PHOTO

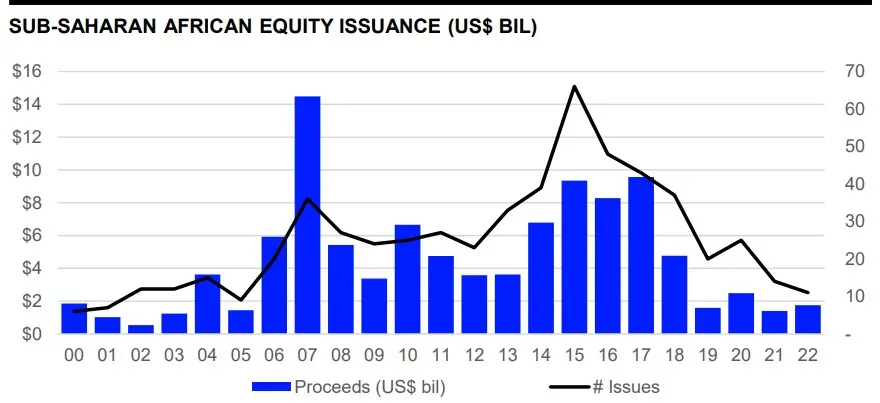

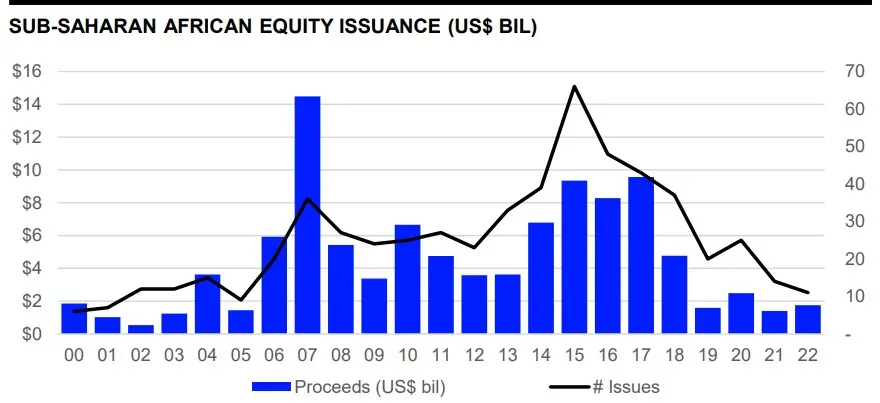

Sub-Saharan equity capital markets (ECM) raised $1.7 billion from issuances in 2022, 24% higher than in 2021 but lower than the previous three-year average of $1.8 billion, according to Refinitiv data.

There was a total of eight issuances, 21% lower compared to the year-ago period and the lowest annual deal count since 2005.

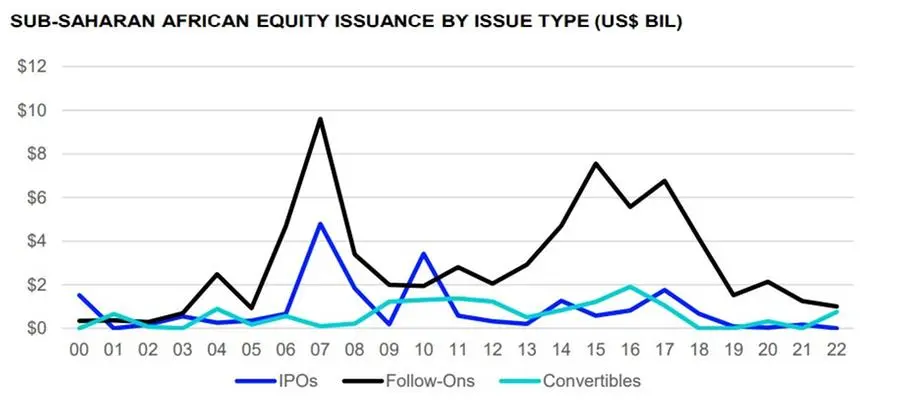

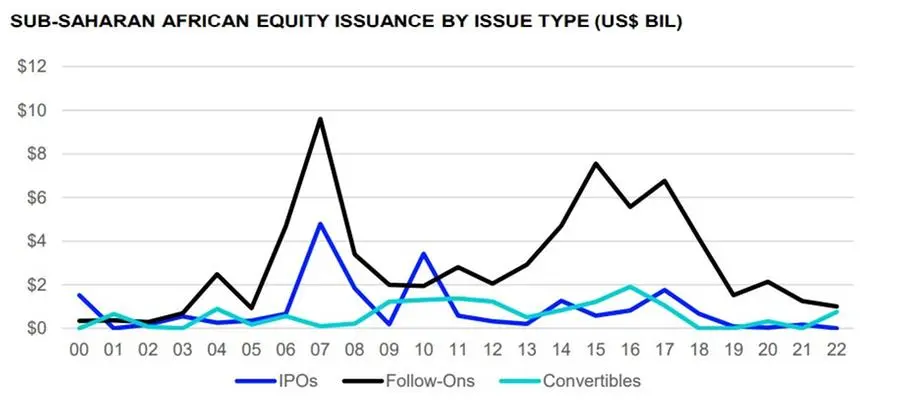

More than half (57%) of the total proceeds raised were from follow-on issuances. South Africa's Pepkor Holdings, MTN Nigeria Communications and South African coal exporter Thungela Resources Ltd. were those who raised fresh equity funds from follow-ons during 2022.

South Africa's Sasol’s $750 million offering was the only convertible bond issued in the region during 2022.

There were no initial public offerings recorded during the year.

South African issuers raised a total of $1.5 billion in the equity capital markets during 2022, while Nigerian issuers raised a combined $277.1 million.

Citi took first place in the Sub-Saharan African ECM underwriting league table during 2022 with a 36% market share. The bank was involved in two issuances which raised a total of $618.7 million.

BofA Securities Inc. took the second spot, accounting for 14% market share and was involved in one issuance which raised $250 million.

(Writing by Brinda Darasha; editing by Seban Scaria)