PHOTO

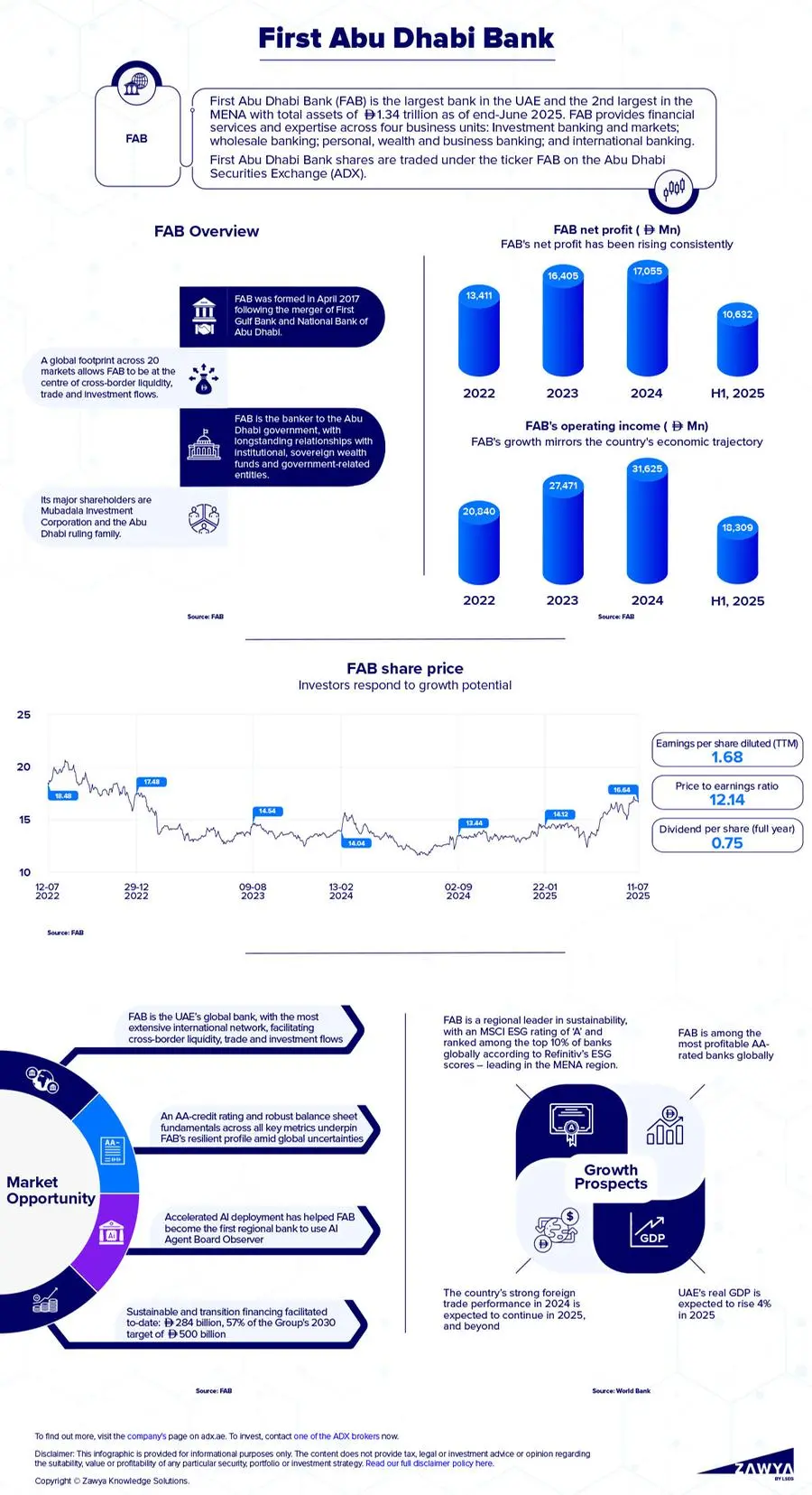

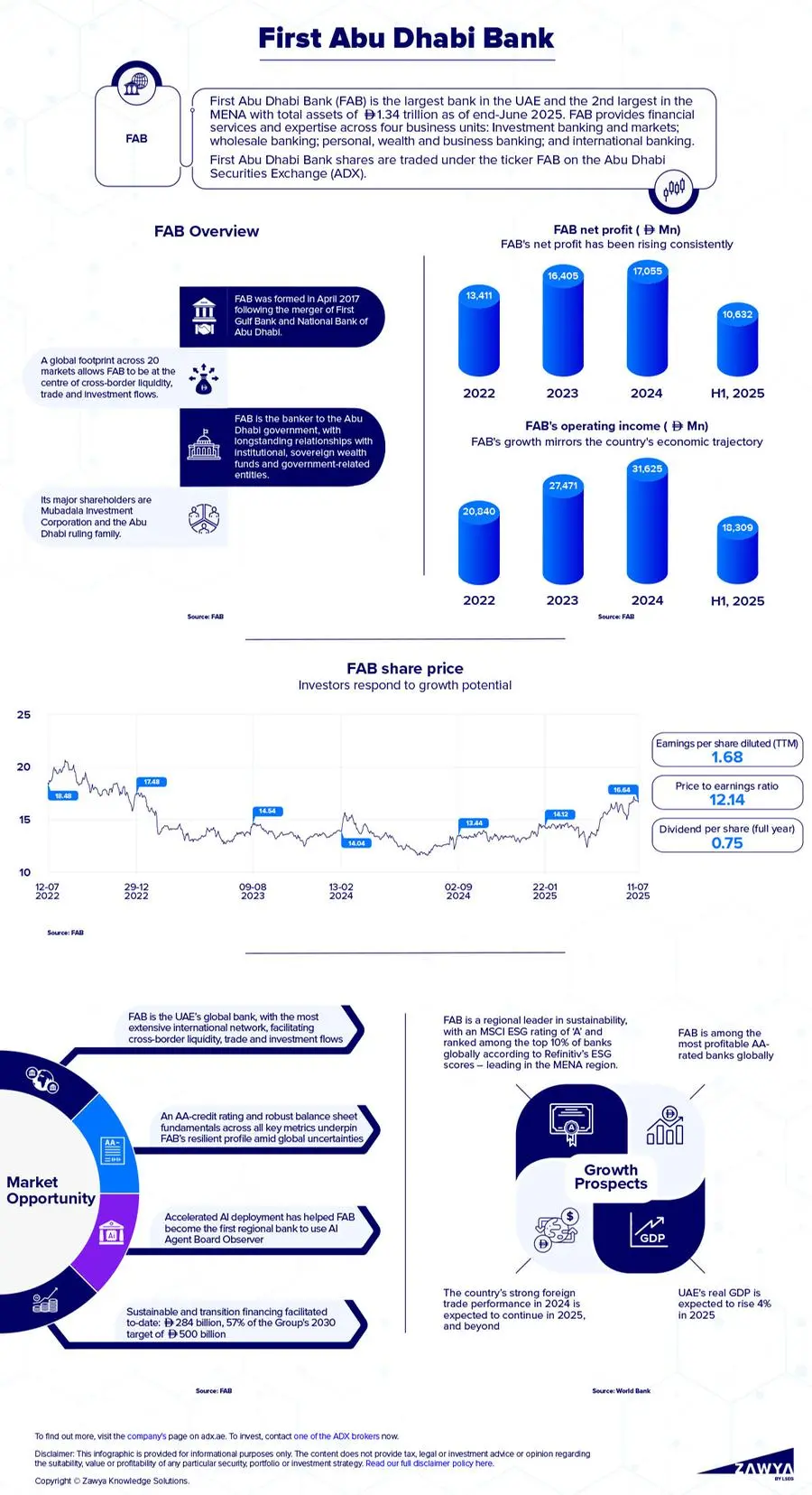

First Abu Dhabi Bank (FAB) is the UAE’s largest bank by total assets and a major financial institution in the Middle East and North Africa (MENA) region. Created in 2017 through the strategic merger of First Gulf Bank (FGB) and National Bank of Abu Dhabi (NBAD), FAB has since emerged as a leading force in the regional banking landscape, with an international presence spanning five continents and 20 markets, including key global financial hubs such as London, Hong Kong, Geneva and Singapore.

