PHOTO

Dubai's private sector business conditions improved sharply in March as output increased due to new business intakes, according to a new business survey.

Meanwhile, confidence in future business activity rose to its highest since December, despite cost pressures triggered by rising energy, raw material prices.

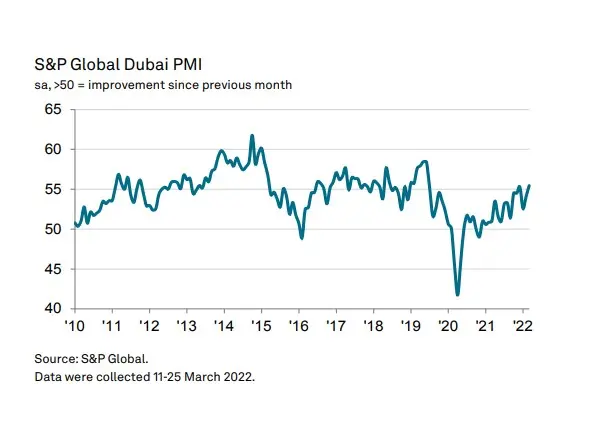

At 55.5 in March, the seasonally adjusted S&P Global Dubai Purchasing Managers' Index (PMI) was at its highest level since June 2019, rising from 54.1 in February and for the second month in a row.

According to the index, the non-oil private sector improved sharply, and to a greater extent than seen on average over 12 years of survey data.

The lifting of COVID-19 restrictions has created more economic activity in the market as well as tourism demand, which has in turn raised the confidence in the market. Subsequently, output levels expanded to the greatest degree since July 2019, with more than a quarter of firms seeing an uplift since February.

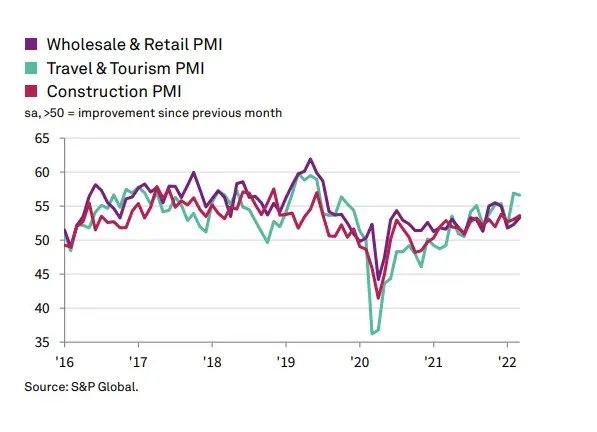

David Owen, Economist at S&P Global, said: "Output growth in both the travel & tourism and construction sectors also quickened to the highest since June 2019, with the latter driven by a strong drive among contractors to complete outstanding projects. Wholesale & retail activity likewise rose to a greater extent than in February."

Overall, inventories rose for the first time since November last year, although the rate of accumulation was mild.

The build-up of stocks was mainly due to decreasing supplier lead times, which also lead to the longest sequence of improving vendor performance since the middle of 2020, the S&P Global Dubai PMI survey noted.

There was only a marginal uplift in employment levels, while the rate of cost inflation was the fastest seen in the year-to-date.

Selling prices were reduced again as firms mentioned offering lower charges and promotions to support the recovery in sales.

"The global surge in commodity prices due to the war in Ukraine had an impact on Dubai businesses during March, with costs rising at the quickest rate in three months. While some firms opted to pass these expenses onto clients, the urge to support sales growth meant that average selling prices continued to fall," Owen said.

(Reporting by Seban Scaria; editing by Daniel Luiz)