PHOTO

Investment banking fees worldwide reached $56.7 billion during the first half of 2022, posting a 31% decrease compared to the first half of 2021 and the slowest opening six-month period for global IB fees since 2019, according to global data provider Refinitiv.

Fees during the second quarter of 2022 declined 12% compared to the first quarter of this year, marking the slowest quarter for IB fees since the first quarter of 2019.

JP Morgan maintained the top spot for investment banking fees earned during the first half of 2022 with $3.8 billion, maintaining its first half 2021 ranking and earning an industry-leading 6.6% share, despite a decline of 1.6 wallet share points.

While Goldman Sachs remained in second place with an estimated 6.1% of global wallet share, BofA Securities took the third spot with $2.8 billion in fees, and Morgan Stanley and Citi rounded out the top five.

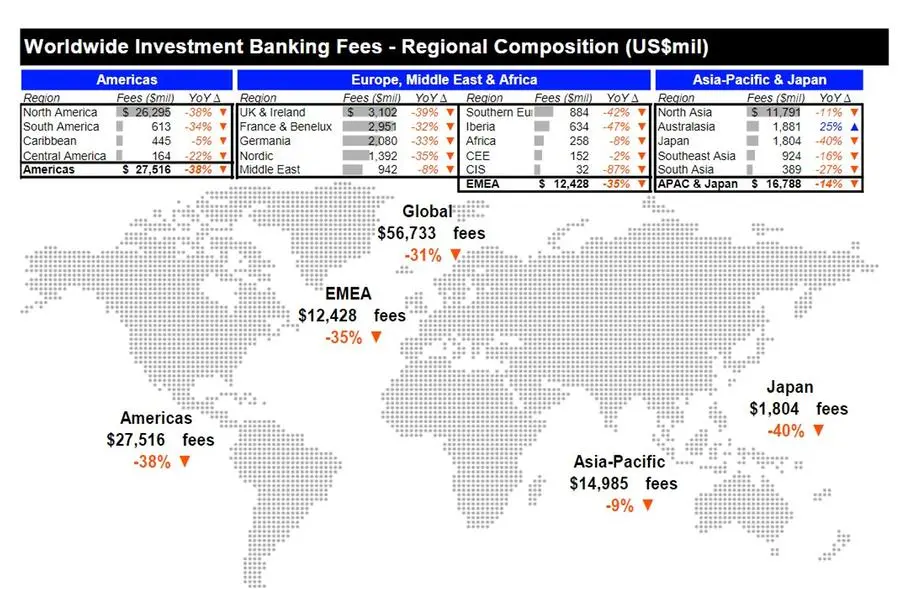

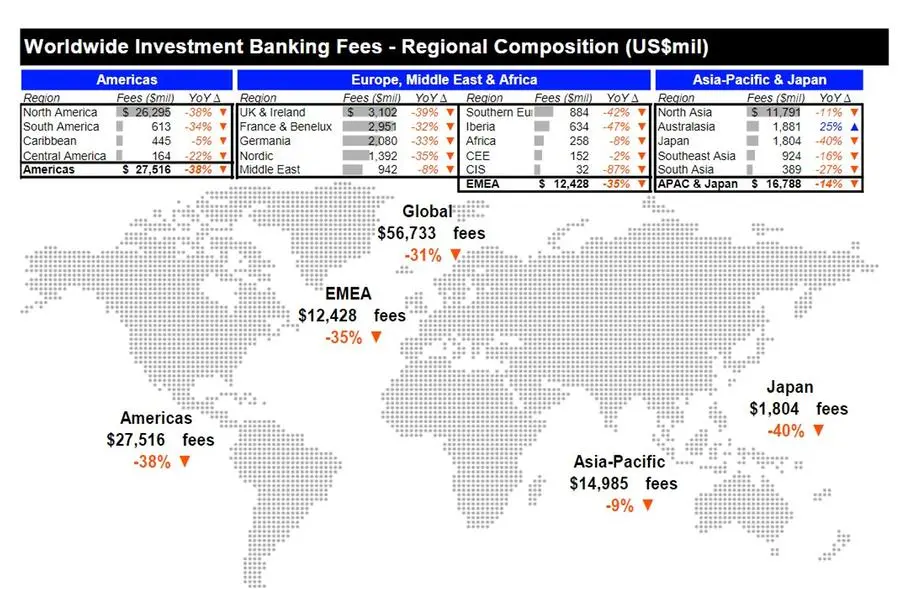

The Americas contributed 49% of all fees generated globally with $27.5 billion, a 38% downtick compared to 2021 levels.

Imputed fees in the EMEA region decreased 35% to $12.4 billion during the first half of 2022. Total IB fees in Asia-Pacific hit $15.0 billion, registering 9% decline compared to first half 2021 levels, while investment banking fees in Japan fell 40% compared to a year ago.

ECM fees register 72% decline

With significant declines across IPOs, follow-ons and convertibles, Equity Capital Market (ECM) underwriting fees totaled $6.5 billion during H1 2022, a 72% decrease compared to 2021 levels and the slowest first half for ECM fees since the first half of 2003, Refinitiv said.

Investors are increasingly becoming more selective and are refocusing on the companies’ fundamentals instead of “growth” stories and projections, especially given the tight market liquidity and declining stock prices of several companies that went public in the last two years.

Paul Go, EY Global IPO Leader, said: “Investors are refocusing on companies with resilient business models and profitable growth, while embedding ESG in their core business values.”

Once the current uncertainties and volatility subside, the many mega IPOs delayed in H1 are likely to come back. "However, strong headwinds are likely to remain. These include geopolitical strains, macroeconomic factors, weak capital market performance and the impact from the lingering pandemic on global travel and related sectors," Go said.

DCM underwriting fees decreased 26% compared to the first half of 2021, while fees from syndicated lending activity reached $13.3 billion, a 9% decrease compared to a year ago.

Completed M&A advisory fees registered a 6% downtick compared to a year ago with $18.5 billion in fees globally, according to Refinitiv data.

Government fees up

Fees from global government and agency-related activity totaled $6.4 billion, up 12% compared to a year ago and the only sector to see year-over-year gains compared to 2021, the global data provider said.

Imputed fees from the financial sector accounted for 32% of first half 2022 totals, registering a decrease of 31% compared to a year ago.

The retail and healthcare sectors registered the strongest double-digit percentage decreases compared to a year ago, down 60% and 55%, respectively, compared to the first half of 2021, it said.

(Reporting by Seban Scaria; editing by Daniel Luiz)