PHOTO

Dubai's industrial property market may have pent-up demand from ecommerce firms looking for huge new units and institutions willing to fund their construction, but lease structures in the emirate has meant that it has missed out on the wave of investment seen in the sector in other parts of the world.

A Dubai Industrial Market report issued by property consultancy Savills on Tuesday highlighted the fact that the “primary new occupiers” of warehousing space are ecommerce brands and the third-party logistics providers who serve that market. It also pointed to research done by Dubai South, the huge masterplanned site that includes Dubai's Al Maktoum Airport and a logistics district, which suggests the ecommerce market is set to grow at a compound rate of 30 percent over the next four years to become a $29 billion sector serving the wider MENA region by 2022.

Moreover, although institutional investor interest in the sector for properties with international tenants has "spiked" in the United Arab Emirates in recent months, it also states that transaction volumes have been low. Globally, investors have investing ever greater sums of cash into industrial property in recent years. Earlier this month, Blackstone Group, which owns a majority stake in Zawya's parent company, Refinitiv, bought 179 million sq ft of warehousing space in the United States from funds managed by Singapore-based GLP for $18.7 billion.

James Lynch, head of industrial and logistics in Savills' Dubai office, told Zawya in a telephone interview that although there is institutional interest in the local industrial property sector, "to date, the volumes of transactions have been low, predominantly because either… the building, or the nature of the leaseback, hasn't been attractive enough".

“An institution might be looking for a 10-year lease and here in the region our leases are sub-5 years - 3-5 years typically. So while there's interest in the sector there hasn't been that many transactions of note to date,” he said.

E-commerce firms are typically looking for buildings with huge floorplates for ‘fulfilment centres’, with noon.com and Jollychic both leasing units of around 200,000 square feet and Amazon leasing a 300,000 sq ft unit in recent years.

"There's not many facilities of that 200,000 sq ft available at all, and what is available still doesn't match that global standards they might have in Europe or the U.S. They will all be looking at a build-to-suit solution,” Lynch said.

Size matters

He added that Amazon's typical fulfilment centre in other parts of the world is around 500,000 sq ft but “there's nothing available” of that size locally.

Savills is also expecting industrial property demand to benefit from increased Chinese investment in Dubai, following a series of announcements regarding proposed investments, and an agreement last year between The China Commodity City (CCC) Group and Dubi Wholesale City - the 30 billion dirham, 550 million sq ft project launched by Dubai ruler Sheikh Mohammed Bin Rashid al Maktoum in 2016.

Lynch said that Chinese investment “will have a positive impact on both logistics and the manufacturing sectors”.

He said that currently, Chinese companies' operations are pocketed across Dubai, but that the areas he expected to benefit most from further investment were Dubai South, Dubai Investments Park and Dubai Industrial City, as well as the Khalifa Industrial Zone in Abu Dhabi (Kizad), following a series of agreements with Chinese companies - the latest being a Memorandum of Understanding between Abu Dhabi Ports and East Hope Group in May which could see the Shanghai-based developer invest $10 billion into industrial facilities at Kizad.

“You would like to think that this is going to be a UAE-wide positive,” Lynch said.

