PHOTO

Dubai, UAE: Mashreq, one of the leading financial institutions in the UAE, today has reported its financial results for the year ending 31st December 2015.

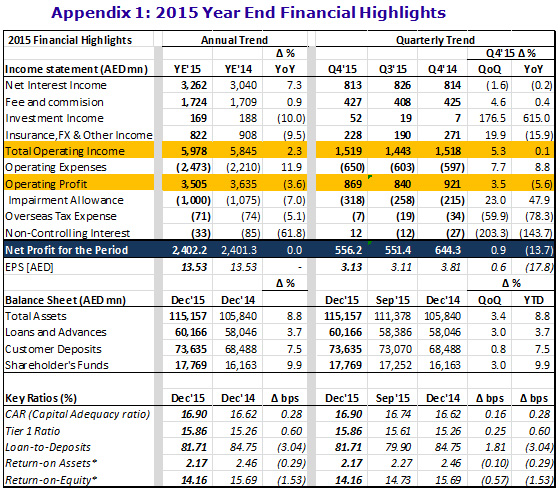

Key highlights [2015 vs 2014]:

· Stable growth in Operating Income

o Operating Income up 2.3% year-on-year to AED 6.0 billion driven by strong growth in Net Interest Income

o Net Interest Income up by 7.3% year-on-year, on the back of a 9.0% y-o-y increase in average loan volume

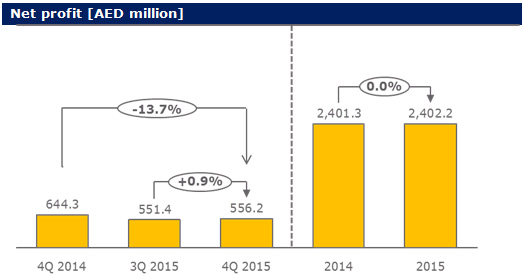

o Net profit for 2015 stood at AED 2.4 billion

· Consistently high proportion of net fee and commission income

o Mashreq's best-in-class Net Fee, Commission, Investment and Other Income to operating income ratio remained high at 45.4%

o Net Fee and Commission income increased by 0.9% year on year

· Strong balance sheet (2015 vs 2014)

o Total Assets increased by 8.8% in the year to reach AED 115.2 billion; Customer Deposits increased by 7.5% to reach AED 73.6 billion

o Loan-to-Deposit ratio remained robust at 81.7% at the end of December 2015

· Healthy liquidity and capital position

o Liquid Assets to Total Assets stood at 29.9% with Cash and Due from Banks at AED 34.4 billion

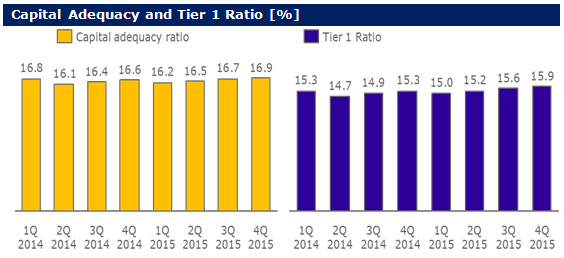

o Capital adequacy ratio and Tier 1 capital ratio continue to be significantly higher than the regulatory limit and stood at 16.9% and 15.9% respectively

· Sustained asset quality

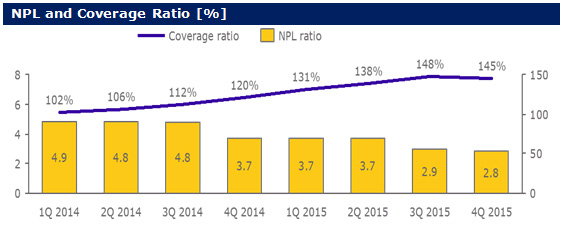

o Non-Performing Loans to Gross Loans ratio decreased to 2.8% at the end of December 2015 (3.7% as of December 2014).

o Total Provisions for Loans and advances reached AED 2.8 billion, constituting 145.0% coverage for Non-Performing Loans

Mashreq delivered stable financial results for the year ending December 2015, reporting a net profit of AED 2.4 billion. Earnings per share are strong at AED 13.53 as of December 2015.

