PHOTO

Kuwait: Coinbase Global, Inc. (Coinbase) leads the top GCC M&A transactions during H1 2025 as per a report recently issued by the Investment Banking Department at Kuwait Financial Centre “Markaz”. The report highlights the USD 2.9 billion transaction that was announced by the American company whereby it revealed its plans to fully acquire Deribit FZE, the Dubai-based crypto derivatives exchange. The transaction marks the largest deal in the crypto industry to date.

In the second position, Group 42 Holding (G42) secured the second-largest transaction by finalizing its acquisition of the remaining 40% stake in Khazna Data Center Holdings Limited (Khazna) from Emirates Telecommunications Group Company (e&), valued at USD 2.2 billion. Established in 2022 by G42 and e&, Khazna is a leading developer and operator of wholesale data centers. Warba Bank took on the following transaction, acquiring 33% of Gulf Bank through the full acquisition of Alghanim Trading Company for a total transaction value of USD 1.6 billion. After the acquisition, Warba Bank and Gulf Bank have begun assessing a potential merger between the two banks to establish a larger shariah-compliant financial institution. Moreover, CVC DIF and National Central Cooling Company have formed a 50:50 joint venture to acquire 100% of PAL Cooling Holding L.L.C. (PAL) for a total consideration of approximately USD 1.0 billion. PAL is a leading district cooling provider in the UAE that delivers services to residential, commercial, and mixed-use developments. Lastly, ACWA Power has acquired stakes in power generation and water desalination assets in Kuwait and Bahrain from ENGIE for a total consideration of USD 693.0 million. The assets include stakes in Az-Zour North (Kuwait), Al Ezzel (Bahrain), Al Durr (Bahrain), and Al Hidd (Bahrain). The target entities own and operate gas-fired power plants with a combined capacity of 4.6 GW and water desalination facilities with a combined capacity of 1,114 thousand cubic meters per day.

GCC M&A Decline

According to Markaz’s report, the GCC market sealed a total of 72 transactions throughout H1 2025, which implies a decline of 22% year over year. United Arab Emirates claimed the lion’s share with 43 closed transactions, followed by Saudi Arabia closing a total of 15 transactions. Apart from Qatar and Oman, all other markets in the region saw a substantial year-over-year decline in their M&A activities.

Acquirers and Targets

Consistent with historical trends, most transactions completed in the first half of 2025 and 2024 were carried out by acquirers from the GCC. Specifically, during H1 2025, GCC acquirers took the lead, being responsible for a substantial 65% of the total completed transactions, leaving foreign acquirers with a 33% share. GCC acquirers also dominated the market during H1 2024 as they accounted for 66% of the total number of closed transactions with foreign counterparts contributing a noteworthy 33%. The residual shares in H1 2025 and H1 2024 represents transactions where buyer information was not disclosed.

Furthermore, GCC acquirers primarily invested in companies within their local markets and in international markets, and targeted regional companies to a lesser extent. Throughout H1 2025, GCC acquirers closed a total of 41 transactions within their local markets, compared to 54 transactions in H1 2024[1]. In addition, GCC acquirers sealed 39 cross-border transactions throughout H1 2025, matching the cross-border transactions recorded in H1 2024. It's noteworthy that UAE buyers spearheaded the cross-border activity, representing approximately 71% of the total number of closed cross-border transactions, while Saudi Arabia and Kuwait followed, contributing 13% and 8%, respectively.

Foreign Buyers

Shifting focus, it is worth mentioning that GCC targets experienced a slight decrease in foreign buyer interest during this period. They concluded a total of 24 transactions, which was marginally lower than the 30 transactions in the preceding year, marking a 20% year-over-year decline. Notably, UAE targets continued to be the prime attraction for foreign buyers, finalizing 19 transactions in the first half of 2025.

Sectorial View

Moreover, the deals concluded in the first half of 2025 were directed towards companies spanning diverse sectors, emphasizing a consistent trend observed in recent periods. That said, the Consumer Discretionary, Financials, Industrials, Education, and Information Technology sectors stood out as the most active, collectively contributing to 58% of the transactions completed during this period.

