PHOTO

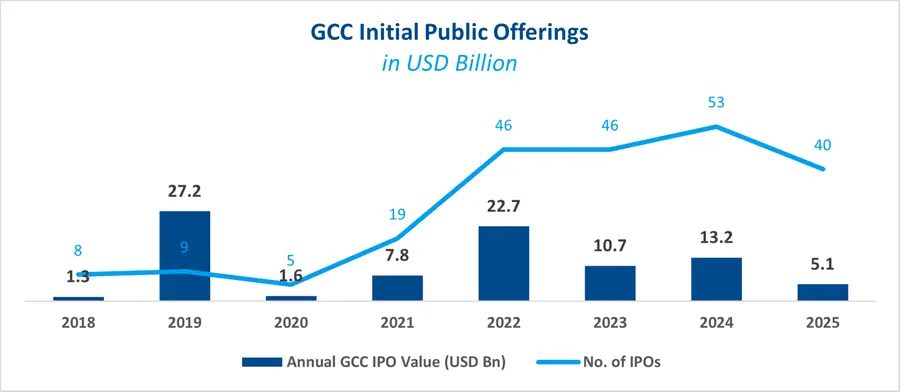

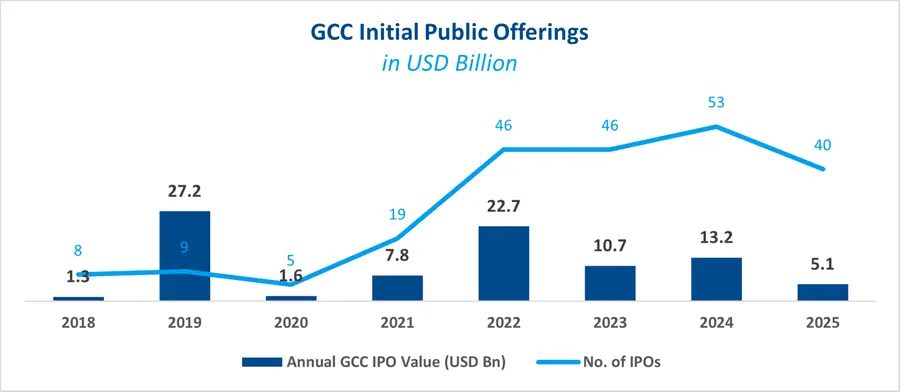

Kuwait – Kuwait Financial Centre “Markaz” released its research report titled “Initial Public Offerings (IPO) in the GCC markets”, stating that the region has seen 40 offerings during the year 2025 raising a total of USD 5.1 billion in proceeds, marking a 61% decrease compared to the previous year, where issuers raised USD 13.2 billion through 53 offerings. Corporate IPOs raised USD 3.9 billion, or 76% of the total GCC IPO proceeds during the year, through 37 offerings. While IPOs offered by government related entities only accounted for 24%, amounting to USD 1.2 billion through 3 offerings.