Mashreq's CEO, Abdul Aziz Al Ghurair commented, "The Bank has maintained a steady performance in the difficult market conditions, proving once again that being prepared is half the battle won. As many others in the industry, we read the signs of the market softening early and took decisions to moderate our growth strategy accordingly. As a result, the year has delivered stable financial results for the year ending December 2015, reporting a Net Profit of AED 2.4 Billion and Earnings per Share of AED 13.53. I believe this is remarkable when you consider how rapidly the market sentiments deteriorated in the last two quarters of the year, influenced by the tumbling price of oil that has had strong impact on all the GCC economies."

He added, "When viewed against the fact that this has been accompanied by the intrinsic improvement in our business where Mashreq continues to have the best in class Net Fee, Commission, Investment and Other Income at 45% of our Operating Income, a strong Balance sheet growth and a robust 81.7 % Loan-To- Deposit ratio, we feel very prepared to face the challenges of the new year. Moreover our NPL ratio has declined to 2.8% with a confidence inspiring NPL coverage of 145%."

Al Ghurair added, "Now more than ever, we need to be creative in our approach to serving our customers even better, faster and in innovative ways so that we continue on our strategic path to achieve our long term goals. The fact is that we are passing through a period of great economic change in the world, and I believe that we must proceed with determination to focus on the essentials to make banking smoother and friction free for our clients and customers. We remain confident that the UAE's effort in economic diversification means it is likely to weather this turmoil with grace and emerge strengthened, with a banking industry that is a beacon of prudence to the world."

Operating Income

· Total operating income for 2015 was AED 6.0 billion, a year-on-year increase of 2.3% compared to 2014 operating income of AED 5.8 billion.

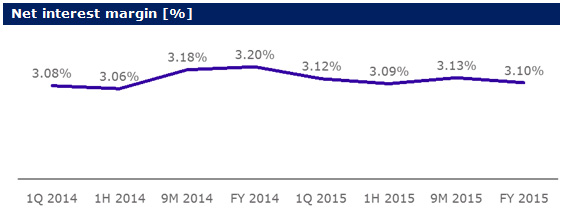

· Net Interest Income at AED 3.3 billion was up by 7.3% compared to 2014, driven by 9.0% year-on-year increase in average loan volume. There has been a slight decline in net interest margin from 3.20% as of December 2014 to 3.10% as of December 2015. On a quarterly basis, Net Interest Income has moderately decreased by 1.6% to AED 813 million in 4Q 2015 as compared to AED 826 million in 3Q 2015.

· Net fee and commission increased slightly by 0.9% year-on-year to reach AED 1.7 billion. Net fee and commission income represented 63.5% of total non-interest income in 2015 as compared to 60.9% in 2014.

· Operating expenses increased by 11.9% year-on-year and by 7.7% quarter-on-quarter to reach AED 2.5 billion; Efficiency Ratio at 41.4% in 2015 increased slightly with respect to last quarter (40.9% as of 9 months 2015).

Assets and Asset quality

· Mashreq's Total Assets increased by 8.8% to reach AED 115.2 billion in 2015, compared to AED 105.8 billion at the end of 2014. Loans and Advances increased by 3.0% in the quarter to end at AED 60.2 billion. On a year-on-year basis, Loans and Advances grew by 3.7% driven by 14.0% growth in Islamic finance. Liquid Assets to Total Assets stood at 29.9% with Cash and Due from Banks at AED 34.4 billion as of December 2015. Loan-to-Total Assets Ratio at 52.3% fell slightly as compared to 54.8% at the end of 2014 (52.4% in September 2015).

· Customer Deposits at AED 73.6 billion, increased by 7.5% as compared to December 2014, driven by 61.9% growth in Islamic deposits and 3.1% growth in conventional deposits. Loan-to-Deposit ratio stood at 81.7% vs 84.8% in December 2014. On a quarter on quarter basis, customer deposits grew by 0.8% from AED 73.1 billion in September 2015 driven by conventional deposits.

