PHOTO

- Brent oil and U.S. WTI prices rise

- China’s economic growth boosts Asian stocks

- Tadawul’s index gains 0.6 percent

- Dollar remains unchanged, gold prices dropped

Oil prices

Oil prices rose in early trading on Wednesday as data from the National Bureau of Statistics showed that China’s refinery throughput in March rose 3.2 percent from a year earlier to 53.04 million tonnes, or 12.49 million barrels per day (bpd).

International benchmark Brent crude oil futures rose 21 cents, or 0.29 percent, to $71.93 a barrel by 0319 GMT. Brent gained as much 0.5 percent to 72.08 a barrel, the highest since November 8 and the highest this year.

U.S. West Texas Intermediate (WTI) crude futures were at $64.45 per barrel, up 40 cents, or 0.6 percent from their previous settlement.

“Crude oil futures edged up as market sentiments were buoyed by a surprise drawdown in U.S. crude oil inventories and tighter market fundamentals in the current term,” Benjamin Lu, commodities analyst at Singapore-based brokerage Phillip Futures, told Reuters.

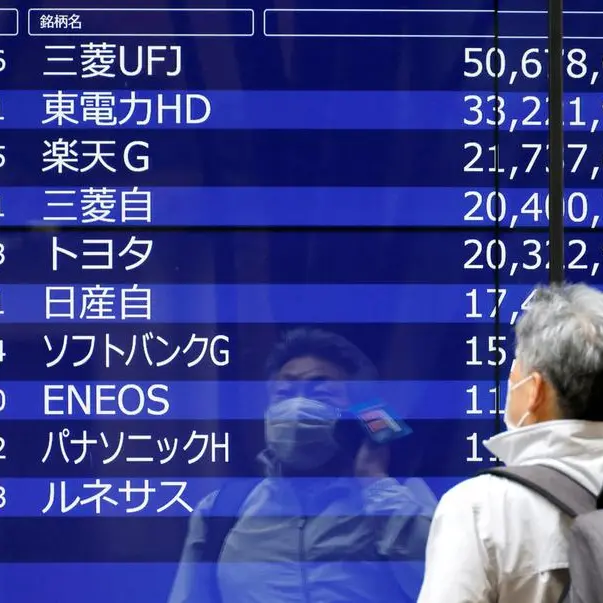

Global markets

Asian shares rose as China’s first-quarter economic growth reached 6.4 percent.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.2 percent to near its highest since July.

China’s industrial output surged 8.5 percent in March from a year earlier, blowing away forecasts of a 5.9 percent increase. Retail sales also pleased with a rise of 8.7 percent.

“This suggests that policy measures introduced by Chinese officials last year are now bearing fruit,” Rodrigo Catril, a senior forex strategist at National Australia Bank, told Reuters.

“We had positive surprises on credit data and housing data last week and now GDP has come in better than expectations, which is building the case that a recovery is on the way,” he added. “We see the revival of the Chinese economy as a necessary condition for an improvement in global growth outlook.”

Middle East markets

Saudi Arabia’s index gained 0.6 percent on Tuesday with Saudi Arabian Mining adding 3.8 percent and Alinma Bank gaining 3 percent.

In Dubai, the index slipped 0.5 percent, weighed down by real estate shares. Emaar Properties dropped 2 percent while DAMAC Properties shed 1.5 percent.

The Abu Dhabi index was down 0.2 percent, easing back from a near five-year high touched in the last session.

Qatar's index was up 0.4 percent with blue-chip petrochemical maker Industries Qatar gaining 0.9 percent.

Egypt’s EGX30 dropped 0.6 percent, Kuwait’s premier market index gained 0.8 percent while Oman’s index dropped 0.7 percent and Bahrain’s index edged 0.1 percent higher.

Currencies

The dollar was mainly unchanged early on Wednesday.

The dollar index, which measures the greenback against a basket of six major currencies, was flat at 96.991.

Precious metals

Gold prices edged lower on Wednesday.

Spot gold was down 0.1 percent at $1,286.38 per ounce, as of 0104 GMT. In the previous session, the metal sank to $1,272.70, its lowest since Dec. 27.

U.S. gold futures edged up 0.1 percent to $1,278.10 an ounce.

(Reporting by Gerard Aoun; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019