PHOTO

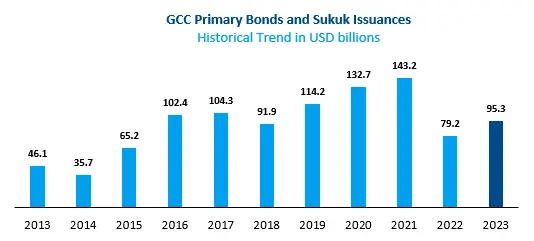

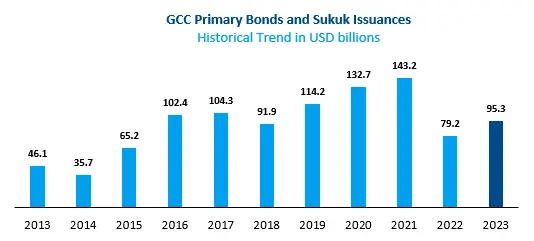

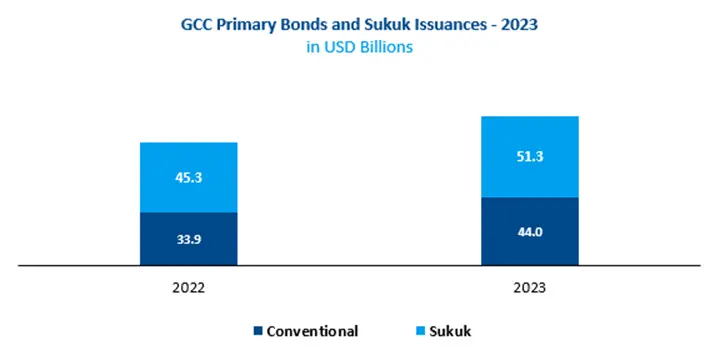

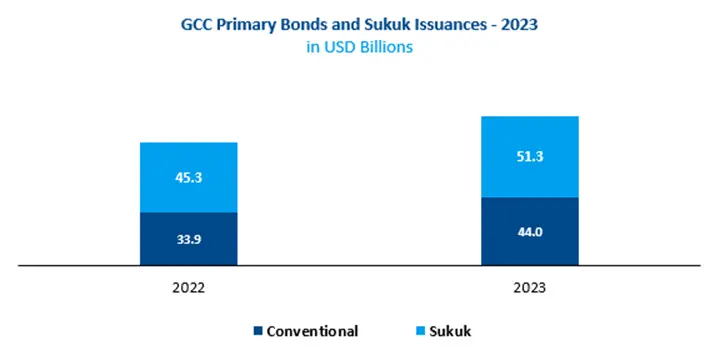

Kuwait: In its Fixed Income Report, Kuwait Financial Centre “Markaz” states that Primary debt issuances of Bonds and Sukuk in the Gulf Cooperation Council (“GCC”) Countries amounted to USD 95.3 billion during the year 2023 compared to USD 79.2 billion raised in 2022, marking a year-on-year growth of 20.3%. During the year 2023, there were 224 primary debt issuances including fixed and floating rate tranches compared to 201 issuances in 2022.