· Non-Performing Loans reduced to AED 2.0 billion in December 2015 leading to a Non-Performing Loans to Gross Loans ratio of 2.8% at the end of December 2015 (2.9% in September 2015). Net Allowances for impairment for 2015 were AED 1.0 billion as compared to AED 1.1 billion in 2014. Total Provisions for Loans and advances reached AED 2.8 billion, constituting 145.0% coverage for Non-Performing Loans as on December 2015.

Capital and Liquidity

· Mashreq's Capital adequacy ratio stood at 16.9% (regulatory minimum of 12%) as of December 2015 compared to 16.6% as of 31 December 2014. Tier 1 capital ratio at 15.9% continues to be significantly higher than the 8.0% regulatory minimum stipulated by the UAE Central Bank (15.3% as of 31 December 2014).

Operational Update:

Corporate Banking:

The Corporate Banking Group has continued its trend of providing world class financing solutions with an emphasis on both relationship management and the provision of innovative solutions in the form of new products and services.

Global Transaction Services has continued its digital journey with launch of Host-to-Host services enabling seamless integration of the Corporate Online Banking platform mashreqMATRIX with the customers ERP systems. Mashreq is a leading player in the transaction banking space in the region; this quarter saw the GTS products and services receive 5 prestigious industry accolades : "Best Cash Management Services in Middle East in 2015", "Best Factoring Services in Middle East in 2015", "Best Product Launch in Middle East in 2015" - EMEA Finance, "World's Best Corporate/Institutional Digital Bank Award in UAE in 2015" - Global Finance, "Trade Bank of the Year - UAE" - Finance Monthly M&A Awards 2015. The accolades are recognition of Mashreq's ability to understand and meet the demand for value added services which can integrate seamlessly with the clients' business requirements.

Corporate Finance had a fantastic Q4 closing over US$1.4 billion (AED 5.1 billion) in transaction value in the quarter itself. Notable transactions include the arranging of US$500m for JBF RAK and US$275m for Royal Jordanian Airline, both as a sole book runner. On the FI side, the team arranged a US$100m for Stanbic IBTC Bank (Nigeria) as a sole book runner and US$250m for Banque Misr (Egypt) which given the market conditions were major accomplishments. The strong quarter has resulted in Corporate Finance posting a solid performance for 2015. Further with the existing pipeline under execution the unit remains well positioned to kick start 2016.

Real Estate Finance & Advisory successfully deployed over AED 600 million of the bank's capital across the commercial, industrial, hospitality and residential sectors during the final two months of the year, and originated deal flow of more than AED 1 billion heading into 1Q 2016. In addition, the division is working on two landmark mandates in the fund management space - advising a diversified local conglomerate on the structuring and establishment of the first onshore real estate fund in the UAE, and launching the UAE's first DIFC-based real estate Qualified Investor Fund ("QIF") in partnership with a prominent real estate private equity

firm in Abu Dhabi. The QIF will have an equity size of US$ 300 million and will also raise debt for Shariah-compliant investments in high-yielding assets.

Retail Banking:

Mashreq has continued to enhance its innovative offerings and to offer simplified financial solutions to customers. The Retail Banking Group launched Instant Cash via the online banking platform. With this facility, customers can now book Easy Cash instantly on their credit cards, transfer other bank card balance to Mashreq by applying for Balance Transfer or book an Easy Payment Plan via the online banking platform. Customers can now apply for a Easy Cash Loan of up to 75% of the available Credit Card limit and have the option to repay in easy installments at low interest rates. This is an ideal solution for times of emergency or when money is needed in a hurry. The instant Easy Cash is a convenient facility that converts the available credit card limit into instant cash and allows customers to receive money instantly in their account. The process involved is simple with no paper work, no waiting time and repayment can be done in easy installments. An added advantage is that customers can choose to transfer cash to a Mashreq account, another bank account or to use the Cardless Cash option via Mashreq ATMs. The new and unique feature of Cardless Cash option allows customers to use an authentication code generated online on any Mashreq ATM to access funds without using a debit/credit card free of charge.

