Key Takeaways

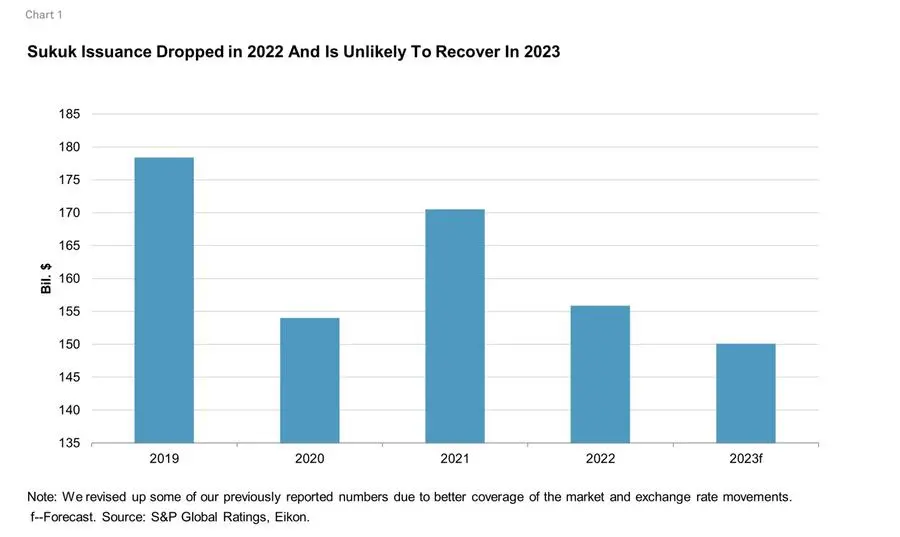

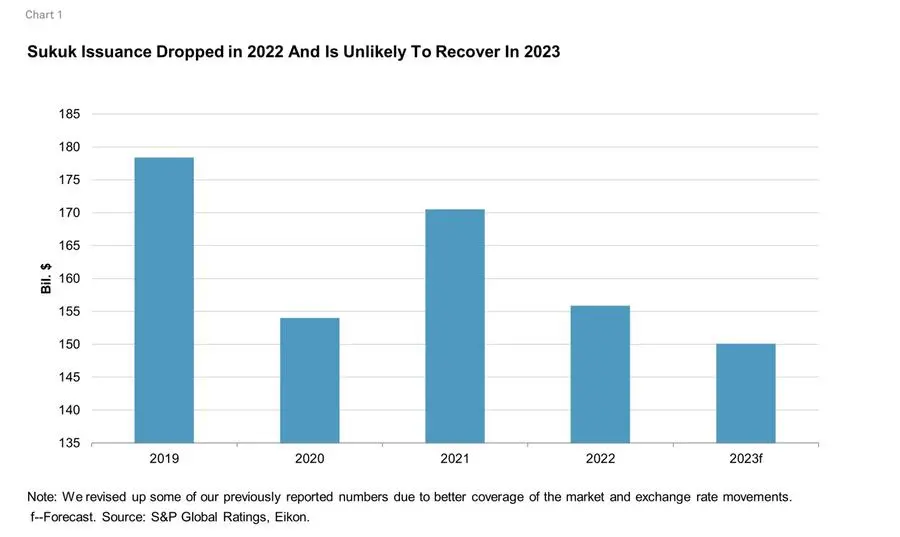

- Total sukuk issuance dropped to $155.8 billion in 2022 compared with $170.4 billion in 2021, mainly due to a decline in foreign-currency-denominated instruments.

- We believe lower and more expensive global liquidity, increasing regulatory complexity, and reduced financing needs in some core Islamic finance countries will hold back the market this year.

- Consequently, we forecast a further decline in total issuance to about $150 billion in 2023, despite governments' continued local currency issuances to support their capital markets

S&P Global Ratings believes that sukuk issuance volumes will continue to decline in 2023, albeit at a slower pace than 2022. We expect lower and more expensive global liquidity, increased complexity, and reduced financing needs for issuers in some core Islamic finance countries to deter the market.

Notably, future standards development and certain Sharia scholars' preference for a higher proportion of profit-and-loss sharing in sukuk could pose additional legal challenges, in our view.

We continue to believe that if sukuk become an equity-like instrument, investor and issuer appetite will likely diminish significantly, in particular amid already expensive liquidity.

However, we see supportive factors in other areas.

Corporates are likely to contribute to issuance volumes, particularly in countries with government transformation visions or plans, such as Saudi Arabia, where well capitalized banking systems will not have the capacity to finance all the projects.