As of the first six months of 2025, FAB reported total assets exceeding AED1.34 trillion, a reflection of both organic growth and a conservative risk appetite. Its net profit was AED10.63 billion, underpinned by strong core income growth, prudent cost control and a well-diversified balance sheet. It enjoys top-tier credit ratings AA- from S&P, Aa3 from Moody’s, and AA- from Fitch making it one of the most creditworthy banks in the emerging markets universe.

FAB serves a wide customer base across the wholesale, investment, retail and private banking segments. It has a dominant share of the wholesale and corporate banking markets, a growing footprint in wealth management and a fast-expanding retail banking franchise. Its diversified business model is increasingly underpinned by fee-based income, with non-interest revenue now accounting for more than 40% of group income a notable shift in the traditionally net interest margin-driven Gulf banking sector.

The bank has positioned itself at the forefront of digital innovation, sustainability-linked financing and cross-border transaction banking, aligning its strategy with both UAE Vision 2031 and broader GCC economic transformation agendas.

Click here to download infographic

Strategic growth drivers

FAB has shifted to a balanced business mix, with non‑funded (fee and trading) income accounting for 45.6% of total revenue in the first half of the year. Investment Banking & Markets saw revenue rise 17% year-on-year (YoY). Wholesale Banking revenue grew 12% YoY, underlining strong activity and business momentum across its client franchise, with loans and deposits up 11% and 6% YoY, respectively. The international franchise saw significant balance sheet growth, with loans and deposits up 28% and 24% YoY, respectively, from broad-based geographies.

The bank is investing in AI and fintech integration, streamlining credit approvals, expanding digital wallets (Payit has over 1 million users) and improving customer satisfaction metrics.

It is also pursuing geographic diversification: international assets were up AED383 billion in the first six months of 2025, contributing to 28.5% of the bank’s assets. The bank operates across five continents, positioning it to capture cross-border flows in trade corridors connecting the UAE to Asia, Europe and Africa.

Investment outlook

In the first half of 2025, FAB reported a net profit of AED10.63 billion, up 26% YoY. Operating income rose 16% and assets surpassed AED1.34 trillion. Return on tangible equity (RoTE) reached 20.5%, well above its medium‑term target, and cost‑to‑income ratio fell to 21.8%.

The company’s valuation remains attractive, with an approximate price-to-earnings ratio of 12.14x and price-to-book ratio of 1.27x below both regional and global peers despite strong fundamentals. Dividend yield was 4.18%, including a per-share dividend of AED0.75 (U.S.$0.20) by the first half of 2025, offering high income appeal.

FAB upgraded its loan growth guidance for 2025 from high single-digit to low double-digit. Credit metrics remain solid, with provision coverage above 90%.

Strategic initiatives & acquisitions

FAB recently reorganised into four business divisions to sharpen operational focus and unlock shareholder value. It is also looking to scale up issuer and dealmaking capabilities.

Sustainability strategy

FAB was the first UAE bank to join global initiatives like the Net-Zero Banking Alliance (NZBA), with a commitment to net-zero emissions by 2050 and a pledge to facilitate AED500 billion (U.S.$136 billion) in sustainable finance by the end of the decade. This includes financing renewable energy, low-carbon infrastructure and green bonds, as well as supporting clients in carbon-intensive sectors to decarbonise.

Country outlook

FAB’s own 2025 Global Investment Outlook projects UAE GDP growth rising from 4.5% to 5.6% in 2025, above the global average of 3.2%. GCC growth is forecast to more than double from 2.1% in 2024 to 4.2% in 2025 due to non-oil expansion, reforms, AI investment, and scale-up of renewables and infrastructure.

Abu Dhabi’s financial centre, ADGM, continues rapid growth with a 32% rise in new firms and a 245% increase in assets under management, attracting global institutions.

Abu Dhabi’s banking system benefits from robust sovereign support, strong capitalisation (S&P AA-, Moody's Aa3), and solid asset quality. FAB stands to benefit as a cornerstone banking franchise in the GCC, distinguished by its strong customer base and strong balanced revenue and international footprint.

Conclusion

FAB’s balance of scale, stability and strategic agility places it in a rare category of banks that combine emerging market growth potential with developed market governance and risk standards. As it continues to expand across geographies and product lines, FAB offers a compelling value proposition to investors looking for resilient exposure to the next phase of MENA financial sector growth.

To find out more, visit the company’s page on adx.ae.

To invest, contact one of the ADX brokers now.