In line with its approach to reward customers, Mashreq ran a Business Loan campaign raffle draw for a chance to win a BMW 320i and other amazing prizes. The campaign awarded all business banking customers, who applied for Mashreq Business Loan, Self Employed Personal Loan or Trade and Working Capital Facility, a guaranteed gift voucher of AED 250. In addition to this, there were monthly draws to give 25 prizes from a range of smartphones, tablets and travel vouchers and the grand draw also included the opportunity for one lucky customer to drive away in a BMW 320i.

Mashreq Cards once again introduced the most exciting overseas shopping offers exclusively for its Credit and Debit Cardholders. Every purchase made when overseas guaranteed the Mashreq cardholder their next free overseas trip - the offer also included a guaranteed free air ticket worth AED 1,000 to fly to any destination of choice following transactions worth AED 20,000 overseas in foreign currency. Mashreq cardholders were also rewarded with air ticker vouchers worth AED 800, AED 500 or AED 350 based on various overseas spend thresholds. Mashreq also rolled out a special offer for cash withdrawals on debit cards while travelling abroad. Cardholders could enjoy whopping 5% cash back on minimum thresholds set for cash withdrawals done overseas.

As part of its role in the community as one of the leading UAE financial institutions, the Bank commemorated the Flag Day, Martyrs' Day and National Day; Mashreq celebrated the development of one of the most progressive countries in the world. To share in that spirit of National Pride, Mashreq launched a month long campaign, "Mashreq #YouAE". This was launched with the objective of identifying and thanking those that have contributed to this nation's ongoing successes.

The Region's first fully automated banking branch imashreq scooped the "Best Branch Experience" award at the 11th Annual Customer Experience Benchmark Index (CEBI 2015) organized by Ethos Integrated Solutions, the regional leader in delivering excellence in customer experience. imashreq is the region's first fully automated branch designed for customers to carry out their banking transactions at any time of day. imashreq allows customers to instantly and digitally open accounts, make utility payments, apply for new credit cards, request loans and much more.

For the 5th consecutive year, Mashreq Al Islami, the Islamic banking division of Mashreq was announced the winner of Best Islamic Window 2015 at the 10th Islamic Business & Finance attended by some 200 Islamic bankers and financiers from around the world. The award is a reflection of the commitment and highest standard of customer service Mashreq Al Islami has delivered.

International Banking:

Mashreq's International business continued to deliver impressive growth and increased its contribution to the banks overall revenues despite competitive challenges including negative impact of reduced oil prices in some of our markets.

While all businesses and presence countries performed well, Egypt and Bahrain led the way with outstanding growth in both revenues and net profit.

Mashreq was the Originator and mandated lead arranger for some of the largest syndication deals in Egypt, Bahrain and Qatar and won various awards along the way, including "Deal of the Year", "Best Corporate Account", "Best Cash Management", "Best SME Trade Finance", and "Best SME Internet Banking" from Banker Middle East for Bahrain. Mashreq also won the "Best Corporate Bank" award from Global Banking & Finance for the third year in a row in Qatar.

The C Ring road Branch and Head Office in Doha was moved to a new - state of the art - premises. Further a fifth branch was added on Bank Street in Qatar with a dedicated Trade Services Desk.

The FI Business has continued to maintain its leadership position in South Asia region and is also strongly making its presence felt in new geographies including Turkey and Africa. Various new technological enhancements including Electronic funds Transfer System in Bahrain and Electronic Cheque Clearing System in Qatar were introduced to support Mashreq's growing business in the international sphere.