We also see continued momentum via the energy transition and increased awareness of environmental, social, and governance considerations among issuers in key Islamic finance countries. However, the sukuk market seems to be lagging the conventional one when it comes to automation and issuance of digital instruments, which could accelerate growth and make the process more appealing.

Issuance Numbers Won't Recover in 2023

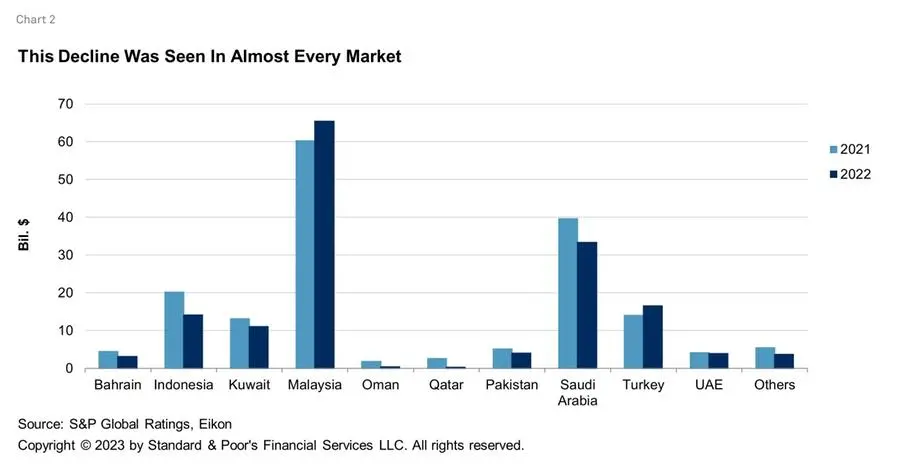

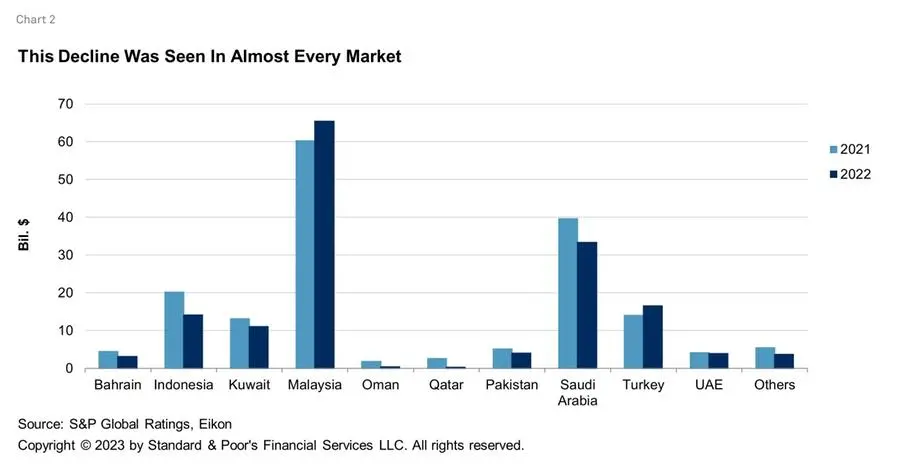

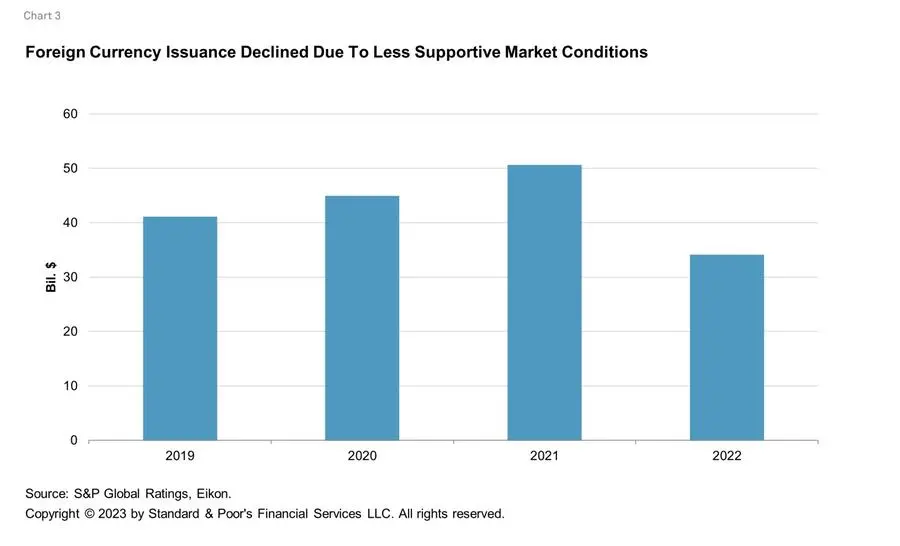

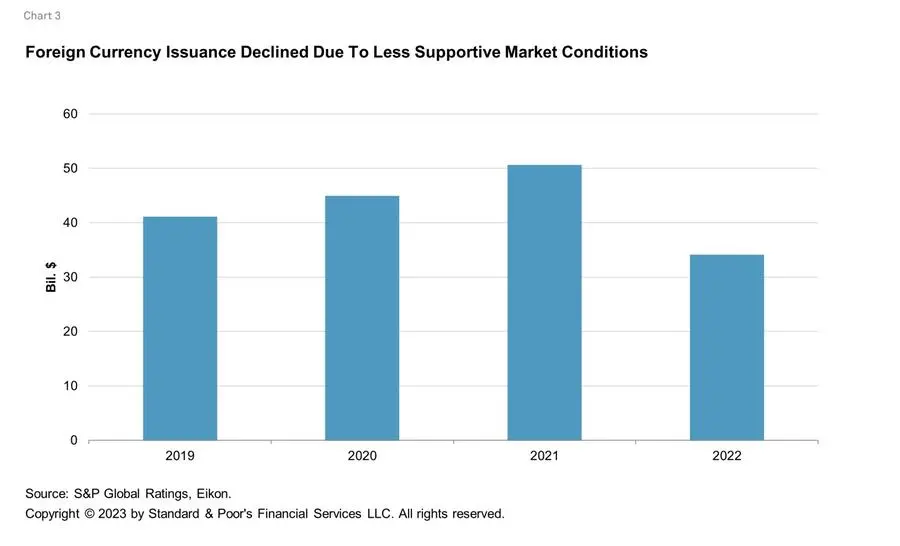

In 2022, total sukuk issuance reached $155.8 billion versus $170.4 billion a year earlier (see chart 1). Declines occurred in most core Islamic finance countries, with only a few exceptions such as Malaysia (higher growth) and Turkey (pursuing all financing sources available) seeing marginally higher numbers (see chart 2). More importantly, issuance in foreign currency plummeted (see chart 3).

We expect this trend to continue in 2023 and forecast sukuk issuance will reduce again to $150 billion, with further risks building. Three factors explain our view:

The world is getting used to more expensive global liquidity. High inflation prompted major central banks to accelerate interest rate increases. This has reduced global liquidity and made it more expensive. Investors' risk aversion has also increased, with major segments of capital markets (for example speculative-grade issuers) experiencing significantly lower activity in 2022 compared with 2021. The sukuk market, as a component of the global capital market, is not immune to these trends. We may see some upside in activity if inflation trends down sustainably and central banks slow the pace of their interest rate increases.

Issuers have reduced financing needs. High oil prices have boosted the balance sheets of several issuers in core Islamic finance countries. Moreover, in some, particularly Qatar and the United Arab Emirates (UAE), an investment cycle has just ended. In others, where government transformation visions are being implemented--such as Saudi Arabia--we expect some corporates to hit the sukuk market because the banking system won't be able to absorb all the investments. We also expect the Saudi government to continue issuing sukuk in local currency to develop the local capital market, although recent pressure on banks' liquidity resulted in lower activity than 2021.

Regulatory uncertainty is still high. Sukuk are more complex and time-consuming than conventional bonds. Therefore, new issuers are mainly taking the Islamic route because they expect to increase their investor base compared with purely conventional transactions. Regulatory uncertainty remains high and resides in the fragile equilibrium between making sukuk a fixed-income instrument and Sharia scholars' push for more profit-and-loss sharing. In our view, if sukuk lose their fixed-income characteristics while adding significant risks compared to bonds they will become a less attractive option, reducing the market's prospects.

