PHOTO

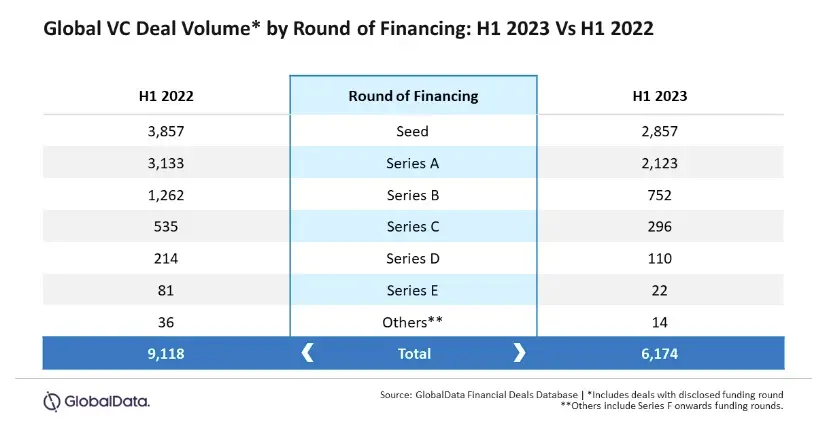

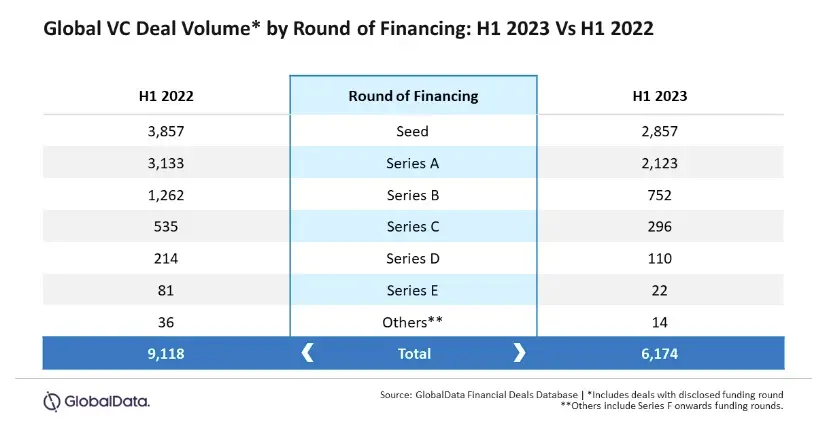

Global venture capitalist (VC) funding rounds for startups fell 32.3% year-on-year (YoY) to 6,174 in the first half of 2023, hurting both early and late-stage rounds amid the prevailing cautious investor sentiment, according to London-based data and analytics firm GlobalData.

Globally, there was a decline in growth, expansion, late-stage (Series B onwards), and early-stage VC funding rounds.

Early-stage funding rounds dominated the global VC funding landscape, accounting for 80.7% of the total deals. However, early-stage funding rounds dropped 28.8% YoY to 4,980 in the first half of 2023.

Growth, expansion and late-stage funding rounds collectively accounted for a 19.3% share of the total VC deals. These funding rounds declined by 43.9% YoY to 1,194.

“The global financial markets continue to experience fluctuations and uncertainty driven by events such as geopolitical tensions, trade disputes, and concerns about the pace of economic recovery after the COVID-19 pandemic,” said Aurojyoti Bose, Lead Analyst at GlobalData.

Collectively, these factors created an environment of uncertainty and caution, leading investors to adopt a more risk-averse approach during H1 2023, he added.

(Editing by Seban Scaria seban.scaria@lseg.com )