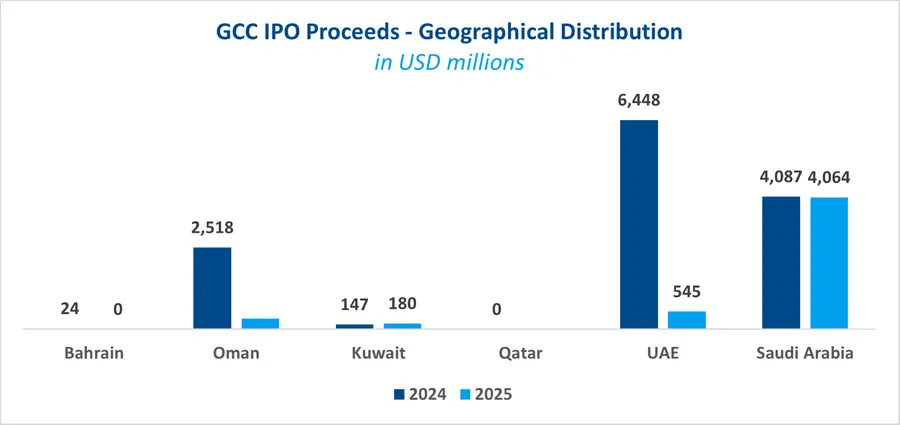

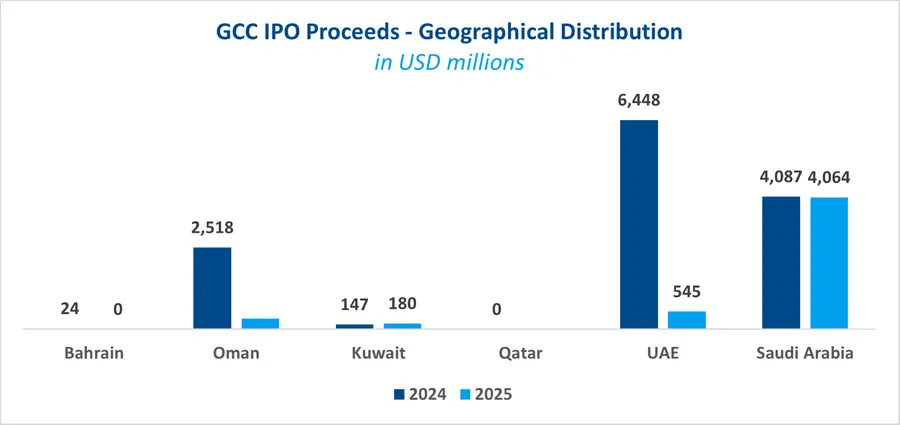

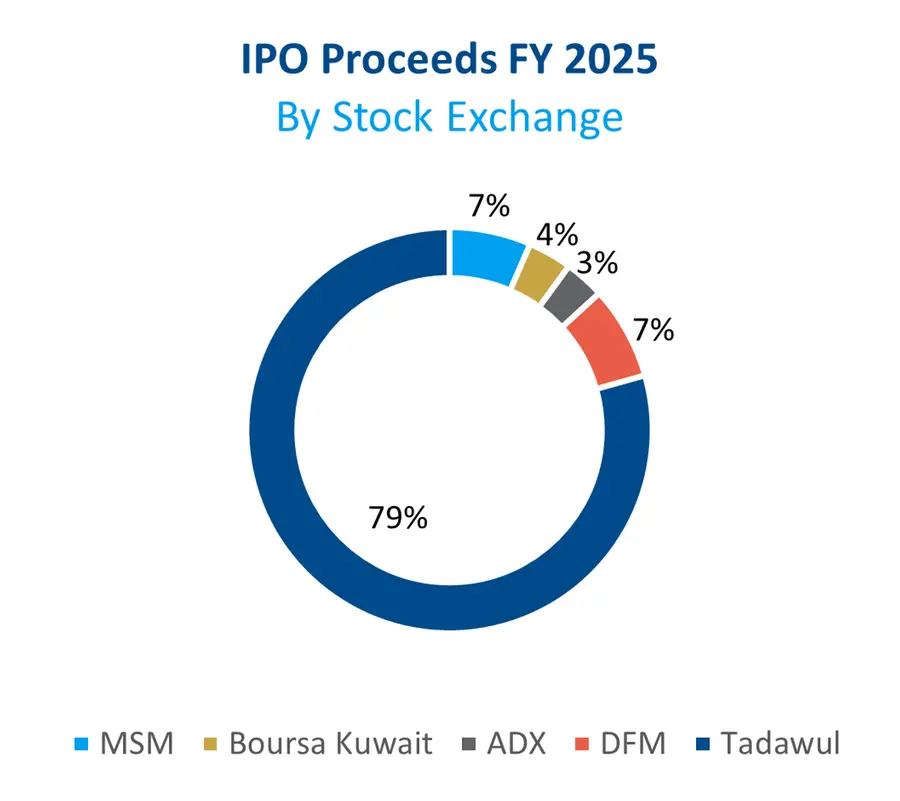

Geographical Allocation:

Markaz’s report stated that Saudi Arabia led the region in terms of IPO proceeds, raising a total of USD 4.1 billion which constituted 79% of the total GCC IPO proceeds during the year. Saudi Exchange (Tadawul) saw 13 IPOs on its Main Market amounting to a total of USD 3.7 billion and 23 IPOs on its Parallel Market (Nomu) raising a total of USD 336 million.

The Emirates saw 2 IPOs during the year where Abu Dhabi Securities Exchange (ADX) raised USD 163 million through Alpha Data’s IPO. On the other hand, Dubai Financial Market (DFM) raised a total of USD 381 million through Alec Holdings IPO.

Oman raised USD 333 million during the year, or 7% of the total GCC IPO proceeds through Asyad Shipping Company IPO on the Muscat Securities Market (MSM). While Kuwait saw the IPO of Action Energy Company during the last quarter of the year. The offering raised a total of USD 180 million constituting 4% of the total GCC IPO proceeds for the year.

