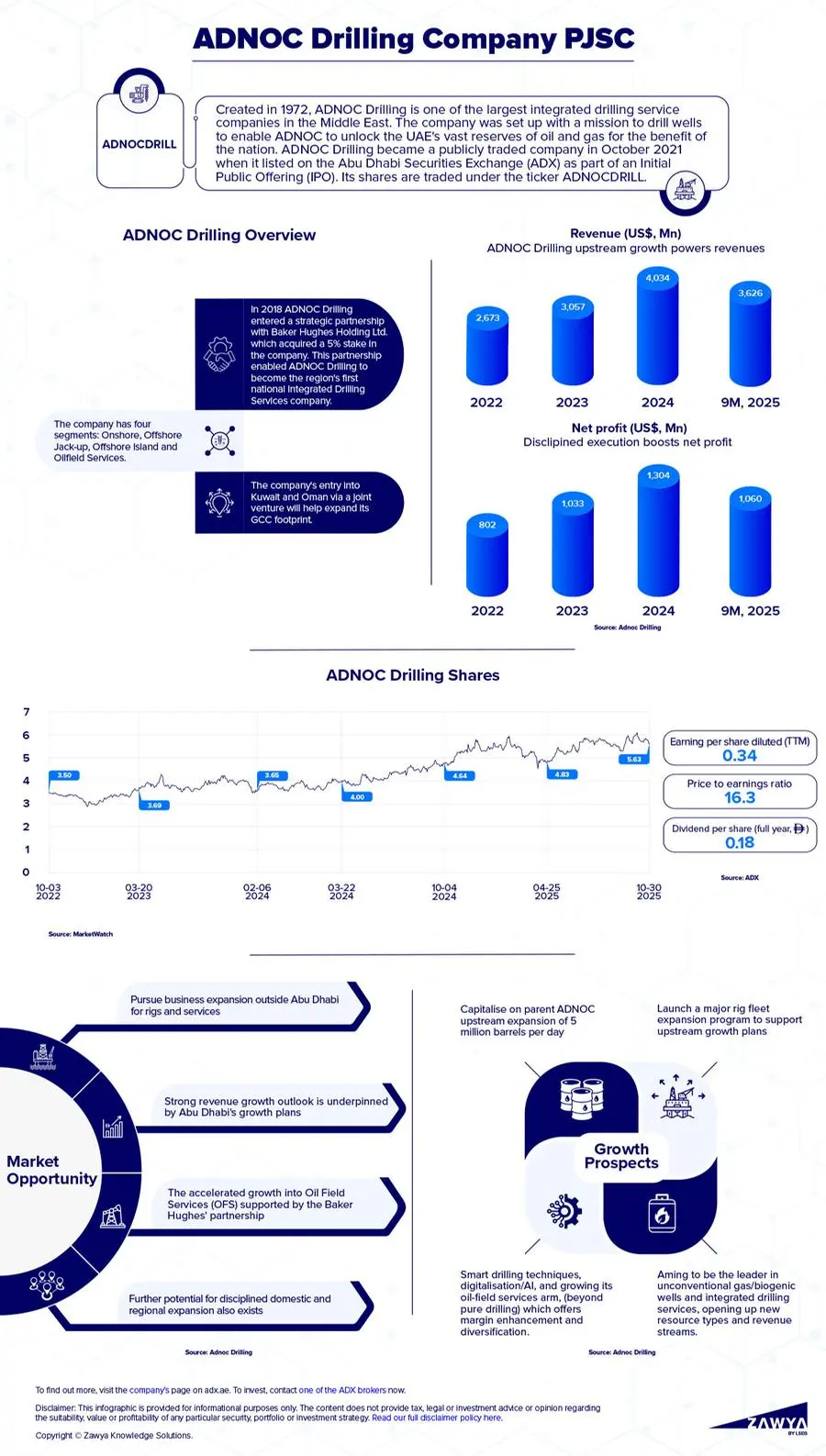

ADNOC Drilling is one of the largest integrated drilling service providers in the world by rig fleet size and serves as the exclusive supplier of drilling and related rig services to the Abu Dhabi National Oil Company (ADNOC) Group, its parent company.

