PHOTO

More than 94,000 prepayment meters were installed in homes in Britain using warrants and without customer consent in 2022, the government said on Monday, adding that British Gas, Scottish Power and OVO Energy accounted for 70% of them.

In February UK energy regulator Ofgem asked all energy suppliers to stop the forced installation of prepayment meters in people's homes and instigated an urgent investigation over such practices.

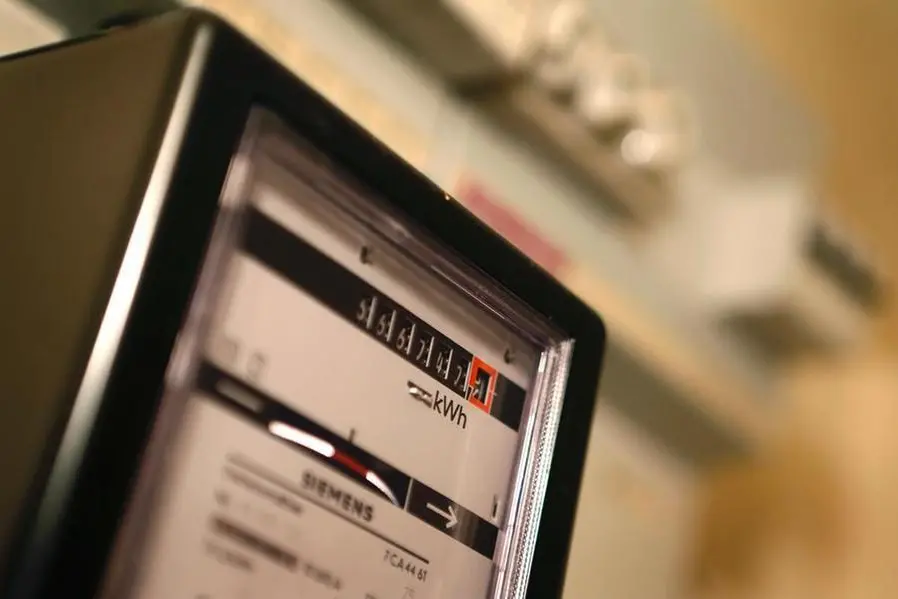

Prepayment meters allow customers to pay for gas and electricity on a pay-as-you-go basis.

However, some suppliers obtained court warrants to break into the homes of customers who had fallen behind on their bills to install prepayment meters, meaning they could have their heating cut off if they did not pay.

An unprecedented surge in energy prices has left many households facing significant energy bills and debt.

British Gas, Scottish Power and OVO Energy forcibly installed 66,187 prepayment metres under warrant last year, the Department for Business, Energy and Industrial Strategy (BEIS) said.

Scottish Power was the worst offender when taking its customer base into account, force-fitting more than 24,300 meters, BEIS said.

British Energy Security Secretary Grant Shapps said: "Today's figures give a clear and horrifying picture of just how widespread the forced installation of prepayment meters had become, with last year seeing an average of over 7,500 force-fitted a month."

Shapps called on companies to focus on compensating such customers.

British Gas owner Centrica said that it would "only ever apply for a warrant as a last resort when all other options have been exhausted". The company said this is a months-long long process in which it makes "multiple efforts to engage and communicate with a customer to try and find a solution".

"In the last six months we have provided £2.8 million of support payments to 60,000 customers," Centrica added.

Scottish Power and OVO Energy did not respond immediately to emailed requests for comment. (Reporting by Bozorgmehr Sharafedin Editing by Jason Neely and David Goodman)