PHOTO

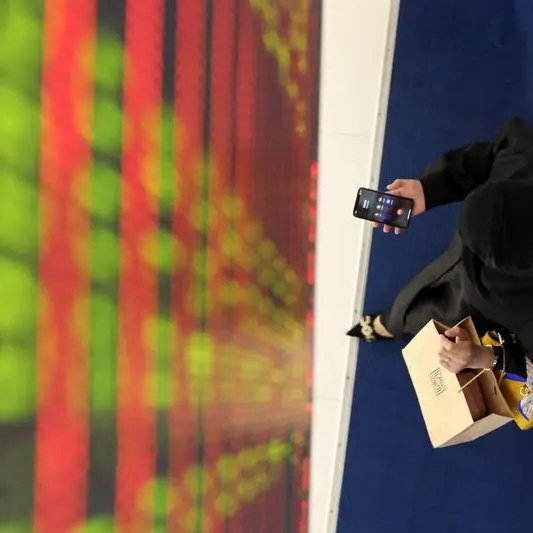

Dubai Investments, a UAE-based multi-asset investment group, is going for an IPO and will list up to 25% of its subsidiary, Dubai Investments Park.

Dubai Investments is currently in talks with banks.

The parent company, which is listed on the Dubai Financial Market (DFM), reported its Q2 profit before tax of 361.39 million UAE dirhams ($98 million) for the period ending June 30.

Launched in 1997, DIP is a mixed-use master community spread over three zones: industrial, commercial and residential across 2300-hectares and over 4,200 companies, according to its website.

In recent months, the UAE has seen a series of IPOs from companies in the real estate and construction sectors.

Earlier this week, Alec Holdings announced it would float 20% of its share capital with a listing on DFM on or around October 15.

On Tuesday, Bloomberg reported Dubai developer Binghatti Holding was also exploring a potential IPO.

In May, Dubai Holding's Dubai Residential REIT, a Shariah-compliant income-generating closed-ended real estate investment fund, raised AED 2.14 billion from its IPO.

(Writing by Bindu Rai, editing by Seban Scaria)