The company has four segments: Onshore, Offshore Jackup, Offshore Island and Oil Field Services (OFS). Its expertise spans the full lifecycle of well drilling and completion – covering both conventional and unconventional reservoirs – onshore, offshore and on ADNOC’s pioneering artificial islands off the Abu Dhabi coastline.

ADNOC Drilling was listed on the Abu Dhabi Exchange in 2021 when parent ADNOC Group floated 11% of the company, which resulted in gross proceeds of U.S.$1.1 billion. The offering saw significant demand from UAE retail investors and qualified institutional investors. Total gross demand for the IPO amounted to over U.S.$34 billion – an oversubscription level in excess of 31 times.

Click here to download infographic

The company aims to deliver greater value to ADNOC Group, other partners and investors by delivering wells that support ADNOC’s status as one of the world’s largest and lowest-cost oil producers. ADNOC Drilling’s transformation into an integrated drilling services company has enabled it to move beyond traditional domestic operations, entering new markets with a competitive cost base and a wider service offering compared with conventional drilling service providers.

Strategic growth drivers

The company aims to support ADNOC’s strategy to raise crude oil production capacity by 25% – from 4 million barrels per day in 2020 to 5 million barrels per day by 2027 – while advancing the UAE’s goal of gas self-sufficiency and unconventional resource development. ADNOC’s discovery of 160 trillion standard cubic feet of recoverable unconventional gas presents a major opportunity for continued drilling activity and long-term growth.

The company is also focused on boosting operational efficiency by improving well duration by 5% to 10% annually. To achieve this goal, ADNOC Drilling has formed a strategic alliance with energy tech company Baker Hughes to integrate project management and oilfield services. By combining this with in-house rig rental and management capabilities, the company hopes to strengthen customer relationships and maximise fleet utilisation.

To meet rising demand from ADNOC’s upstream expansion and regional opportunities, ADNOC Drilling is pursuing a major rig fleet expansion programme. This will allow the company to broaden its rig hire, drilling, completion and associated services portfolio, enhancing revenue growth and profitability.

As part of its transformation, ADNOC Drilling aims to become a regional leader in unconventional drilling and biogenic well development, expanding operations beyond the UAE. Biogenic gas – typically found at shallow depths and of high quality – offers economically attractive potential and additional revenue streams, while unlocking further natural resources across the UAE and wider region.

Finally, ADNOC Drilling is pursuing regional expansion beyond Abu Dhabi. With the MENA drilling and oilfield services market expected to grow by 6% between 2024 and 2028, the company sees significant opportunities to expand operations outside the UAE and establish itself as a regional services leader.

Joint ventures

ADNOC Drilling is pursuing innovative strategic ventures that are expected to deliver transformative, long-term benefits. This includes the development of a diversified portfolio of technology-enabled companies in the oilfield services and energy sectors through its U.S.$1.5 billion Enersol JV, in partnership with Alpha Dhabi.

The UAE’s aim for gas self-sufficiency by 2030 also presents an opportunity, through the successful launch of Turnwell JV with SLB & Patterson-UTI. The venture is expected to unlock the UAE’s world-class unconventional energy resources, benefiting both the company’s short-term earnings and long-term growth.

Investment outlook

ADNOC Drilling's current return on equity of 39.2% is substantially above its five-year average of 27.1%. The company’s forward P/E of 16.3 represents a 17% discount to its 5-year average of 19.6.

Conclusion

Over the past year, ADNOC Drilling has increased its asset base, expanded its capabilities, grown geographically and increased market share. ADNOC Drilling provides exposure to the UAE’s dominant oil and gas sector. Parent company ADNOC is one of the world’s biggest oil producers, with near-term plans of raising production.