PHOTO

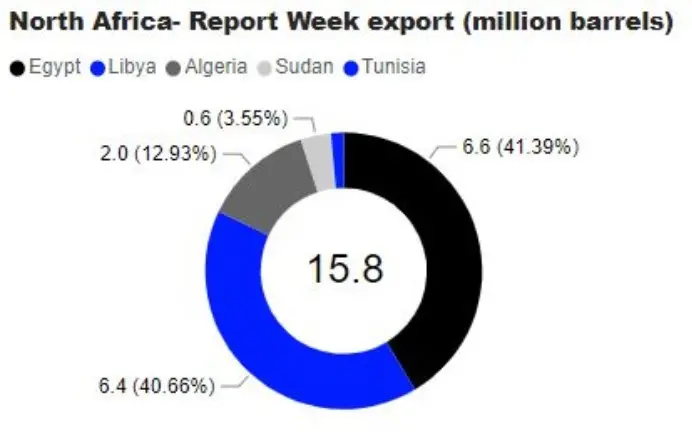

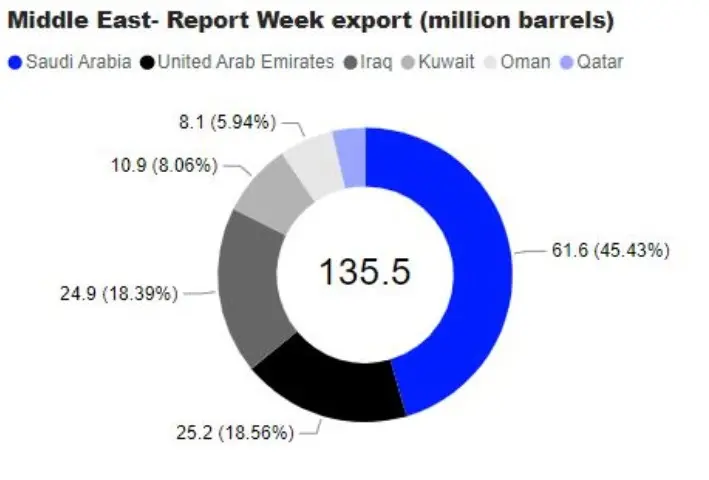

Weekly crude oil exports from the Middle East and North Africa were higher at 151.3 mln bpd, according to Refinitiv oil research estimates.

The OPEC+ group reportedly produced 2.892 million bpd below agreed targets in July, Reuters reported. This is said to have taken the compliance to the production targets to 546% versus 320% in June.

Libya's National Oil Company (NOC) announced that production was at 1.211 million barrels per day, in a statement on Sunday. The production has recovered gradually after the force majeures and field shutdowns that had resulted in the change of the NOC chief.

The numbers continue to highlight the struggle in the group to increase production and meet agreed targets with limited spare capacity available to provide buffer in case of outages, geopolitical issues or demand spikes, and is likely to keep volatility elevated, Refinitiv said.

The spread between Brent and Dubai crude oils, also known as EFS narrowed sharply as Brent linked crude oil grades became cheaper and likely candidates for arbitrage flows to Asian refiners, adding pressure on Middle Eastern benchmarks.

A sustained narrow spread could further dampen demand for spot crudes from the Middle East, as Asian refiners would likely seek alternatives linked to Brent.

Supply side analysis

On the supply front, the disruption in Kazakhstan exports from Russia via the CPC pipeline on account of equipment failure was seen negated with increasing anticipations of an Iranian nuclear deal in the offing which is expected to add to supply.

The talks witnessed fresh developments with leaders from the US, Britain, France and Germany discussing efforts to revive the deal, which is likely to have also included discussions on the response from Iran on the final deal text put forth by the EU.

Iran's Foreign Ministry spokesperson told a news conference that the US was not taking a decision and maintained that a prisoner swap was not linked to the negotiations. The talks have seen positions change frequently with constant back and forth discussions.

It is unlikely that the talks could impact the supply in the near term and any impact could only be seen in the mid-long term subject to sanctions being lifted on petroleum exports.

(Writing by Sudharsan Sarathy; editing by Seban Scaria seban.scaria@lseg.com )