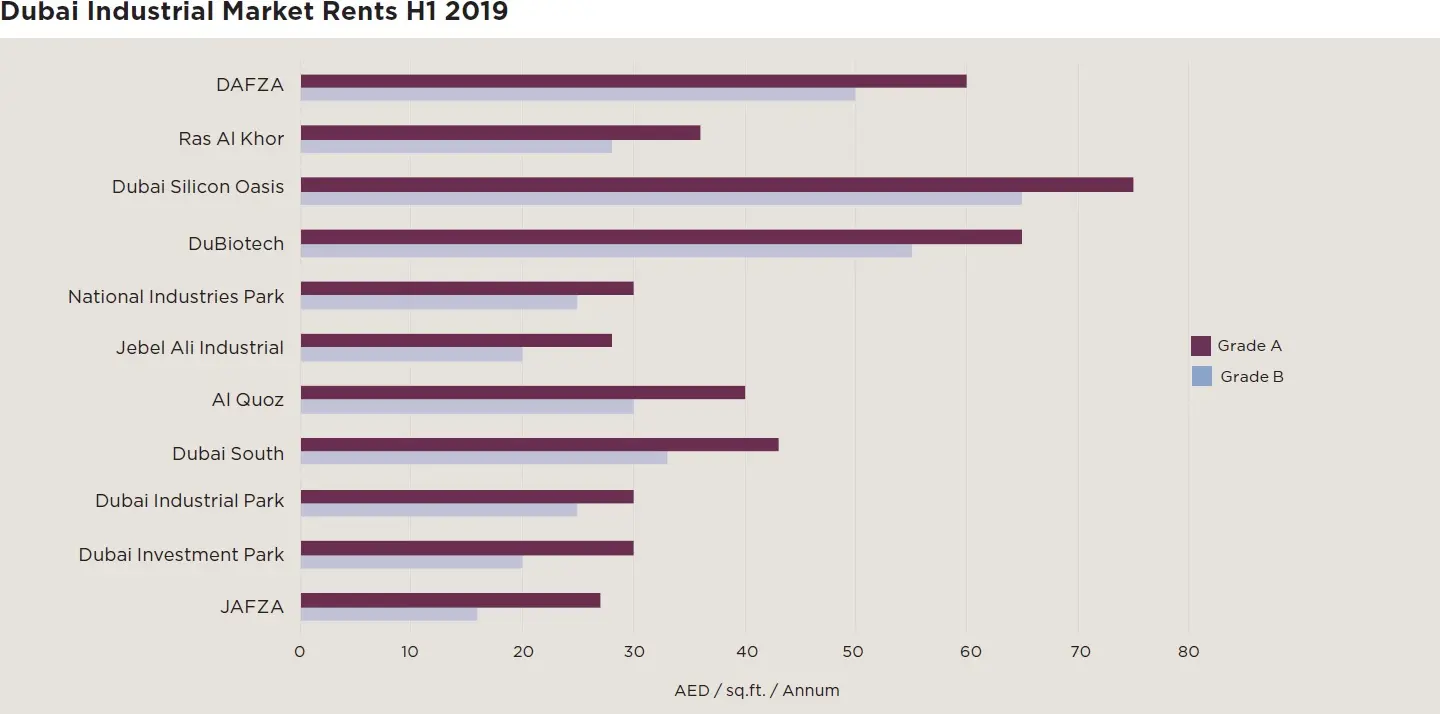

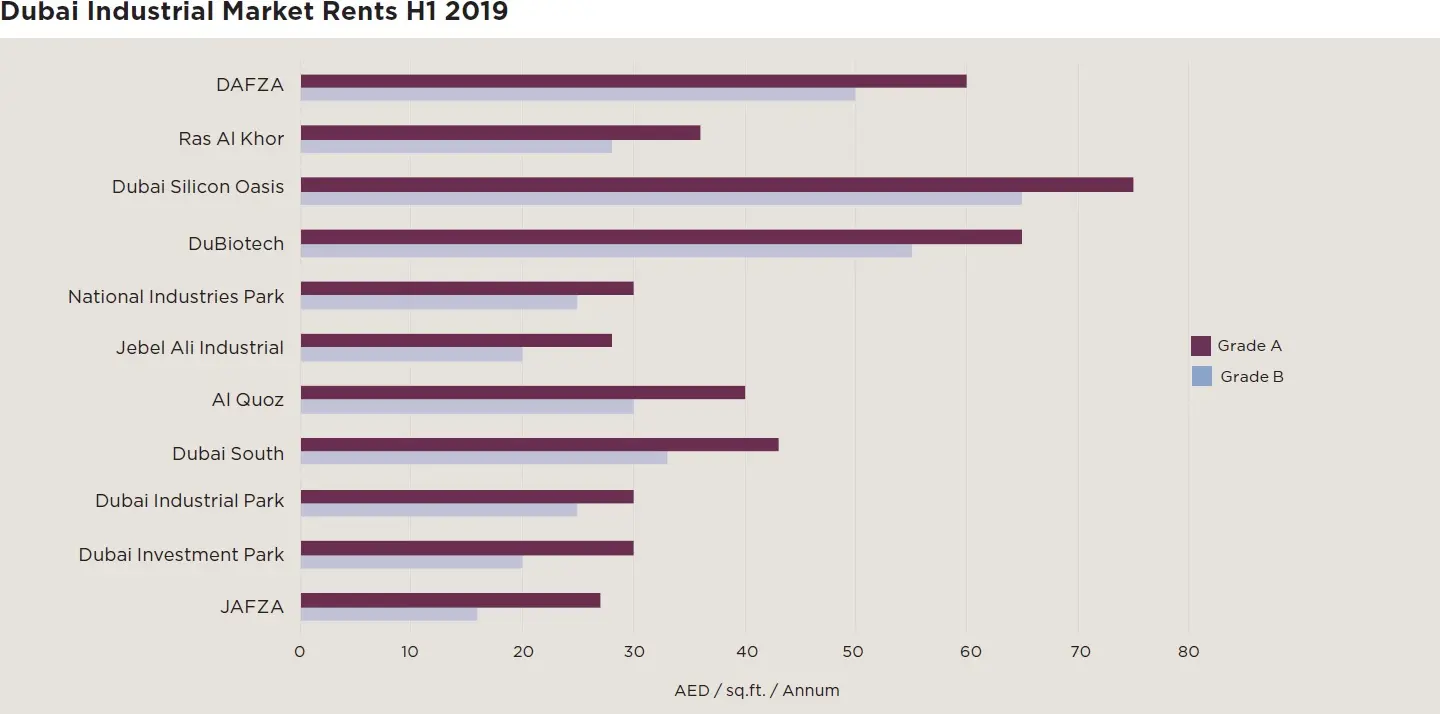

Source: Savills.

(Writing by Michael Fahy; editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019