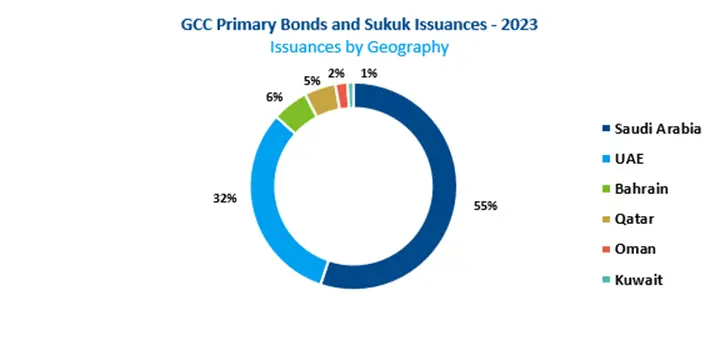

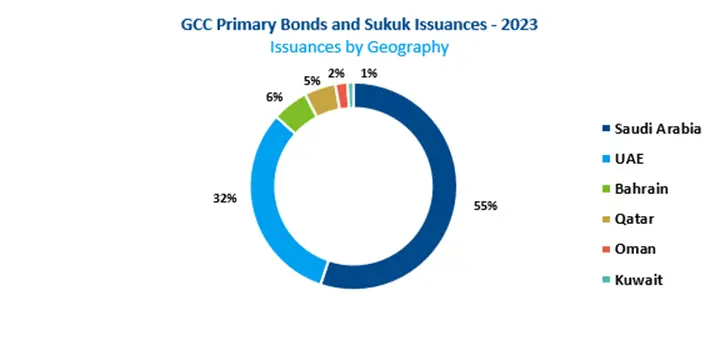

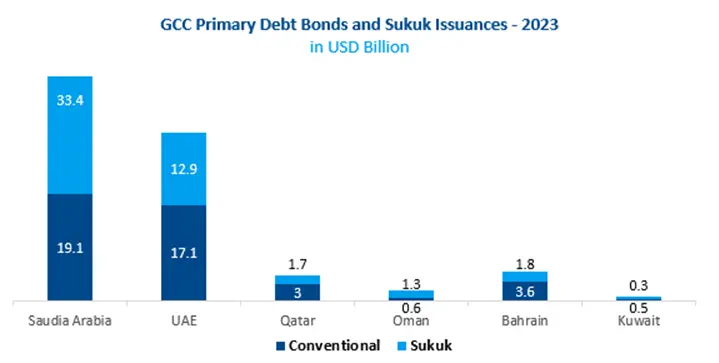

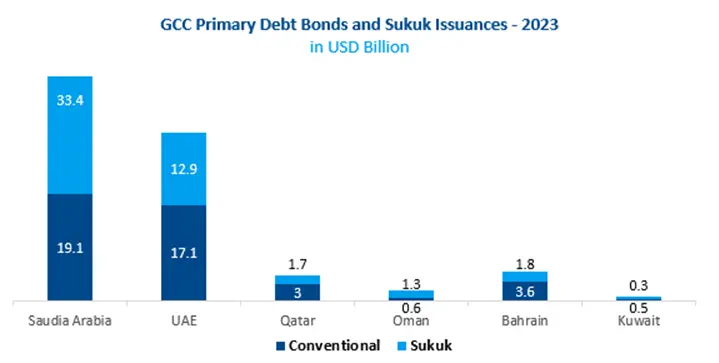

Issuances by Geography:

Saudi-based issuers led the GCC Bonds and Sukuk market during the year, raising a total of USD 52.5 billion through 69 issuances, representing 55.1% of the total value raised in the GCC, followed by UAE issuers which raised USD 30.0 billion with 94 issuances, representing 31.5%. Bahrain entities raised a total of USD 5.3 billion representing 5.6% while Qatar entities raised a total of USD 4.7 billion representing 4.9% of the total new amount issued during the year. Oman entities raised a total of USD 1.9 billion representing 1.9% followed by Kuwaiti issuers that raised a total of USD 0.8 billion through 5 issuances.

Sovereign vs. Corporate: Issuances by Sovereign entities in the GCC made up 42.5% of the total value of GCC primary issuances during 2023, amounting to USD 40.5 billion and down 5.8% year-on-year from its value in 2022. Primary issuances by Corporates, on the other hand, amounted to USD 54.8 billion during 2023 constituting 51.4% of the total value of GCC primary issuances and marking a year-on-year growth of 51.4% compared to the preceding year.

Conventional vs. Sukuk: Conventional issuances increased by 29.6% year-on-year during 2023, raising a total of USD 44.0 billion representing 46.1% of the total value of primary issuances in the GCC. On the other hand, Sukuk issuances amounting to USD 51.3 billion made up 53.9% of the total value of primary issuances during 2023 and recording a 13.4% year-on-year growth.

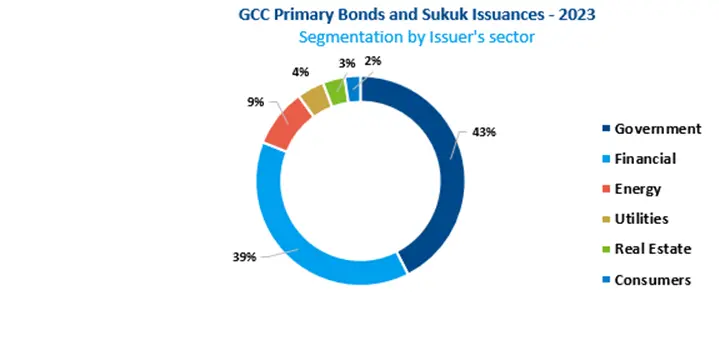

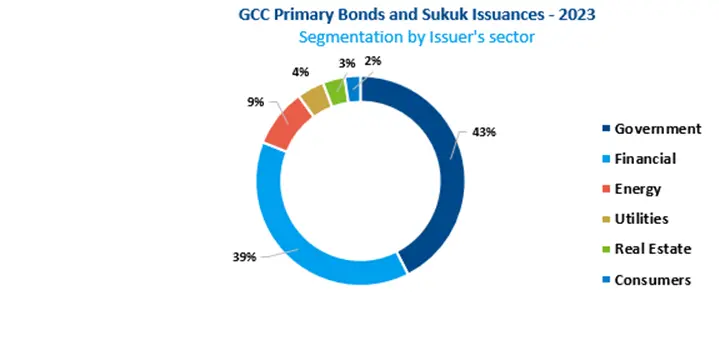

Sector Segmentation: The Government sector accounted for the largest amount of primary debt issuances by value, raising a total of USD 40.5 billion, or 42.5% of the total value of issuances in the GCC in 2023, closely followed by the Financial sector (including quasi-government entities) that raised a total value of USD 36.7 billion, representing 38.5% of the total amount issued.

