Kuala Lumpur: The Value-based Intermediation Financing and Investment Impact Assessment Framework (VBIAF) Sectoral Guide Working Group (WG) today issued the second cohort of the VBIAF Sectoral Guides on Oil & Gas (O&G), Manufacturing and Construction & Infrastructure (C&I). With more than 6 months and over 1,200 hours of development work, >40 technical and subject-matter experts and observers, >50 project managers and WG members, the Sectoral Guides provide an in-depth impact-based risk management toolkit for financial institutions (FIs) to implement VBIAF at a more granular and transactional level.

This initiative is a continuation from the first cohort that developed the Sectoral Guides on Palm Oil, Renewable Energy and Energy Efficiency in early 2021. The latest Sectoral Guides introduced new critical elements such as performance management, stakeholder inclusion and validation, and remedial measures, in addition to the key focus areas from the previous set of Sectoral Guides.

“The Sectoral Guides will trigger new areas of investigation, new credit processes, new VBI mandates-offering sufficient motivation for FIs to not only implement the guidelines, but also make further improvement in their own VBI and Environmental, Social, & Governance (ESG) operating models and decision making. This will ultimately lead to FIs managing their ESG risk exposures better, making ESG performance a differentiator to strengthen their value proposition to investors and customers alike”, said Syamsul Azuan bin Ahmad Fauzi, Chief Executive Officer of Public Islamic Bank Berhad and the Chairman of the 2nd Cohort.

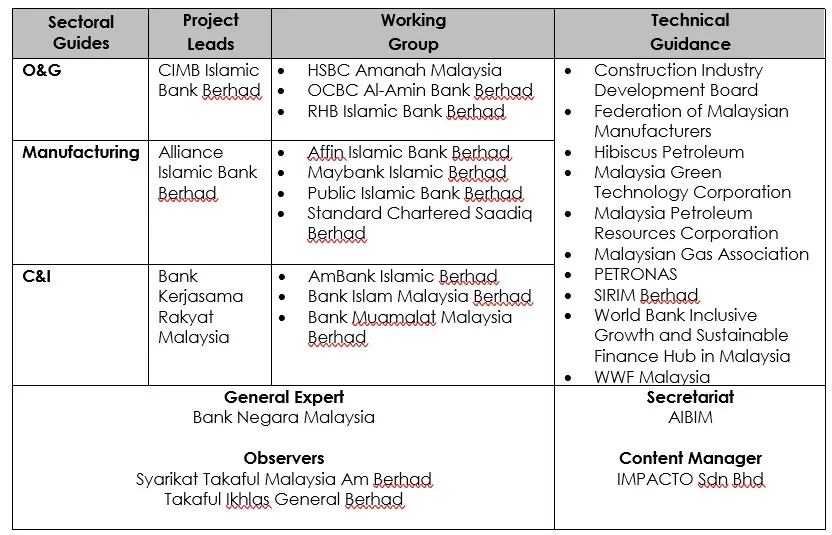

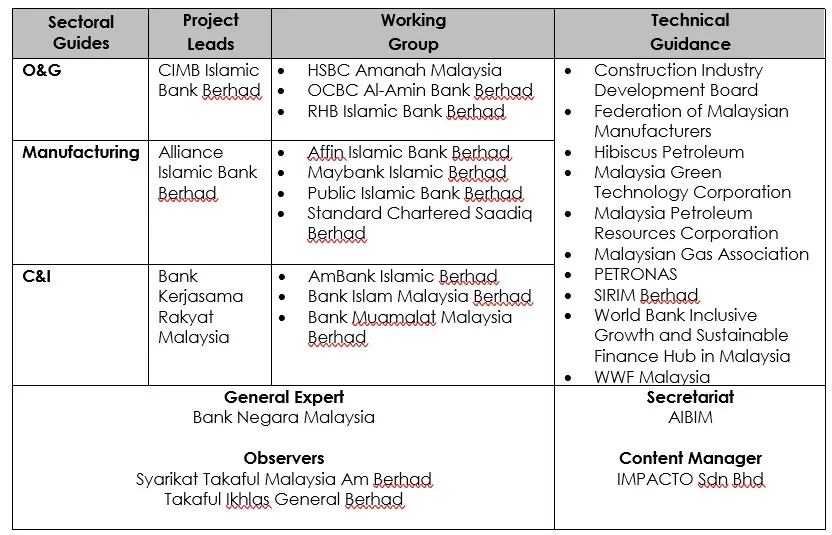

These Sectoral Guides are expected to accelerate the efforts of the VBI Community of Practitioners (CoP) to promote VBI integration, sustainable financing and responsible banking. The CoP comprises 15 leading Islamic banks in Malaysia, of which CIMB Islamic, Alliance Islamic and Bank Rakyat took the lead as Project Managers for O&G, Manufacturing and C&I Sectoral Guides respectively.

"The publication of these Sectoral Guides is another commendable achievement of the VBI CoP in advancing the sustainability agenda of the Malaysian financial sector. The Sectoral Guides will assist FIs in integrating assessment of ESG considerations in financing, investment and protection decisions. In turn, this will contribute towards practical implementation of VBI Financing and Investment Impact Assessment Framework (VBIAF) as well as measures by the Joint Committee on Climate Change (JC3) such as the Climate Change and Principle-based Taxonomy", added Adnan Zaylani Mohamad Zahid, Assistant Governor, Bank Negara Malaysia.

The second cohort has been an independent effort led by the CoP instead of the regulator, making it an all-inclusive in terms of its applicability, relevance and acceptance.

“Responding to the global crisis in climate and nature will require a reshaping of our economic relationships with the natural world. We commend the multi-stakeholder efforts of the WG members for deliberating and acting on burning ESG issues in their respective sectors in the context of the fast evolving economic, regulatory and policy landscape in Malaysia concerning responsible business practices. The Guides will aid financial institutions in driving an orderly transition towards a more equitable, net-zero and nature-positive future, while also supporting Malaysia’s commitment to the Paris Agreement and landmark global pledges”, concluded Sophia Lim, Executive Director/CEO, WWF-Malaysia.

For more information or clarification, please write to the Secretariat at vbi@aibim.com

-Ends-

ABOUT VBIAF

The "Value-based Intermediation Financing and Investment Impact Assessment Framework - Guidance Document" (VBIAF) was issued by Bank Negara Malaysia on 1 November 2019. The guidance document has been jointly developed by the VBI Community of Practitioners (CoP), the International Centre for Education in Islamic Finance (INCEIF), The World Bank Group (Malaysia Office) and World-Wide Fund for Nature (WWF) (Malaysia and Singapore Offices).

The VBIAF aims to facilitate the implementation of an impact-based risk management system for assessing the financing and investment activities of Islamic financial institutions in line with their respective VBI commitments. The VBIAF also serves as a reference for other financial institutions intending to incorporate environmental, social and governance (ESG) risk considerations in their own risk management system.

ABOUT 2nd COHORT WORKING GROUP

About AIBIM

The Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) was established in 1995 as the Association of Interest Free Banking Institutions Malaysia. Currently, AIBIM has 27 member banks consists of 12 domestic banks, 5 development financial institutions and 10 locally incorporated foreign banks. The organisation promotes sound Islamic banking system and practice in Malaysia; represents interest of members locally and abroad; provides advice and assistance to members pertinent in the development on Islamic banking and finance at local, regional and global level; coordinates human capital development initiatives, and promotes public awareness.

Media enquiries, please contact:

Norhisham Mohamed

Association of Islamic Banking and Financial Institutions Malaysia (AIBIM)

Email : vbi@aibim.com