PHOTO

Saudi Arabia is undoubtedly the biggest Islamic finance market in the Middle East. The kingdom is now banking on its comparative advantages to lead the industry to a global level and expects them to bring economic progress and social prosperity, effectively contributing to Vision 2030.

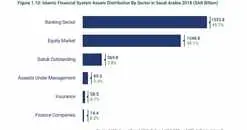

A new report form Islamic Research and Training Institute (IRTI) states that, by the end of 2018, Islamic finance assets in Saudi Arabia reached $879.2 billion (SAR 3,297 billion), making the kingdom the largest Islamic finance market globally among economies with dual financial systems comprising both conventional and Islamic financial sectors.

Saudi Arabia reiterates focus on Islamic finance

“Saudi Arabia is unquestionably a major hub of the Islamic financial industry not only in the Middle East, but also worldwide. With Vision 2030, and with an energetic and innovative youth population, Saudi Arabia has a great potential to lead the industry in the 21st century. Not surprisingly, Islamic finance is one of the key pillars of the Financial Sector Development Program set out by the Government of Saudi Arabia,” Dr Bandar Hajjar, President of the IsDB Group, stated.

IRTI launched the report titled “Islamic Finance in Saudi Arabia: Leading the Way to Vision 2030” alongside the G20 Summit that is being held in the kingdom.

Click image to enlarge

According to the report, Saudi Arabia could become a global leader in the Islamic financial services industry particularly by capitalizing on its distinctiveness in two areas:

1) Awq?f: As a spiritual destination for Muslims worldwide, the Kingdom offers favorable incentives and can benefit from sizeable opportunities in terms of investment and spending. Awq?f can be an ideal channel for investment as awq?f require sustainable income generation.

2) Small and Medium Enterprises (SMEs): Mobilizing resources for the SMEs through suk?k, equity, crowdfunding, and venture capital would give the Islamic finance industry an edge in innovation, diversity and economic impact. Since SMEs are the engine of job creation, investing in the SMEs sector is essential for sustainable economic growth.

The report further highlights the Saudi Arabia's actions in the area of digital transformation, evidenced by the formation of “Fintech Saudi” to act as a catalyst to develop the Fintech ecosystem alongside the vibrant regulatory sandbox set out by the kingdom’s monetary authority.

Dr Ahmed Abdulkarim Al kholifey, Governor of Saudi Arabian Monetary Authority (SAMA) said Islamic finance plays its part in reaching the economic and financial aspirations of the Financial Sector Development Program (FSDP) in terms of attractiveness and competitiveness of the Saudi financial sector.

SAMA plays an important role in incentivizing the contribution of the Islamic finance segment to sustainable economic development and job creation, he said, adding, a “sandbox regulatory environment” contributes to innovation in Islamic financial services industry in the kingdom.

The regulatory sandbox welcomes local and international firms that are willing to test new digital solutions in a ‘real’ environment with a view to deploying such solutions in Saudi Arabia in the future.

The monetary authority has been moving towards a cashless society by promoting electronic transactions. Employing NFC technology to make contactless payments using MADA cards or smart phones, enabling payment through QR codes and launching the “Esal” platform for B2B e-invoicing and payments as well as “MADA Online” were some of SAMA's major initiatives.

"The impact of these new technologies in the Saudi financial service market will be observed and assessed, through the sandbox, which encourages the transformation of the Saudi market into a smart financial center," Al Kholifey said.

SAMA has licensed 21 companies to operate within the sandbox and offer various services in the field of digital payments.

(Writing by Seban Scaria seban.scaria@refinitiv.com; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020