PHOTO

The multi-year bull run in United States equity markets may come to an end in 2018, with the S&P 500 Index last week closing 7 percent lower than at the start of the year, but there is still life left in the world's biggest stock market, according to State Street Global Advisors (SSGA).

The chief investment officer of the U.S-based asset management company's investment solutions unit, Dan Farley, argued that although U.S. stocks are currently trading at higher valuations than peers in Europe and in emerging markets, this is because they are offering "a better return on equity".

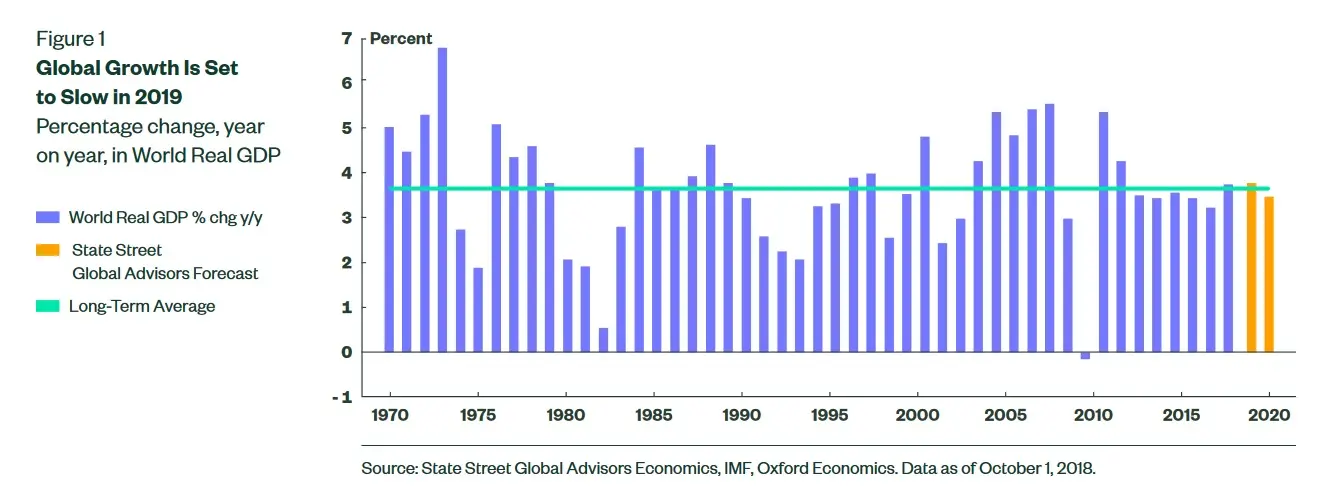

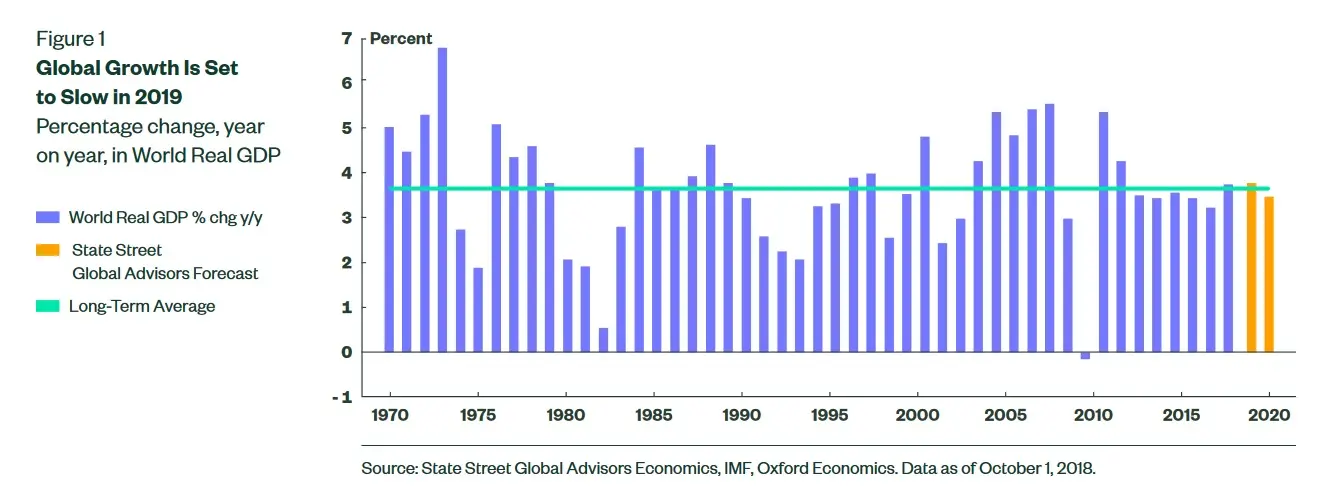

The firm is predicting that global growth will slow in 2019 to 3.5 percent, down from 3.8 percent this year. Farley said at an event held in the Dubai International Financial Centre earlier this month that earnings growth among U.S. companies is likely to continue in 2019, which is partly due to higher capital expenditure investments made - especially in information technology.

