PHOTO

Investment banking fees generated in the Middle East and North Africa (MENA) reached an estimated $1.2 billion across the whole of 2020, down 12 percent from 2019 and representing the fourth-highest total since 2000, according to data from Refinitiv.

Advisory fees worth $441.2 million were earned from completed M&A transactions throughout 2020, up 12 percent from 2019 and the second-highest year in fees since 2000, second only to 2007 with $447.3 million, the global data provider noted.

Debt capital markets saw an increase in fees reaching a record $282.3 million, up 10 percent compared to 2019.

"This represents the highest annual fees total since our records began in 2000. Meanwhile, equity capital market underwriting fees declined 61 percent to $86.9 million, marking the lowest full-year equity fees total since 2016," Refinitiv said.

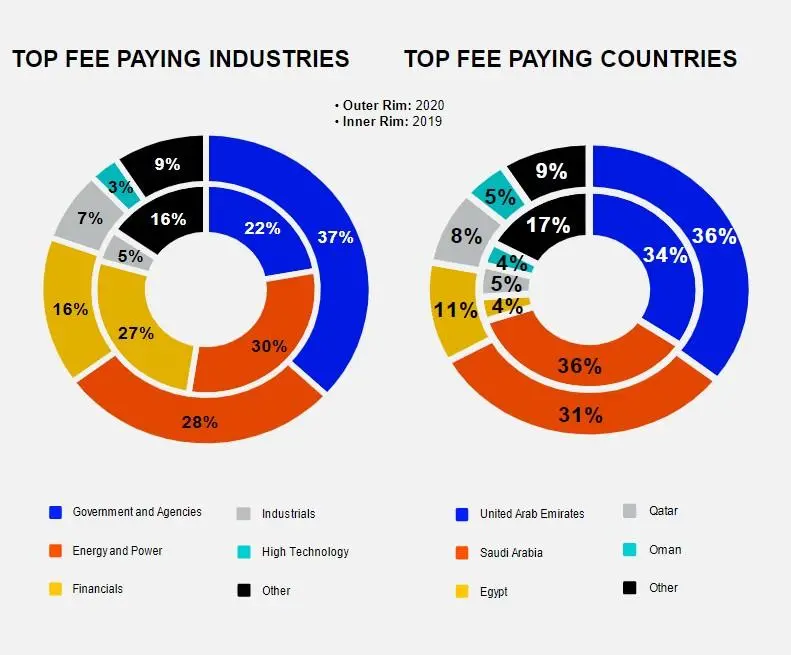

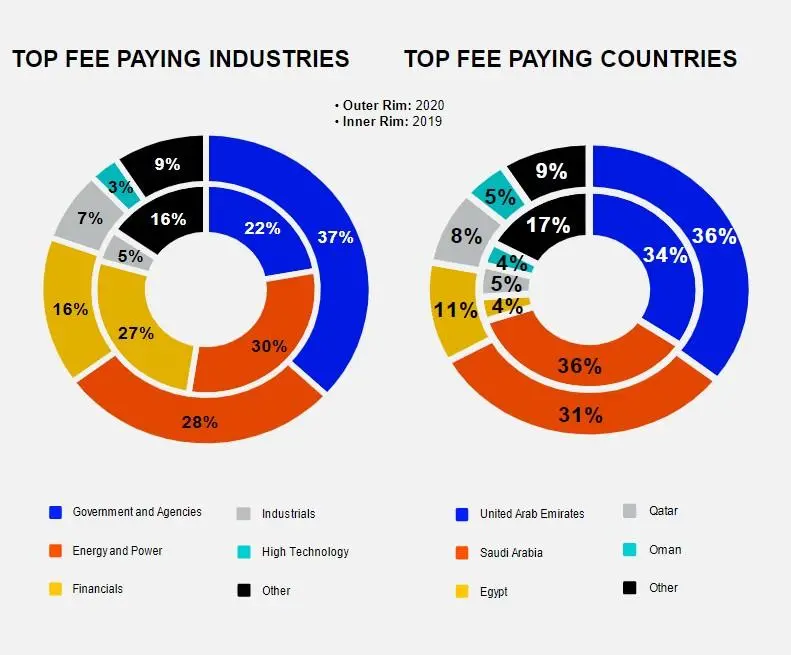

Syndicated loans also fell 8 percent to a three-year low of $410.4 million. Government and Agencies contributed the most fees with $450.7 million, representing 37 percent of total fees, up from 22 percent in 2019.

The UAE along with Saudi Arabia represented two-thirds of Investment banking fees in MENA generating $433.9 million and $382.9 million, respectively. HSBC earned the most investment banking fees in MENA during 2020, a total of $104.8 million or an 8.6 percent share of the total fee pool.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021