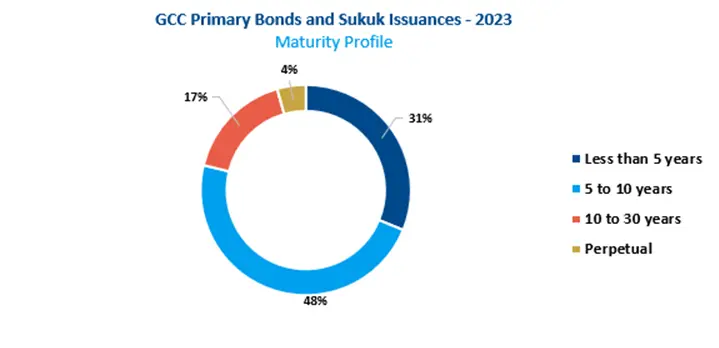

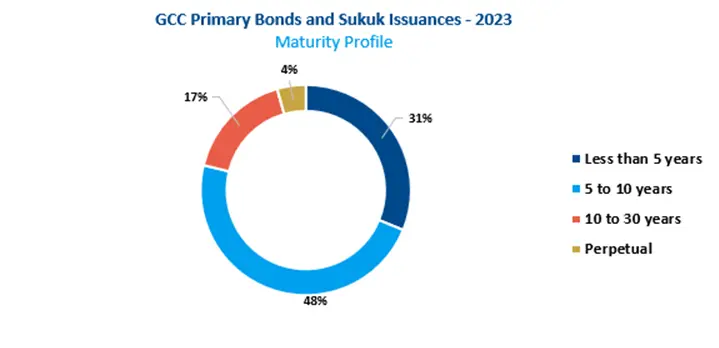

Maturity Profile: Issuances with tenors of 5-10 years dominated the GCC debt capital markets by total value, with a total of USD 45.4 billion, or 47.6% of the total value of issuances. Issuances with tenors of less than 5 years came in second with a total value raised of USD 29.7 billion, or 31.2% of the total value of issuances.

Issue Size Profile: The size of GCC Bonds and Sukuk primary issuances during the year ranged from USD 1 million to USD 4.0 billion. Issuances with principal amounts greater than or equal to USD 1 billion raised the largest amount totaling USD 58.8 billion, representing 61.7% of the total primary issuances.

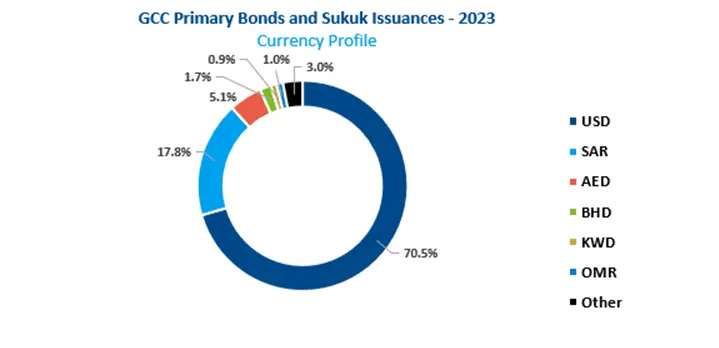

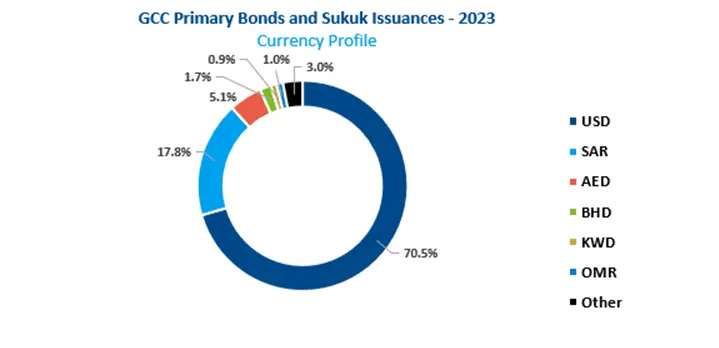

Currency Profile: US Dollar-denominated issuances led the GCC Bonds and Sukuk primary market in 2023, raising a total of USD 67.2 billion or 70.5% of the total value of GCC primary issuances. This was followed by Saudi Riyal denominated issuances that raised a total of USD 17.0 billion or 17.8% of the total value of issuances in the GCC.

Rating: In 2023, a total of 69.1% of GCC primary Bonds and Sukuk issuances (in terms of value) were rated by either one of the following rating agencies: Standard & Poor’s, Moody’s, Fitch and/or Capital Intelligence, of which 59.1% were rated within the Investment Grade.

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.16 billion as of 30 September 2023 (USD 3.75 billion). Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund in Kuwait), Forsa Financial Fund (the first and only options market maker in the GCC since 2005), and the GCC Momentum Fund (the first passive fund of its kind in Kuwait and across GCC that follows the momentum methodology), all conceptualized, established, and managed by Markaz.

For further information, please contact:

Sondos S. Saad

Corporate Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com