PHOTO

Saudi Arabia saw the most growth in cryptocurrency transactions over the year to June, while the United Arab Emirates has emerged as one of the world’s most innovative crypto hubs due to its innovation-friendly regulatory focus, according to a new report.

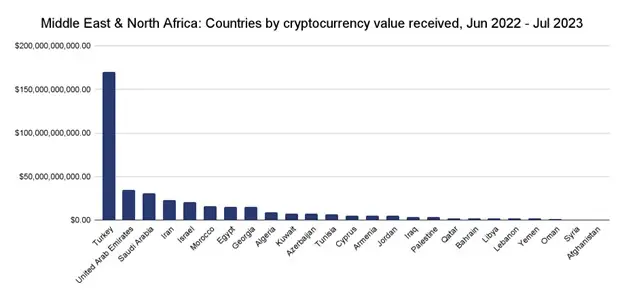

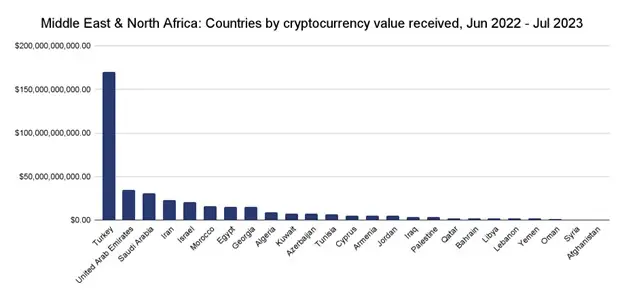

The Chainalysis 2023 Geography of Cryptocurrency Report, whose Middle East and North Africa (MENA) section released on Tuesday, also reported that Türkiye received the largest raw crypto transaction volume in the region, at approximately $170 billion, over the last year.

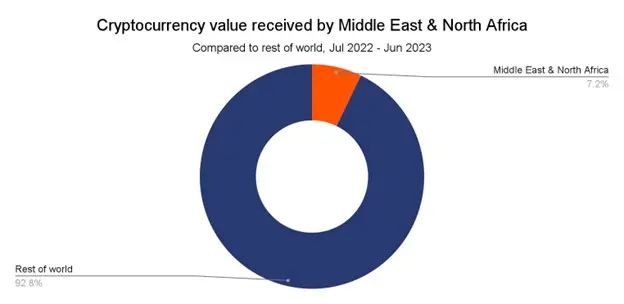

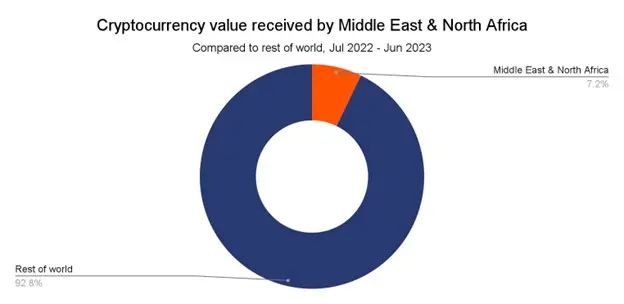

The region accounted for an estimated $389.8 billion in on-chain value received between July 2022 and June 2023, Chainalysis said. In total, the figure comprises the sixth largest crypto economy of any region, representing nearly 7.2% of global transaction volume during the period studied in the report.

By contrast, MENA residents received $566 billion in cryptocurrency over the previous period, from July 2021 to June 2022, a 48% increase over the year prior.

“The drop in crypto transaction values for nations across the region was expected given the performance of the global crypto, and indeed traditional finance markets,” Kim Grauer, Director of Research at Chainalysis, told Zawya in an interview.

“Economic pressures are most likely the major factor behind the decreased appetite for crypto investment, but this is also true of traditional investment vehicles. This also likely explains why the decline in the UAE this year (17%) is far less than that in Lebanon (96%) as the UAE has largely bucked the global economic trend,” she added.

“It is also likely that consumer confidence was shaken by the FTX implosion as it was around that time (late 2022) when the global crypto market hit its lowest point,” Grauer said.

Cryptocurrency exchange FTX collapsed spectacularly last November. At least $8.9 billion in customer funds are missing, The Wall Street Journal reported in March. The company’s lawyers say $7.3 billion has since been recovered.

Total worldwide cryptocurrency market capitalisation hit a two-year low of $779 billion in November 2022 but rebounded to highs above $1.27 trillion in April. As of Sunday, 24 September, total cryptocurrency market capitalisation stood at $1.05 trillion, according to data from CoinMarketCap.com.

Türkiye has the largest crypto transaction volumes in the MENA region and the fourth overall behind the US, India and the UK. Crypto transactions received in Türkiye were approximately $170 billion over the year to June, a 36% year-on-year decline, Chainalysis said.

Turkish residents could be turning to crypto to preserve their savings and counter currency devaluation, the report said. Inflation in the country has accelerated far beyond the global mean, reaching 58.9% year-on-year in August 2023.

The Turkish Lira crashed in 2021 after the central bank cut interest rates by 100 basis points and reached record lows this year.

“Consequently, many Turks appear to be seeking a less volatile and more freely traded currency, and crypto is filling that need,” the report said.

Turks have flocked to USDT, a widely accepted stablecoin pegged to the US dollar.

Saudi Arabia posts crypto growth

In the Gulf, Saudi Arabia’s crypto economy is on an upward curve, receiving $30.9 billion between July 2022 and June 2023, a year-on-year volume transaction growth of 12%. It was the only MENA country and one of just six countries worldwide that saw a year-on-year increase in transaction volume, Chainalysis said.

“Cryptocurrencies have something of a ‘quasi-legal’ status in Saudi Arabia. On the face of it, the government prohibits local banks from processing crypto-related transactions and crypto trading is deemed illegal.

However, while international exchanges such as Binance and Coinbase aren’t allowed to operate in the country, regional exchanges enable Saudi residents to purchase cryptocurrencies, and the government hasn’t declared any penalties for such activities,” Grauer said.

The Saudi Arabian Monetary Authority (SAMA) warned cryptocurrencies were illegal in 2019.

In June, the Financial Times reported that the kingdom is in talks to join China’s New Development Bank, also known as the BRICS bank.

At the time of writing, the BitOasis exchange was listing the Kingdom among the 14 countries it supports within the region.

“Clearly, there is an appetite for crypto among the nation’s residents,” Grauer said.

DeFi leads crypto transactions in UAE

The UAE stands out among in the Chainalysis 2023 report because it is the only country in the region, apart from Israel, to have a higher share of crypto activity taking place on decentralised finance (DeFi) protocols at 48% than on centralised exchanges (46%).

The total value of crypto received by the UAE was $34.9 billion over the observed period.

One reason DeFi, an advanced blockchain technology, is more popular in the UAE could be the country’s innovation-friendly regulatory frameworks, which allow new crypto platforms to develop with oversight of consumer safety, the report said.

Consequently, crypto entrepreneurs and enthusiasts have been attracted to the UAE.

Dubai first launched a blockchain strategy in 2016. Abu Dhabi and Dubai both have frameworks for virtual assets, regulated by the Abu Dhabi Global Market and Dubai’s Virtual Asset Regulatory Authority respectively.

(Reporting by Keith J Fernandez; editing by Seban Scaria seban.scaria@lseg.com)