Global salary increases forecast to be the highest in three years however lower oil prices have impacted the outlook in the Middle East

Real wage increases in the GCC forecast at 2.3 per cent

Some organisations are looking to freeze pay at its current level in an effort to minimize costs

LOS ANGELES, Dec. 8, 2015

A forecast issued today by Korn Ferry (NYSE: KFY), the preeminent global people and organizational advisory firm, reveals that workers around the world are expected see real wage increases of 2.5 per cent - the highest in three years - as pay increases combine with historically low inflation to leave employees better off.

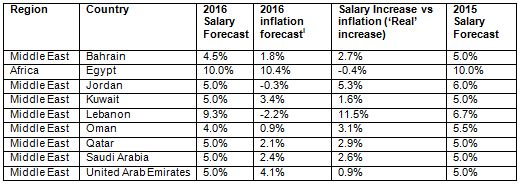

In the Middle East, the forecast is more sombre as businesses focus on driving profitability by minimizing their fixed costs, including salaries. In the Gulf Cooperation Council (GCC) countries, workers can expect a real wage increase of 2.3 per cent, the lowest of these being the UAE where salaries are expected to increase by 0.9 per cent, once inflation is taken into account.

Vijay Gandhi, Regional Director for Productized Services at Hay Group said: "As 2015 draws to a close we can look back on a year of continued growth in GCC. However we have seen a gradual slow down, due primarily to lower oil prices which have impacted the economies in our region."

A focus on costs

The forecast appears positive for workers in the Middle East however plunging oil prices and economic and political uncertainty throughout the region is continuing to make an impact. Mr Gandhi explained: "There is a definite feeling of slow down in the market with around 15 to 20 per cent of companies now suggesting that they will introduce a pay freeze for 2016. We are already seeing some corrections in some key sectors including Real Estate, Luxury Retail, Financial Services and Oil and Gas Services."

"There is no doubt that there is a cloud of cautiousness in the UAE as businesses focus on restricting increases in fixed costs (including through the payroll), improving their profitability and top line revenue and restructuring to gain higher efficiency from their current staff. In addition to lower pay increases, we're expecting this to result in lower bonus pay outs than recent years," continued Mr Gandhi.

The impact of inflation

Organisations in the Middle East and Africa have forecast salaries to rise by 5.3 per cent and 6.5 per cent respectively. Relatively low inflation means that workers are set to see real wage increases of 3.8 per cent and 1.6 per cent.

In the Middle East, Jordan (5.3 per cent) is amongst the highest of real wage increases, with the UAE set to see the slowest real wage growth (0.9 per cent) - down from 2.8 per cent last year. High inflation in Egypt means it is the only country in the region set to see a cut in real wages (-0.4 per cent).

The war for executive talent continues

Executive talent is still in high demand across the GCC region with a shortage of key talent at the C-Suite level. Mr Gandhi says that businesses looking to retain their top employees are emphasizing long term incentive plans and creating enterprise value schemes that reward leaders over the longer term.

Mr Gandhi explained: "Long term incentives drive alignment with corporate goals and reward high performance. Our data shows that the fixed pay of executives is broadly competitive with the UK, Europe and Australia; however the total variable pay received significantly lags behind these markets. Going forward, we will see a bigger proportion of total executive remuneration at risk than we see today."