"Why is that important? That leads to productivity, productivity leads to better earnings," he said, adding that government spending was also set to increase, which would pump more money into the economy in the short-term.

Farley said that SSGA's artificial intelligence team had scoured U.S. company earnings announcements and had highlighted that two of the most common terms mentioned by management teams were capital expenditure and shareholder payouts. He said there had been around $80 billion of shareholder payouts made by firms, either through special dividends or, more frequently, through share buybacks.

Given that buybacks reduce the number of shares in issue, it has a positive impact on growth in earnings per share (EPS).

"You could argue that that's not great EPS growth… you'd rather see it in terms of top line (growth), but this still will be supportive from an overall equity market point of view," he said.

The Brexit dilemma

In terms of other global equity markets, the firm is less positive on the outlook for Europe, despite lower valuations of European equities, because earnings expectations are starting to tail off, Farley said. SSGA’s Global Market Outlook 2019 report also pointed to the "stronger headwinds" faced in Europe next year as a result of ongoing uncertainty surrounding the outcome of the United Kingdom's withdrawal from the European Union. It expects eurozone growth to slow to 1.6 percent next year, down from 1.9 percent this year.

In terms of emerging market (EM) equities, SSGA’s report said that their relative valuation hit an all-time low in 2018 as they traded at a 70 percent discount to developed market equities. In the short-term, with further interest rate rises expected from the U.S. Federal Reserve in the first half of 2019, "emerging markets are likely to struggle in aggregate", the report said.

However, Farley argued that as 2019 progresses, there could be some strong buying opportunities generated within emerging market equities, as they offer a similar return on equity (ROE) to developed market shares, but are heavily discounted and have better growth prospects (it predicts 4.5 percent emerging markets growth next year).

"Even with a similar ROE, considering we're going to get that at a significant discount, with improving earnings, says to us again that it's probably a place from an intermediate-to-long term view that offers some good value," Farley said.

Paper promise

In terms of the fixed income and currency markets, SSGA's head of investments for Europe, Middle East and Africa, Bill Street, said at the same event that he expects "the credit cycle to extend" in 2019, meaning that conditions for fixed income investors are likely to remain relatively benign.

"We're not looking for interest rates to move much higher in the short end," he said, forecasting that the U.S Federal Reserve could skip one of the three 250 basis point (0.25 percent) interest rate rises currently flagged for next year.

Street said that long-term yields on 10-year U.S. treasury bonds are likely to remain at about 3.4-3.5 percent, meaning that the yield curve between short- and long-term bond yields is likely to remain flat.

A flat yield curve has historically been a very accurate predictor of an ensuing recession, but Street argued that there were "structural forces" within the fixed income market which means this may not be the case, such as a huge demand for longer-dated income products by pension companies to meet obligations to a growing base of retirees, as the 'baby boomer' generation reaches retirement age.

A benign credit market would present opportunities for investors in the U.S. high-yield ('junk') bond market, where spreads of 400-450 basis points over U.S. treasury bonds are available.

Street said that this suggests a default rate among U.S. firms of around 4.5 percent. "In the last few years, the realised rate in the junk bond market… is 2 percent," he said.

Street said that although there is an upside risk, as spreads on high yield bonds have historically reached 5-6 percent in times of recession, for those (like his firm) who believe the current credit cycle will elongate the U.S. high-yield market "looks like a pretty good opportunity".

"You're getting 400 basis points of spread on top of a nominal yield, which is, say, 3 (percent, or 300 basis points) - 7 percent feels like a decent return when equities are not returning that much this year," Street told Zawya. “Dividend yields are 5 percent.”

No boom or bust

In its Global Investor Outlook published earlier this month, Swiss bank UBS said it also expected slower growth in 2019, and that a recession was "unlikely".

In a press release accompanying the report, UBS Global Wealth Management's chief investment officer, Mark Hafele, said: "Investors should retain positions in global equities but plan for market volatility. A slight slowdown in economic and earnings growth doesn't mean no growth, and the recent sell-off (in equities) has left a number of assets more attractively valued, but investors must also take into account the tense geopolitical environment as well as monetary policy tightening."

The firm's base case scenario predicted growth of between 0-5 percent for both U.S and eurozone equities, with ongoing uncertainty about growth prospects meaning that volatility will remain high.

Commenting specifically on Middle Eastern economies, Ali Janoudi, UBS's regional head of wealth management, said: "While we expect structural reforms and higher oil prices to support economic growth in the Middle East, we continue to encourage local investors to embrace diversification strategies, particularly in the light of anticipated market volatility."

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018