PHOTO

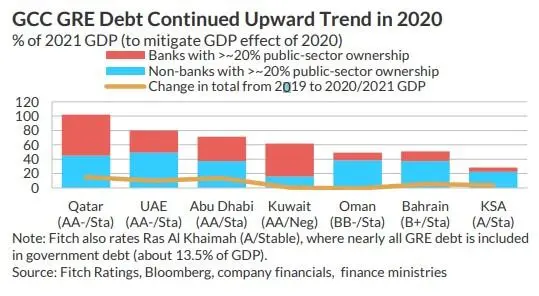

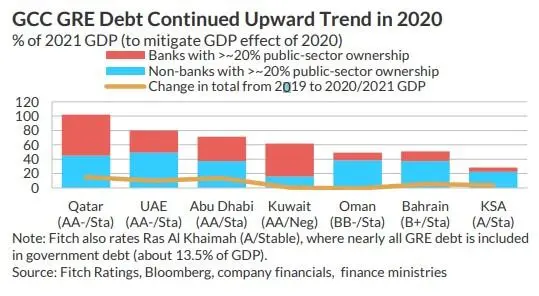

Government-related entity (GRE) debt as a share of GDP has declined across the GCC in 2021, due to higher oil prices and incipient recovery from the pandemic. However, in most of the GCC states, GRE debt levels remain higher than before the pandemic, according to a report by Fitch Ratings.

"The upward trend in GRE debt/GDP that has been in evidence since 2014 could resume as GREs help to drive national economic agendas, aiming at job creation, diversification and the energy transition," the report said.

However, increased focus on privatisation and asset sales could mitigate this trend over time, Fitch noted.

Aggregate GCC non-bank GRE debt hit 37 percent of GDP in 2020 (an increase of 7pp over 2019), driven in part by declines in nominal GDP on lower oil prices and Covid-19-induced recessions. The ratio is 32 percent in relation to forecast 2021 GDP.

Aggregate debt of GCC government-related banks rose to 24 percent of GDP in 2020. However, potential contingent liabilities from banks are larger. For instance in Qatar, sector assets reached above 300 percent.

GCC states have always supported their GREs, either on an ongoing basis or in periods of distress. The likelihood of future assistance is high given past experience, combined with the continuing importance of GREs to national economic growth strategies and, frequently, their status as national champions.

"We assess that GRE indebtedness has the highest potential to affect sovereign ratings in Qatar and Oman, considering the scale of potential exposure against the strength of their balance sheets."

Across much of the GCC, large sovereign net foreign assets and low net debt limit the credit impact of large or growing contingent liabilities. The high standalone credit quality of some GREs, in particular most of the national oil companies in the region, is also a mitigating factor. Nevertheless, many GCC sovereign ratings rely on exceptional balance-sheet strengths to outweigh structural weaknesses, including undiversified economies and political risk.

(Writing by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021