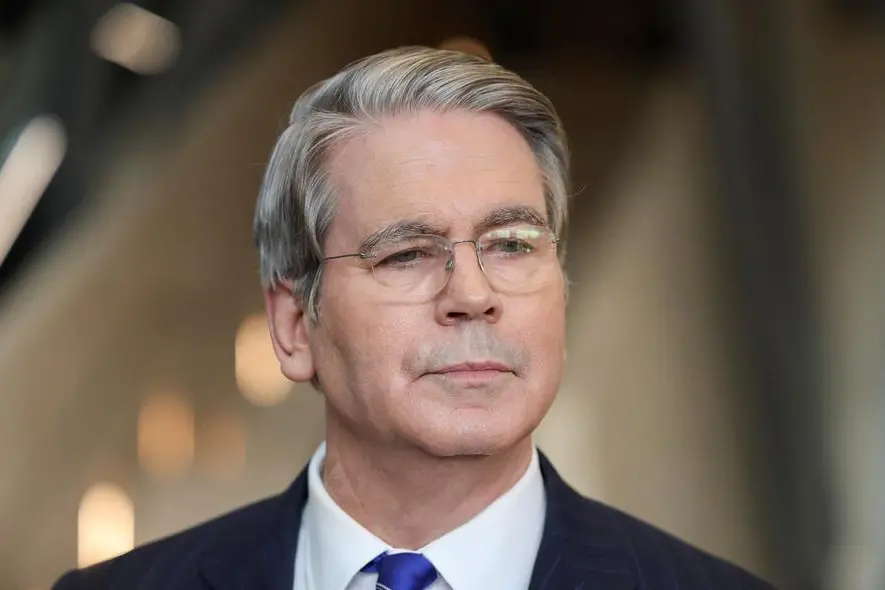

PHOTO

(The opinions expressed here are those of the author, a columnist for Reuters.)

LONDON - For anyone betting on a U.S. dollar rebound, your biggest barrier is in Washington - and not just at the Federal Reserve.

Treasury Secretary Scott Bessent this week publicly prodded the Bank of Japan to keep raising interest rates, an extraordinary intervention that indicates how sensitive the current U.S. administration is to any dollar rally.

Whether you agree with it or not, President Donald Trump's administration has a clear worldview rooted in its ideas about "fair trade" and the link between exchange rates and economic regeneration. A weaker dollar is clearly central to this Weltanschauung.

The Trump administration's economic agenda centres on cutting U.S. trade deficits, forcing U.S. firms to return home to reindustrialise the economy, increasing U.S. export competitiveness and narrowing current account gaps. Importantly, this means less foreign capital in U.S. markets - but it sees that as a feature and not a bug.

At the heart of all this, therefore, is the desire for an effective devaluation of what the Trump team sees as an egregiously overvalued dollar. The greenback's real effective exchange rate has climbed almost 50% in the 15 years through 2024, only retreating about 5% since then.

Officials are unlikely to use the "D" word publicly, but their direction of travel is clear.

Engineering a tacit devaluation in a world of free-floating exchange rates isn't easy, although undermining Federal Reserve independence and pressuring it to make deep interest rate cuts is one way to try.

The problem is that exchange rates are two-sided, meaning the country on the other side has to play ball.

And that speaks to another pillar of the Trump worldview - namely the idea that other countries have been keeping their currencies artificially weak for years to gain a trade advantage.

SHOT ACROSS THE BOW

Enter Bessent.

The Trump team's visit to Tokyo this week comes at an important time for the BOJ. This makes it all the more notable that Bessent publicly urged Japan's government to allow the BOJ to pursue a "sound monetary policy" to complement the new prime minister's fiscal push and avoid "excess exchange rate volatility". The latter phrase is clearly code for a weaker yen.

Although slightly ironic given that some fear the opposite is happening stateside, the comments were a clear warning shot to Japan's new Prime Minister Sanae Takaichi and her reported preference for both loose monetary and fiscal policies that could undermine the currency once more.

And the verbal intervention comes six weeks after a somewhat peculiar joint statement between the U.S. Treasury and Japan's finance ministry to allow market-determined exchange rates and avoid excessive volatility.

Amid discussions of trade deals worth hundreds of billions of dollars, the Treasury secretary's position this week seemed to pack an instant punch. The yen strengthened this week as Bessent spoke.

SCOTT FREE

Taking a wider view, this year's currency market reactions to various aspects of the trade upheaval have consistently shown an asymmetric bias toward a weaker dollar.

As the tariff shock unfolded in April, the greenback weakened sharply, contrary to what was expected by many economists beforehand. The dollar has since stabilised, but it certainly hasn't rallied as subsequent trade deals have emerged.

Instead, a weaker dollar appears to be a ghostly part of the negotiations.

Consider that as Trump prepared to meet Chinese President Xi Jinping in South Korea this week to smooth out rancorous trade tensions, the yuan suddenly strengthened sharply near its best levels of the year. And as Trump inked a trade deal with South Korea on Tuesday, the won there climbed too.

Europe is clearly an outlier here. But the euro zone's apparent embrace of a "global euro" that could help attract domestic capital back to the region appears to have kept the issue there at bay.

Now that the Trump administration has shown that it can successfully wield its big tariff stick, it likely believes it reserves the right to use it for any purpose. Opposing renewed currency weakness overseas would be a prime candidate.

For the markets, the dollar's stabilisation since mid-year - after its worst first half of the floating exchange rate era - has kindled some hopes that a sustained rebound may be brewing.

If it is, it could very well be snuffed out in Washington.

The opinions expressed here are those of the author, a columnist for Reuters

-- Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. Follow ROI on LinkedIn. Plus, sign up for my weekday newsletter, Morning Bid U.S.

(by Mike Dolan; Editing by Jamie Freed)