PHOTO

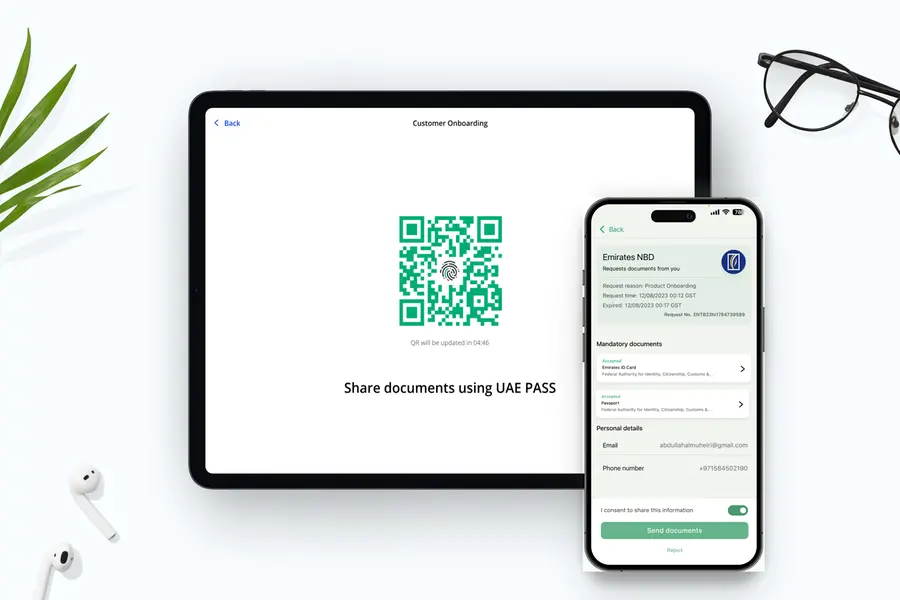

- Integrated with UAE Pass, Tablet X offers immediate authentication and special paperless processing for UAE Nationals

- The new innovative journeys reflect Emirates NBD’s commitment to serve UAE Nationals with bespoke solutions and empower them with best-in-class banking services

Dubai, UAE: Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has launched Tablet X, a tablet banking platform that enables account opening in just three minutes as well as instant journeys to issue a credit card, request a personal loan or open a fixed deposit, all via one simplified application.

Well known as a digital-first bank and innovator in the financial sector, Emirates NBD is the first in the region to introduce a digital assisted banking experience rivalling that of leading global retail stores. The new platform enables anytime, anywhere servicing both individually or as a bundle journey.

Owing to a booming economy, the UAE has a high inflow of new-to-country customers who prefer the convenience and flexibility of assisted banking services. Tablet X ensures Emirates NBD serves these customers securely, digitally and instantly and provides a seamless experience from the get-go. The new platform will also enable the bank to bolster back-office productivity and efficiently manage the rise in application volumes expected as the current economic boom in the region continues in the coming years.

Further consolidating Emirates NBD’s position as the bank of choice for UAE Nationals, Tablet X has been integrated with UAE Pass, allowing UAE citizens to use their UAE Pass to open an account, receive a credit card, or request for a personal loan in minutes, for extra convenience.

Marwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD, said: “As a homegrown financial institution, we are continuously pushing the boundaries of innovation to introduce distinctive, world-class banking experiences that support the financial needs of our customers. We are also dedicated to enhancing our position as the bank of choice for Emirati customers through the provision of the most digitally advanced, smart technologies and platforms that cater to their needs.”

Pedro Sousa Cardoso, Chief Digital Officer, Retail Banking and Wealth Management, Emirates NBD, said: “Emirates NBD has decades-long expertise in leveraging innovation to simplify banking. Our new digital assisted banking journeys deliver on our commitment on serving our customers with a state-of-the-art banking experience and accessible services at their fingertips, and we are witnessing a real impact of these solutions on the ground.”

About Emirates NBD

Emirates NBD (DFM: Emirates NBD) is a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region with a presence in 13 countries, serving over 20 million customers. As at 30th September 2023, total assets were AED 836 billion, (equivalent to approx. USD 228 billion). The Group has operations in the UAE, Egypt, India, Türkiye, the Kingdom of Saudi Arabia, Singapore, the United Kingdom, Austria, Germany, Russia and Bahrain and representative offices in China and Indonesia with a total of 853 branches and 4,213 ATMs / SDMs. Emirates NBD is the leading financial services brand in the UAE with a Brand value of USD 3.89 billion.

Emirates NBD Group serves its customers (individuals, businesses, governments, and institutions) and helps them realise their financial objectives through a range of banking products and services including retail banking, corporate and institutional banking, Islamic banking, investment banking, private banking, asset management, global markets and treasury, and brokerage operations. The Group is a key participant in the global digital banking industry with 97% of all financial transactions and requests conducted outside of its branches. The Group also operates Liv, the lifestyle digital bank by Emirates NBD, with close to half a million users, it continues to be the fastest-growing bank in the region.

Emirates NBD contributes to the construction of a sustainable future as an active participant and supporter of the UAE’s main development and sustainability initiatives, including financial wellness and the inclusion of people of determination. Emirates NBD is committed to supporting the UAE’s Year of Sustainability as Principal Banking Partner of COP28 and an early supporter to the Dubai Can sustainability initiative, a city-wide initiative aimed to reduce use of single-use plastic bottled water.

For further information on Emirates NBD, please contact:

Ibrahim Sowaidan

Senior Vice President

Head - Group Corporate Affairs

Emirates NBD

e-mail: ibrahims@emiratesnbd.com

Safa Yakoob

ASDA’A BCW

email: Safa.Yakoob@bcw-global.com