PHOTO

The value of announced M&A transactions with any MENA involvement reached $8.3 billion during Q1 2023, according to data from Refinitiv. This is 65% less than the value recorded in the Q1 2022.

The number of deal announcements in the region also fell 26% from 2022, making it the slowest start to a year since 2020, the global data provider said in its MENA Investment Banking Review.

Deals involving a MENA target fell to a seven-year low and totalled $2.9 billion during Q1 2023, down 75% from a year ago. The number of deals declined 22% from last year and marked the lowest first quarter deal count since 2020.

Inbound deals involving a non-MENA acquiror declined 72% from a year ago to $742.3 million, while domestic deals fell 76% in value to US$2.2 billion.

MENA outbound M&A totalled $5 billion, down 46% compared to the value recorded during Q1 2022.

TOP DEALS

Saudi oil giant Aramco's plans to acquire a 10% stake in China's privately controlled Rongsheng Petrochemical Co for about $3.6 billion was the top deal with MENA involvement. This was followed by another deal in which the kingdom's sovereign wealth fund invested a total of $1.3 billion in four local construction firms.

India's eyewear retailer Lenskart’s deal with Abu Dhabi Investment Authority (ADIA), which raised $500 million in funding was ranked as the third top deal with MENA involvement by Refinitiv.

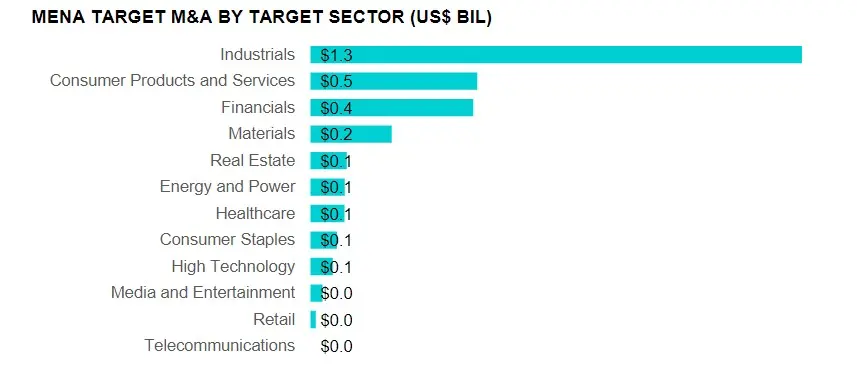

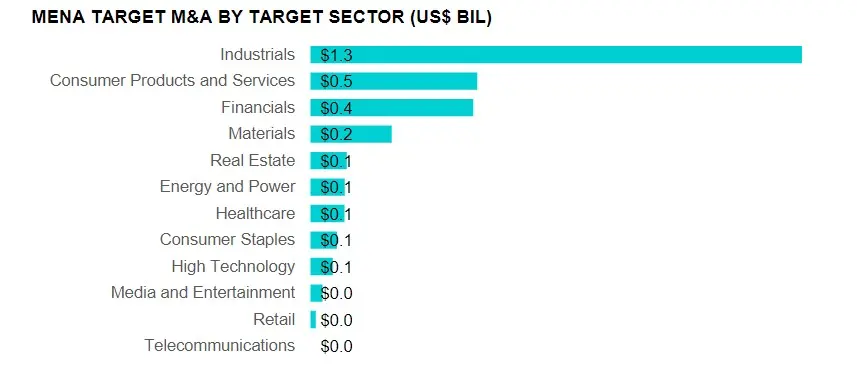

The industrials sector was most active, with deals targeting industrial companies accounting for 45% of MENA target M&A during Q1 2022, followed by the consumer products & services sector with 15%.

The Saudi Arabia was the most targeted nation, followed by UAE and Egypt.

Morgan Stanley topped the any MENA involvement announced M&A financial advisor league table during the first quarter of 2023.

(Reporting by Seban Scaria; editing by Daniel Luiz)