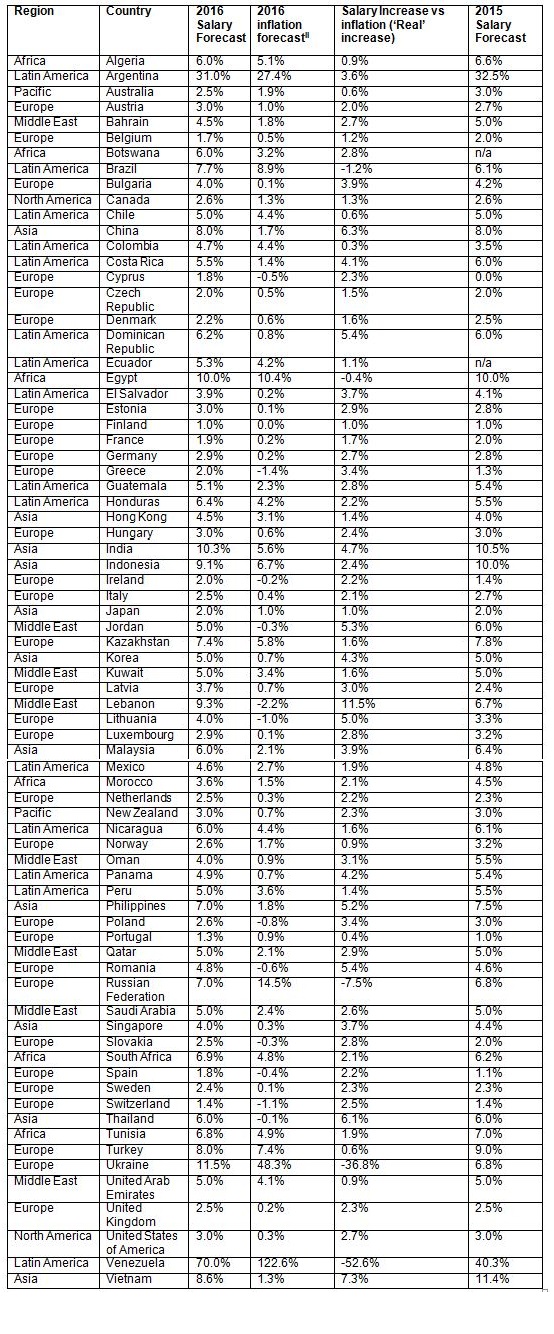

The global perspective

According to the Korn Ferry Hay Group forecast, the outlook remains positive in Europe where workers are set to see an average salary increase of 2.8 per cent in 2016, and with inflation at 0.5 per cent, they will see real wages rise by 2.3 per cent. Fuelled by a low inflation environment, those in Western Europe will see a 2 per cent increase in real wages compared to a 2.9 per cent increase in Eastern Europe.

Two outlier countries are excluded from the European averages, due to specific political issues causing high inflation which impacts real wage increases. Workers in Ukraine are forecast to see the biggest wage rises in Europe (11.5 per cent), but due to high inflation (48.3 per cent) real wages are set to drastically reduce by 36.8 per cent. The outlook is similar in Russia as the impact of economic sanctions and falling oil prices hit the economy. Despite an average salary increase of 7 per cent, with inflation at 14.5 per cent, real wages are set to fall by 7.5 per cent. This is significantly more than the 0.7 per cent decrease in real wages seen last year.

In Asia, salaries are forecast to increase by 6.4 per cent - down 0.4 per cent from last year. However, real wages are expected to rise by 4.2 per cent - the highest globally, despite China's economic slowdown. In fact, the increasing need for skilled workers and the sustained rise of the burgeoning middle class has resulted in a positive outlook for the Asian region.

Seeing the benefit of being a part of the fastest growing major economy, Indian workers are also forecast to see the highest real wage increase they have seen in the last three years, at 4.7 per cent compared to 2.1 per cent last year and 0.2 per cent in 2014.

This upward trend can also be seen in North America, where the labour market is buoyant. In the USA, with low inflation (0.3 per cent), employees will experience real income growth of 2.7 per cent. Canadian workers will meanwhile see salaries increase by 2.6 per cent and experience real wage growth of 1.3 per cent.

Economic turmoil is impacting workers in Latin America with high inflation (12.8 per cent) leading to real wage cuts of 1.4 per cent. However, Venezuela is set to suffer the most significant cut in real income across the globe. Salary increases are high at 70 per cent, but when predicted inflation is factored in (122.6 per cent), employees can expect real wage cuts of 52.6 per cent.

Average real wages increases are based on 73 countries in Hay Group's PayNet - excluding Ukraine and Venezuela, where political turmoil and high inflation have led to real wage decreases of 36.8 per cent and 52.6 per cent.

-Ends-

For further information on this story or to interview Vijay Gandhi please contact Megan Willis on +971(0)563 694 003 or megan.willis@haygroup.com

About the study

The data was drawn from Hay Group PayNet which contains data for more than 20 million job holders in 24,000 organizations across more than 110 countries.

It shows predicted salary increases, as forecasted by global HR departments, for 2016 and compares them to predictions made at this time last year regarding 2015. It also compares them to inflation predictions for 2016 from the Economist Intelligence Unit.

Summary of Salary Forecasts: Middle East Region

Summary of Salary Forecasts: Global Averages

About Korn Ferry

Korn Ferry is the preeminent global people and organizational advisory firm. We help leaders, organizations and societies succeed by releasing the full power and potential of people. Our nearly 7,000 colleagues deliver services through Korn Ferry and our Hay Group and Futurestep divisions. Visit kornferry.com for more information.

[i] Inflation rates, Economist Intelligence Unit

[ii] Inflation rates, Economist Intelligence Unit

© Press Release 2015