PHOTO

- Global Muslim consumer spending on six real economy sectors rose 5.5% YoY to US$ 2.4 trillion in 2023, while UAE maintaining 4th place in SGIE ranking, with trade pacts and AI-led innovation power growth across halal sectors

- UAE ranks #4 in the Global Islamic Economy Indicator (GIEI), placing top five in six of seven sectors, while placing #7 in Modest Fashion, on the strength of trade connectivity and innovation

- Malaysia tops the Global Islamic Economy Indicator (GIEI) for an 11th straight year, followed by Saudi Arabia, Indonesia, the UAE and Bahrain

- Investments in Islamic-economy-relevant companies reached US$ 5.8 billion across 225 deals in 2023/24; Media & Recreation saw the most transactions, while Islamic Finance attracted the highest capital

- 50 UAE M&A, PE and VC deals worth US $1.5 billion made the Emirate the 2nd largest destination for Islamic-economy related investment value in 2023/24

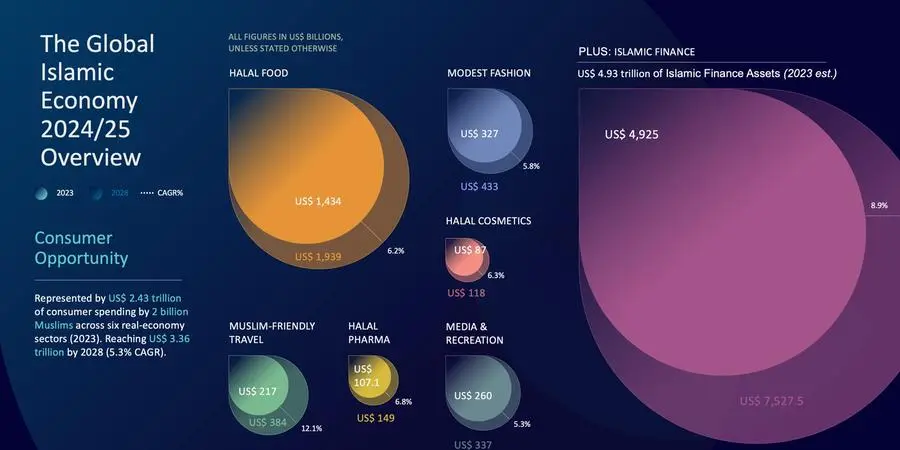

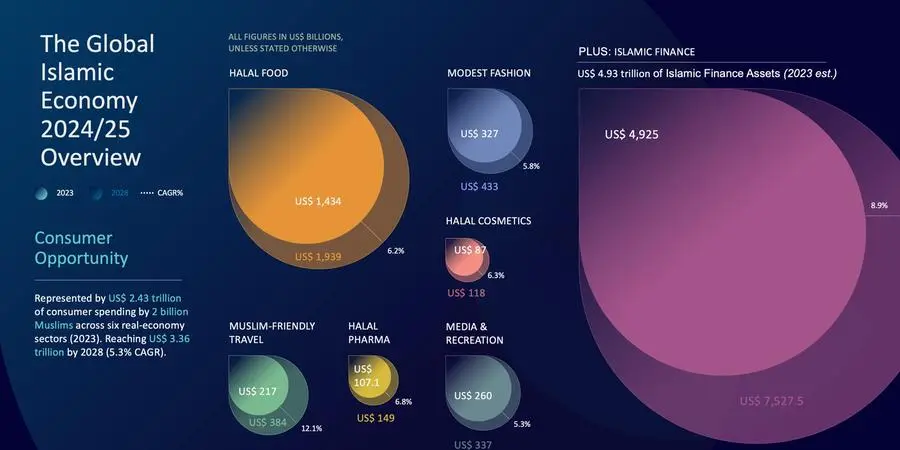

- Aggregate size of the global halal economy reached US$ 7.3 trillion in 2023 — the sum of Muslim consumer spending on halal-aligned products and services (US$ 2.4 trillion) and Islamic-finance assets (US $4.9 trillion)

- Muslim-friendly travel is the fastest-growing sector globally, projected to increase from US$ 216.9 billion in 2023 to US$ 384.1 billion by 2028 (12.1 % CAGR)

- Global Muslim spending on halal food is forecast to hit US$ 1.9 trillion by 2028 (6.2% CAGR)

- Total OIC imports of halal-related products set to grow to US$ 608.4 billion by 2028.

