PHOTO

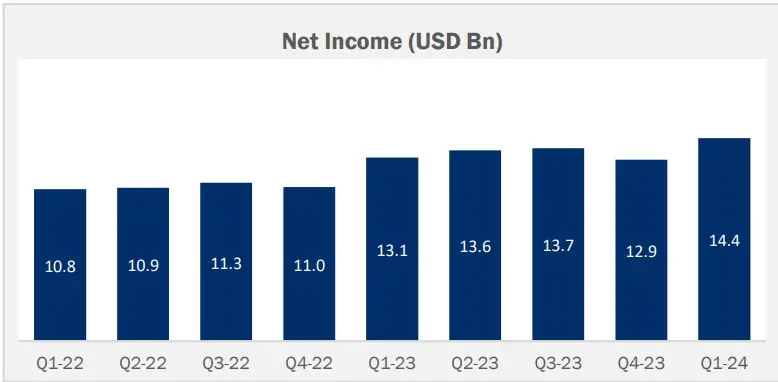

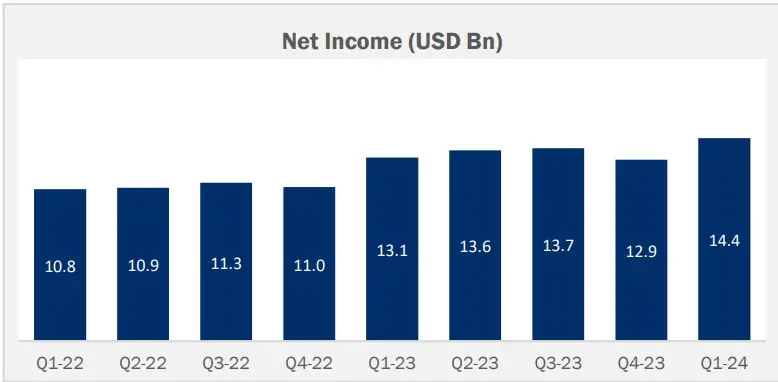

GCC banks’ earnings continued to rise in the first quarter of the year despite a quarter-on-quarter decline in revenues, supported by lower impairments.

Total net income of listed lenders in the region reached $14.4 billion during the quarter, up from approximately $13.1 billion posted a year earlier and $12.9 billion in the previous quarter, Kamco Invest said in a recent report.

“The strong growth came despite a fall in revenues during the quarter and reflected a fall in total operating expenses coupled with a steep fall in quarterly impairments,” the asset management firm noted.

During the quarter, banks in the region booked $2.3 billion in loan loss provisions, marking a five-year low.

The strong growth reflected a fall in total operating expenses, coupled with a steep decline in quarterly impairments.

Total assets reached approximately $3.3 trillion, up from $3 trillion a year ago. Net loans grew to $1.92 trillion from $1.8 trillion over the same period.

Overall, revenues for the sector reached $31.4 billion, down from a record high of $32 billion during the last three months of 2023. Revenues for the quarter, however, were higher than the $28.7 billion recorded in the same period last year.

The quarter-on-quarter fall in revenues came from the decline in net interest income, as well as non-interest income.

(Writing by Cleofe Maceda; editing by Brinda Darasha)