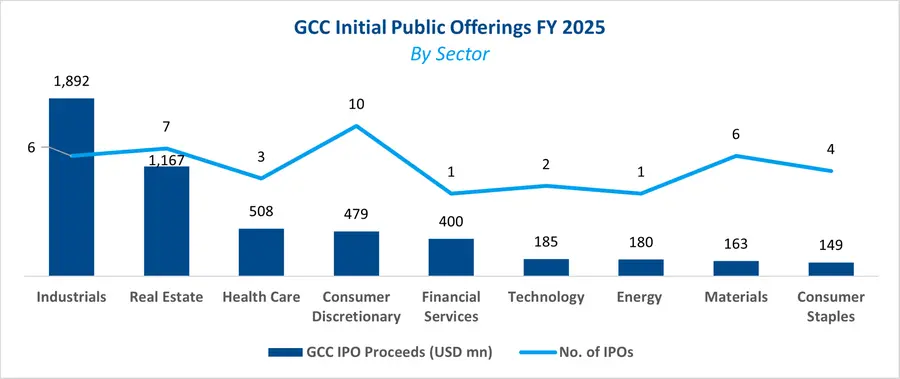

Sector Allocation:

The Industrials sector raised a total of USD 1.9 billion, accounting for nearly 37% of the total proceeds during 2025 with the largest contribution coming from Saudi Arabia’s Flynas with a value of USD 1.1 billion. This was followed by the Real Estate sector with USD 1.2 billion, or 23% of the total proceeds, from 7 IPOs including Umm Al Qura for Development and Construction and Dar Al Majed Real Estate Company. The Healthcare sector raised a total of USD 508 million, constituting 10% of the total proceeds, from 3 IPOs from SMC Hospitals in the Main Market of Tadawul and Basma Adeem and Wajd Life Trading Company in the Nomu Market of Tadawul.

Moreover, the Consumer Discretionary sector saw USD 479 million in proceeds, constituting 9% of the total proceeds, through 10 IPOs all in Saudi Arabia while the Financial Services sector saw USD 400 million from Derayah Financial Company’s IPO on Tadawul, constituting 8% of the total GCC IPO proceeds during the year. This was followed by the Technology, Energy, Materials, and Consumer Staples sectors which constituted 4%, 4%, 3% and 3% of total offerings respectively.

Post-Listing Performance:

The top IPO gainers of 2025 benefited from attractive offer pricing, strong post-listing liquidity, and exposure to sectors with clear growth or defensive characteristics. Listings on Tadawul, across both the Main Market and Nomu, saw performance supported by broad investor participation and sustained demand. The largest gainer was Ratio Specialty Company listed on Nomu in March 2025 with shares that rose by 190% after its offering price at SAR 10.

On the other hand, some IPOs have recorded negative performance being weighed down by overvaluation, limited liquidity, and exposure to low-growth or margin-pressured sectors. Companies faced structural challenges and muted post-listing investor interest, which negatively impacted performance throughout the year. The weakest performer was Smoh Almadi listed on Nomu in January 2025 with shares that drop by 60% after its offering price at SAR 22.

GCC Markets Performance

Most of the GCC equity market indices ended 2025 on a positive note. Muscat Securities Market outperformed its GCC peers with a 28.1% gain, followed by Boursa Kuwait with a 25.3% increase. Dubai Financial Market increased by 17.2% while the Abu Dhabi Exchange gained 6.1%. Bahrain Bourse and the Qatar Stock Exchange recorded increases of 4.1% and 1.8% respectively. In contrast, Saudi Tadawul declined by 12.8% during the year.

GCC IPO Pipeline:

GCC IPO activity is expected to rise in 2026 compared with 2025, driven by stable global interest rates and ongoing divestment initiatives. With strengthening investor confidence and evolving regulatory frameworks, the region is likely to attract a broader range of companies preparing for public offerings.

| Selected IPOs | Country | Market | Offering Size (Stake) | Sector |

| Aluminum Products Co. | KSA | Tadawul | NA | Materials |

| National Unified Procurement Company for Medical Supplies | KSA | Tadawul | 30% | Healthcare |

| Dar Albalad | KSA | Tadawul | 30% | Technology |

| Mutlaq Al-Ghowairi Contracting Company | KSA | Tadawul | 30% | Industrials |

| AlDyar AlArabia Real Estate Development Company | KSA | Tadawul | 30% | Real Estate |

| Etihad Airways | UAE | ADX | 20% | Industrials |

| Dubai Investment Park | UAE | DFM | 25% | Real Estate |

| Al Koot Insurance & Reinsurance | Qatar | Qatar Stock Exchange | NA | Financial Services |

| Oman India Fertiliser Co. | Oman | MSM | NA | Energy |

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.61 billion (USD 5.28 billion) as of 30 September 2025. Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics and help Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund in Kuwait), Forsa Financial Fund (the first options market maker in the GCC since 2005), and the GCC Momentum Fund (the first passive fund of its kind in Kuwait and across GCC that follows the momentum methodology), all conceptualized, established, and managed by Markaz.

For further information, please contact:

Sondos Saad

Corporate Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: Ssaad@markaz.com

markaz.com