Deals in the Pipeline

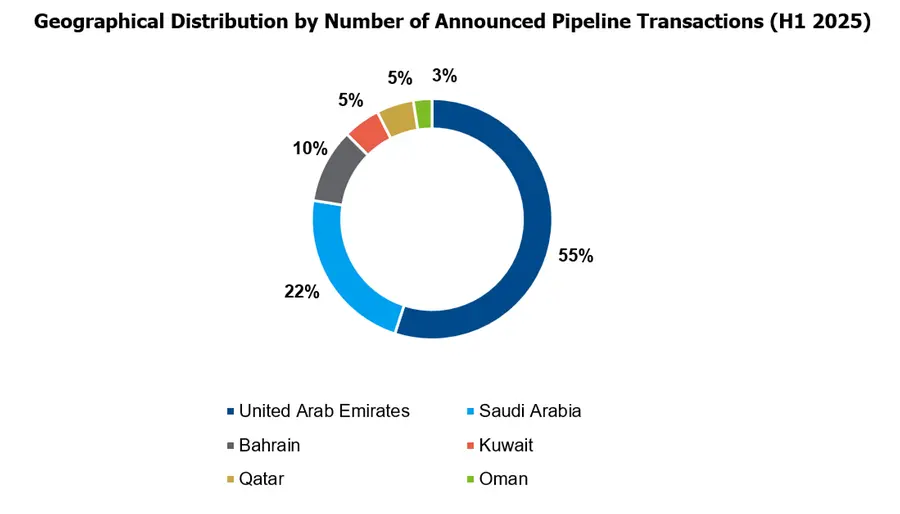

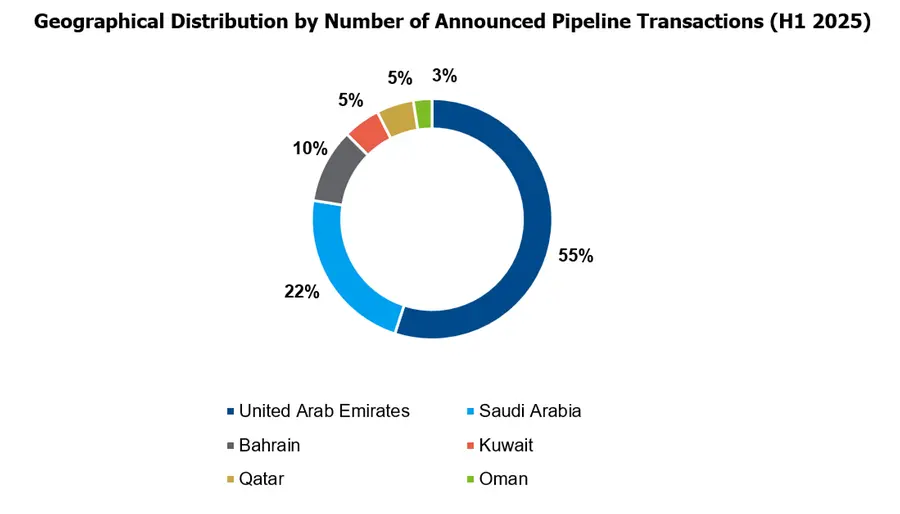

By the end of H1 2025, there were a total of 40 announced transactions in the pipeline, marking a substantial reduction compared to the preceding year when the pipeline saw a total of 55 announced transactions. The majority of these transactions involved United Arab Emirates targets, who accounted for 55% of the total number of announced deals, followed by Saudi Arabia and Bahrain at 23% and 10%, respectively. The remaining transactions involved Kuwaiti, Qatari, and Omani targets. All regions witnessed zero to negative growth in H1 2025 compared to the prior year.

Top 5 M&A Deals by Reported Value* – H1 2025

| Target Company | Target Country | Buyer | Buyer Country | Percent Sought | Deal Value (USDmn) | Status |

| Deribit FZE | United Arab Emirates | Coinbase Global, Inc. | United States | 100 | 2,900 | Announced |

| Khazna Data Center Limited | United Arab Emirates | Group 42 Holding Limited | United Arab Emirates | 40 | 2,200 | Closed |

| Gulf Bank** | Kuwait | Warba Bank | Kuwait | 33 | 1,615 | Closed |

| PAL Cooling Holding L.L.C. | United Arab Emirates | CVC DIF; National Central Cooling Company | United Arab Emirates | 100 | 1,030 | Announced |

| ENGIE's shares in Oil Fields in Bahrain & Kuwait | Bahrain*** | ACWA Power Company | Saudi Arabia | 100 | 693 | Closed |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Markaz Analysis

*Top deals were chosen based on transactions, which had all necessary information provided.

**Warba Bank acquired 100% of Alghanim Trading Company which owns 33% in Gulf Bank.

***The target includes assets in Kuwait

Number of Closed GCC M&A Transactions*

| Country | H1 2025 | H1 2024 | % Change (YoY) |

| Bahrain | 4 | 4 | - |

| Kuwait | 1 | 4 | -75% |

| Oman | 4 | 1 | 300% |

| Qatar | 5 | 2 | 150% |

| Saudi Arabia | 15 | 28 | -46% |

| United Arab Emirates | 43 | 53 | -19% |

| Total | 72 | 92 | -22% |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Markaz Analysis

Classification of Deals by Sector – H1 2025

| Sector | GCC Acquirers | Foreign Acquirers | Other* | Grand Total | %** |

| Consumer Discretionary | 6 | 4 | 0 | 10 | 14% |

| Financials | 6 | 4 | 0 | 10 | 14% |

| Industrials | 3 | 5 | 0 | 8 | 11% |

| Education | 5 | 2 | 0 | 7 | 10% |

| Information Technology | 5 | 2 | 0 | 7 | 10% |

| Energy | 5 | 0 | 1 | 6 | 8% |

| Healthcare | 4 | 0 | 0 | 4 | 6% |

| Insurance | 3 | 1 | 0 | 4 | 6% |

| Consumer Staples | 1 | 2 | 0 | 3 | 4% |

| Real Estate | 3 | 0 | 0 | 3 | 4% |

| Communication Services | 2 | 0 | 0 | 2 | 3% |

| Materials | 1 | 1 | 0 | 2 | 3% |

| Media & Entertainment | 0 | 2 | 0 | 2 | 3% |

| Professional Services | 1 | 1 | 0 | 2 | 3% |

| Utilities | 2 | 0 | 0 | 2 | 3% |

| Total | 47 | 24 | 1 | 72 | 100% |

*Other refers to deals where buyer information is not available.

**Totals may exceed 100% due to rounding.

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.56 billion (USD 5.11 billion) as of 30 June 2025. Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics and help Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund in Kuwait), Forsa Financial Fund (the first options market maker in the GCC since 2005), and the GCC Momentum Fund (the first passive fund of its kind in Kuwait and across GCC that follows the momentum methodology), all conceptualized, established, and managed by Markaz.

For further information, please contact:

Sondos Saad

Corporate Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com

[1] Local transactions refer to those whereby a GCC company acquires a target within their respective country (i.e. Kuwaiti company acquires Kuwaiti companies, Saudi company acquires Saudi company, etc.)