- A focused social-media listening study finds 15.6% explicitly endorsing ethical “alternative” brands, with positivity highest in food & beverages

- Thirty-plus opportunity signals identified, from blockchain-enabled halal certification, AI-driven product personalisation, digital sukuk issuance, values-driven consumer activism to green pharma innovation

Jakarta – DinarStandard unveiled the findings of the State of the Global Islamic Economy Report (SGIE) 2024/25 to Indonesian stakeholders at an event held at Jakarta, with presence from The 13th Indonesian Vice President, Prof. Dr. (H.C.) K.H. Ma’ruf Amin; The Minister of National Development Planning, Prof. Dr. Ir. Rachmat Pambudy; Minister of Religious Affairs of Indonesia, Prof. Dr. Nasaruddin Umar; Minister of Investment and Downstream, Mr. Rosan Perkasa Roeslani; Governor of Bank Indonesia, Mr. Perry Warjiyo. The event was organized by Bappenas and IHLC.

Now in its 11th edition, the SGIE—produced by US-based research firm DinarStandard—tracks the performance of the halal products, Islamic finance and lifestyle sectors that together form the multi-trillion-dollar global Islamic economy.

The report estimates that the world’s two billion Muslims spent US$ 2.4 trillion in 2023 across halal food, pharmaceuticals, cosmetics, modest fashion, travel and media. Despite geopolitical and supply-chain headwinds, that figure represents 5.5% year-on-year growth and is projected to reach US$ 3.4 trillion by 2028. Islamic-finance assets grew to US$ 4.9 trillion in 2023 and are on course for US$ 7.5 trillion by 2028, an 8.9 % CAGR.

Malaysia retains the overall #1 position for the 11th consecutive year, topping every sector except modest fashion. Saudi Arabia consolidated second place, Indonesia held third, and the UAE and Bahrain rounded out the top five, while Pakistan and Senegal were the notable movers.

The UAE places #4 overall in the 2024/25 GIEI—behind Malaysia, Saudi Arabia and Indonesia—and lands within the top five in every pillar except modest fashion (#7). Performance is propelled by world‑class trade connectivity, diversified export capacity and a high innovation score.

One of only three OIC member states ranked among the top exporters to OIC markets, the UAE has extended its reach through a network of Comprehensive Economic Partnership Agreements (CEPAs). CEPAs with Indonesia and Türkiye entered into force in September 2023—the Türkiye agreement includes a dedicated halal‑cooperation clause to advance mutual recognition—while negotiations concluded with Morocco and Malaysia and a new agreement was signed with Jordan in 2024. The UAE also officially joined the BRICS economic partnership at the start of 2024.

Investments in Islamic economy-relevant companies in 2023/24 reached US$ 5.8 billion with investors completing 225 M&A, PE and VC transactions. Media & Recreation registered 87 deals, reflecting demand for culturally aligned digital content. Islamic Finance recorded the largest deal value at US$ 1.98 billion across 59 transactions. Indonesia (40 deals; US$ 1.60 billion) leads with total deal value, followed by the UAE (50 deals; US$ 1.53 billion), and Saudi Arabia (34 deals; US$ 1.08 billion).

The report spotlights more than 30 important signals of opportunity, including blockchain-backed halal supply-chain traceability, Islamic DeFi platforms, AI-driven tourism services, social-commerce-powered modest fashion, and soaring ethical-consumer activism that is accelerating local halal-brand growth.

Total OIC imports of halal-related products amounted to U$ 407.8 billion in 2023, with 72% of it being food imports. This is set to grow at 8.3% CAGR to US$ 608.4 billion by 2028.

Rafi-uddin Shikoh, CEO and Managing Partner, DinarStandard, said: “The UAE’s combination of deep trade networks, ambitious digital and AI agendas, and fast-scaling halal manufacturing capacity positions it as one of the most influential hubs in the global Islamic economy. As more CEPAs embed halal cooperation and as verification becomes digital by default, UAE-based businesses are exceptionally well placed to serve both OIC and non-OIC demand.”

The SGIE report 2024/25 has been produced in partnership with SalaamGateway.com, the largest Islamic economy news and media platform. The thought leadership partner of the report is IsDBI. The global strategic partner of the report this year is halal certifier IFANCA. The bronze partner is Duopharma.

The full State of the Global Islamic Economy Report 2024/25 can be downloaded at https://salaamgateway.com/specialcoverage/SGIE24

About DinarStandard

DinarStandard™ is a growth-strategy research and advisory firm specialised in the halal and ethical economy, government innovation and social-impact sectors. Since 2008 it has supported more than 30 governments, investment institutions and industry leaders across 12 countries.

Media Contact

Reem El Shafaki

DinarStandard

Email: reem.elshafaki@dinarstandard.com