Treasury and Capital Market:

In what continues to be a challenging and volatile macro environment, Mashreq was able to grow its Treasury product suite across asset classes, supported by an online trading platform and 24 hour dealing room. Increased FX volatility assisted the FX & Derivatives business to achieve strong results and the Rates & Structured Solutions business closed several large ticket hedging transactions for clients across the region, including a structured Profit Rate Swap for a real estate loan. The Bond Brokerage business established relationships with several asset managers based in the US to enhance bond/ sukuk trading, whilst also working with a UAE based corporate on a partial buyback of their sukuks. The Asset Management business achieved strong growth - Mashreq's fixed income funds (both conventional and Sharia'h compliant) remain amongst the top performing funds in the market.

2015 Awards:

- Meeting of the Council of Ministers of Labor to honor organizations from the private sector

Mashreq Emiratisation - Outstanding Performance Award

- The Customer Festival Middle East

Best Social Media Strategy

- 10th Islamic Business & Finance

Best Islamic Window

- 11th Annual Customer Experience Benchmark Index (CEBI)

Best Branch Experience" imashreq

- Pan Arab Excellence Academy

Golden Award (Banks category) - Mashreq Snapp

- Customer Experience Management, Middle East Summit organized by IQPC

Best Customer Experience Management Brand by a Call Center in Middle East

Best use of Technology to improve Customer Experience by a Call Center

Customer Experience Champion of the year

- MasterCard Innovation Forum

Most Innovative Consumer Marketing Campaign' in the Middle East &

Africa

- CSR Label - Dubai Chambers

- EMEA Finance Awards Treasury Services Awards

Best cash management services in the Middle East

Best factoring services in the Middle East

- Global Finance Awards (World's Best Consumer Digital Banks In The Middle East and Africa)

Country Winners category:

Best Consumer Digital Bank in Qatar - Mashreq

Regional Sub-category winners:

Best Integrated Consumer Bank - Mashreq UAE

o Gallup Great Workplace Award

o Finance Monthly M&A Awards

Trade Finance Firm of the year UAE

- Banker ME Industry Awards

Best Regional Retail Bank

Best Private Bank - UAE

Best Branding GCC

Best Real Estate Financing

- Annual Insight Middle East Call Centre Awards

Best Customer Care

Best Customer Experience Management

Best in CRM Management

Best Service to Sales

Best VOC Implementation in Large Organization

- Smart Card & Payments Awards, Middle East

Best Premium Card - Solitaire Credit Card

Best Credit Card - Mashreq sMiles

Best Debit Card - Mashreq Private Banking VISA Infinite

- The Asian Banker's Excellence in Retail Financial Services

Best Social Media Engagement in the Middle East Award

Best Employee Engagement in the Middle East Award

- Retail Banker International Awards

Middle East Retail Bank of the year 2015

- Islamic Finance News

Best Islamic Deal of The Year Award' in Qatar

- Global Banking & Finance Review Awards

Best Corporate Bank Qatar 2015

Best Retail Bank Qatar 2015

Best Customer Service Bank Qatar 2015

Best Retail Bank UAE 2015

Most Innovative Banking Initiative (imashreq) UAE 2015

Innovative Islamic Banking Solutions Provider UAE 2015

- Arab Organization for Social Responsibility Award

Corporate Social Responsibility Award

- Banker Middle East Product Awards

Best Premium Banking Service

Best Mobile Banking Service

Best Real Estate Advisory

Best Self Employed Finance

Best Debit Card

Best SME Exchange Service

- Super brands

- Global Finance

Best Regional Debt Bank in the Middle East

Best Investment Bank in the UAE

- MENA Fund Manager Awards

Best Fixed Income fund in a 3 year category

Sharia'h Compliant Fixed Income fund of the year

-Ends-

For media enquiries, please contact:

Huda Ismail Nssrin Khalil

Public Relations, Mashreq Public Relations, Mashreq

Tel: 04 -6083629 Tel: 04 - 6083836

Email: HudaI@mashreq.com Email: NssrinK@mashreq.com

For investor relations enquiries, please contact:

Ali Zaigham Agha

Investor Relations, Mashreq

Tel: 04 -2077543

Email: AliAgha@mashreqbank.com

© Press Release 2016