Sustainability Sukuk Are Becoming More Prevalent

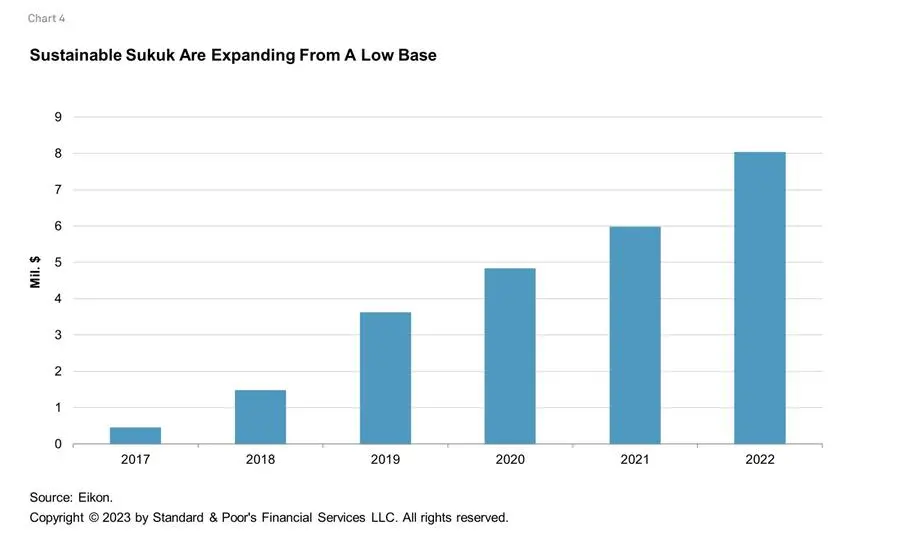

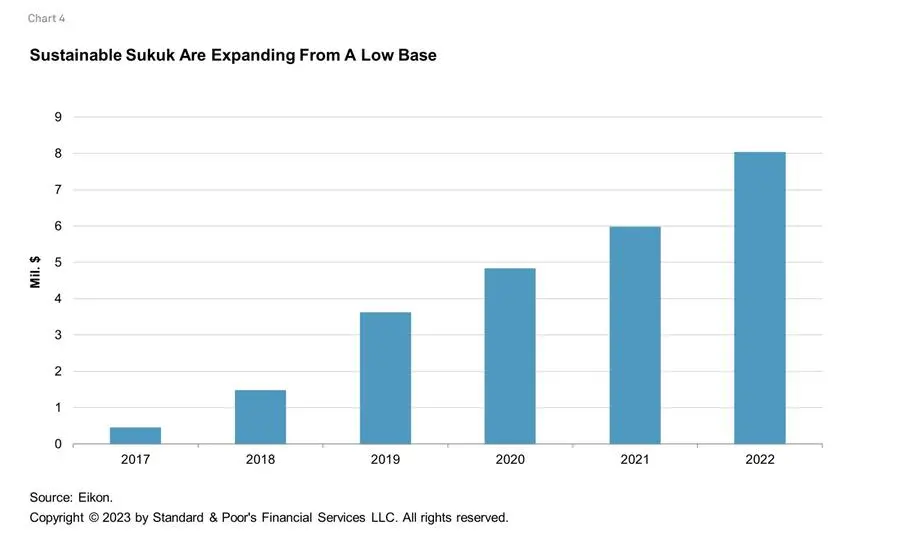

Despite the natural alignment of Islamic finance and sustainable finance, sustainability sukuk issuance remains limited, albeit expanding (see chart 4). From green to social, we expect to see higher volumes as issuers meet investor demands and core Islamic finance countries seek to reduce their carbon footprints.

Many of these countries are developing and implementing strategies to transition to greener economies, which could imply future growth potential for green sukuk issuance. We expect to see much more activity in this space as issuers tap global investor interest. Furthermore, but less visible, Islamic finance's social aspect holds appeal as the economic impacts of various political/geopolitical shocks continue to hit populations in some countries.

Digitalization Still Has A Long Way To Go

In the digital space, we are seeing more conventional than Islamic activity. One could argue that this is a necessary step because the conventional market has traditionally led the Islamic one.

However, even when companies have tried to develop the necessary infrastructure, issuer and investor take up appears limited. In any case, we believe that digital sukuk could provide a quicker and cheaper way for issuers to tap Islamic finance markets due to the limited number of intermediaries involved. The benefits may also include enhanced transaction security, traceability, and integrity, which could further strengthen compliance with Sharia. However, this assumes the availability of reliable technology, readiness of legal frameworks to accommodate these instruments, and presence of standard legal documents that can be used as a template.

Reducing the time, cost, and minimum issuance volume requirement in this way could open the sukuk market to more issuers. However, investors in digital sukuk will continue to bear traditional risks, including credit market and liquidity risk. They will also be exposed to higher operational risks from technology stability and cyber risks and need a means to transact digitally, for example, a stable Islamic coin or a central bank digital currency. Despite this, we expect to see more digital transactions in 2023

Related Research

- Saudi Capital Markets Will Be Key To Powering Corporate Investments, Nov. 29, 2022

- Islamic Finance In The U.K. Is Still Learning To Crawl, Sept. 01, 2022

- Global Sukuk Issuance 2022: How Low Can It Go?, July 4, 2022

-Ends-

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved.

Copyright & Disclaimer

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors.

S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors.

S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor’s Financial Services LLC.

PRIMARY CREDIT ANALYST

Mohamed Damak, Dubai

mohamed.damak@spglobal.com

SECONDARY CONTACTS

Sapna Jagtiani, Dubai

sapna.jagtiani@spglobal.com

Puneet Tuli, Dubai

puneet.tuli@spglobal.com