PHOTO

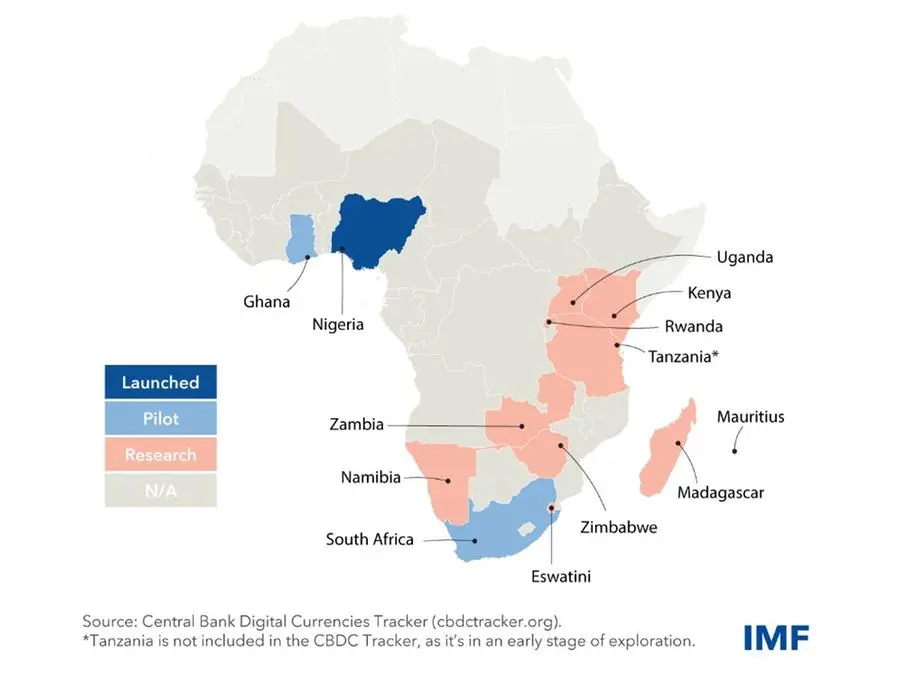

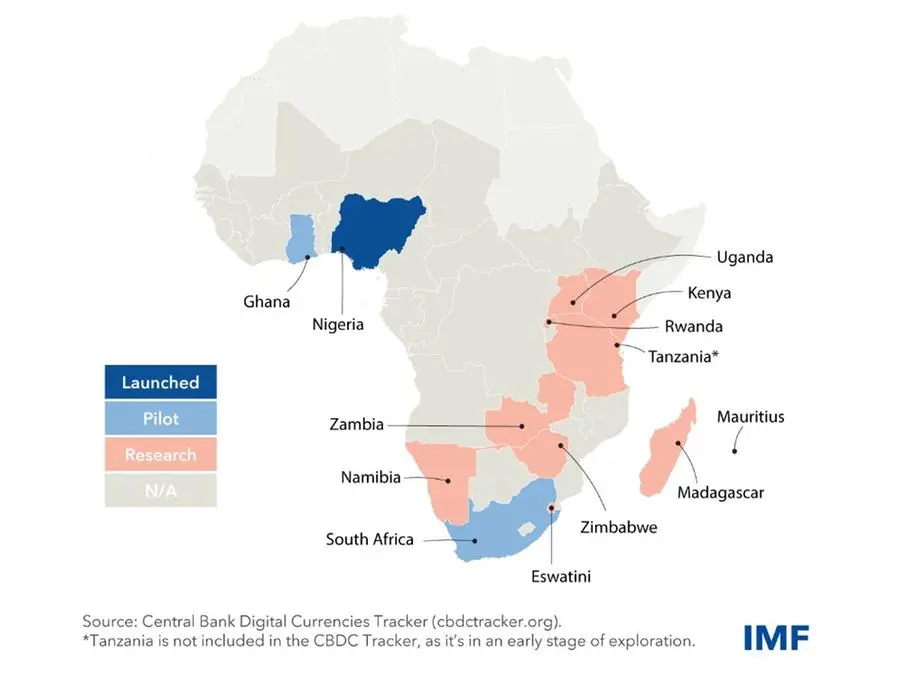

Many sub-Saharan African central banks are considering a digital currency or already piloting one. While countries have different motives for issuing Central Bank Digital Currencies (CBDCs), there are some benefits for the whole region, such as financial inclusion and cross-border payments.

As CBDCs fall under the purview of central bank regulations, they are considered more secure and less volatile than crypto assets as they are issued and regulated by central banks.

Nigeria was the second country after the Bahamas to roll out a CBDC. Following Nigeria’s October introduction of e-Naira, South Africa and Ghana are running pilots while other countries are in the research phase, the IMF said in its digital money and fintech blog.

South Africa and Ghana

As part of the second phase of its Project Khokha, the South African Reserve Bank is experimenting with a wholesale CBDC, which can only be used by financial institutions for interbank transfers.

Regulators in the country are also working on testing the digital rand and developing rules for its use.

South Africa is also participating in a cross-border pilot with the central banks of Australia, Malaysia and Singapore.

Meanwhile, the Bank of Ghana is testing a general purpose or retail CBDC, the e-Cedi, to determine whether the digital currency will work seamlessly with mobile money.

It can be used by anyone with either a digital wallet app or a contactless smart card that can be used offline.

"It is important that the eCedi is implemented to complement and enhance the existing payment systems. The various existing electronic and mobile payment solutions will therefore have to be interoperable with the eCedi to enable their utilization of the eCedi,” the central bank said.

Cross-border payments

Though the private industry for digital payment services has made big leaps in promoting financial inclusion and cross border payments via mobile money, CBDCs could also facilitate cross-border transfers and payments.

CBDCs could make sending remittances easier, faster, and cheaper by shortening payment chains and creating more competition among service providers.

According to the IMF, sub-Saharan Africa is the most expensive region to send and receive money, with an average cost of just under 8% of the transfer amount.

Faster clearance of cross-border payments would help boost trade within the region and with the rest of the world, the IMF noted.

Some of the risks and challenges that should be considered before issuing a CBDC include allocating investments for digital infrastructure that will enable easy access to phones and internet connectivity.

Central Banks should also develop the expertise and technical capacity to manage the risks to data privacy. The banks should not ignore the risk of citizens pulling too much money out of banks to purchase CBDCs, affecting their ability to lend. This is especially a problem for countries with unstable financial systems, the IMF said.

(Reporting by Seban Scaria; editing by Daniel Luiz)