PHOTO

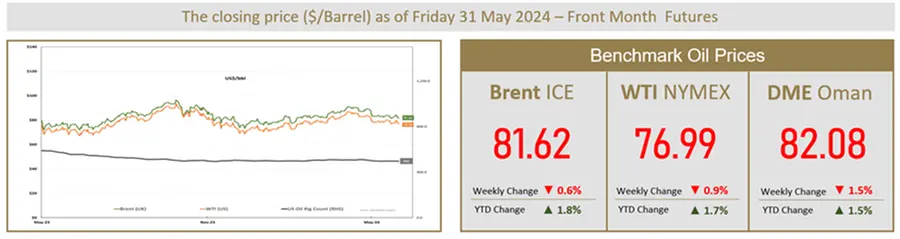

Oil Settles Down Ahead of OPEC+ Meeting, Posts Weekly Loss

Oil prices fell on Friday and posted a weekly loss as investors awaited an OPEC+ meeting on Sunday that will determine the fate of the producer group's output cuts. Brent futures for July delivery were down 24 cents, or 0.3%, to $81.62 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell 92 cents, or 1.2%, at $76.99. For the week, Brent was down 0.6%, with WTI posting a 1% loss. Markets are awaiting the OPEC+ meeting on Sunday, with the producer group working on a complex deal that would allow it to extend some of its deep oil production cuts into 2025, sources said. In the U.S., crude production rose in March to its highest level this year, data from the U.S. Energy Information Administration (EIA) showed on Friday, while fuel product supplied, a proxy for demand, fell 0.4% to 19.9 million barrels per day. The oil market has been under pressure in recent weeks over the prospect of U.S. borrowing costs staying higher for longer, which ties down funds and can curb oil demand. Both oil benchmarks were on course for their biggest monthly declines since December after dropping in the previous session on a surprise build in U.S. fuel inventories, while oil rigs fell by one to 496 last week.

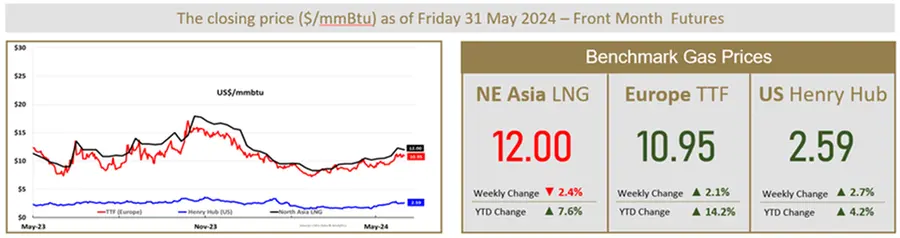

Asian Spot LNG Prices Hold at Near 6-Month Top as Heatwave Persists

Asian spot liquefied natural gas (LNG) prices saw a slight decline last week, but still held near a six-month top as hot weather in the region encouraged demand for cooling, and as Northeast Asian buyers focus on supplies for the summer. The average LNG price for July delivery into north-east Asia was at $12.00 per million British thermal units (mmBtu), industry sources estimated. This is slightly down from $12.30 per mmBtu in the previous week, which was its highest levels since mid-December. In Europe, TTF gas markets have found some support on the back of increased Asian LNG demand. Although European gas inventories are well filled, and the filling season is still in progress, market participants seem to react nervously when there are signals regarding higher Asian demand, or supply disruptions as we have seen due to the unexpected Norwegian outages, analysts said. In the United States, production has increased as the Cameron LNG terminal in Louisiana has raised its feedgas intake to levels that would suggest all three trains are operating close to capacity. Sabine Pass inflows, however, remain lower than would usually be seen during winter months.