PHOTO

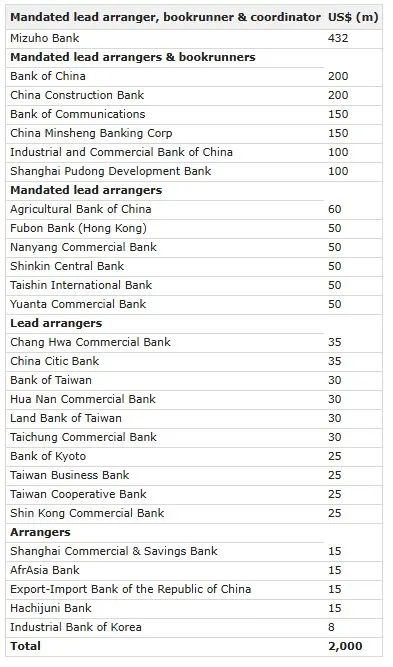

Qatar National Bank has doubled the size of its five-year loan to US$2bn in a successful outcome for syndication through which the borrower had targeted only Asian lenders for the first time in its history.

It is the largest Asian pure play syndication by a bank in the Gulf Cooperation Council, achieving the tightest pricing, QNB said.

It is part of QNB’s strategy to further broaden its relationships worldwide.

The unsecured term loan was launched at a US$1bn size in January offering an interest margin of 80bp over SOFR and a top-level upfront fee of 110bp.

“This facility has attracted strong interest from major Asian banks, enabling us to further diversify our investor base,” said Abdulla Mubarak Al-Khalifa, QNB Group’s CEO.

“The issuance was oversubscribed at competitive all-in pricing, which, despite challenging global market conditions, reaffirms our reputation as a high-quality issuer.”

Mizuho Bank was sole coordinator, bookrunner and mandated lead arranger on the financing.

Allocations are:

Source: IFR