PHOTO

The first investment to be made from the $100 million financial technology (fintech) fund launched by Dubai International Financial Centre (DIFC) is set to be made "shortly", according to the centre's chief business development officer, Salmaan Jaffery.

Speaking to Zawya on the sidelines of the Funds Forum Middle East and Emerging Markets event in Dubai on Sunday morning, Jaffery said that he expects an initial investment to be made soon, but he declined to give a specific date on when this would be.

The $100 million fintech fund was announced by DIFC at its inaugural Global Financial Forum event in November last year. In the opening address at the Fund Forum Middle East event on Sunday, Jaffery said that the fund "is in the process of being seeded and structured as we speak".

Jaffery also highlighted upgrades to DIFC's regulatory technology (regtech) platform and its innovation and testing licence regime as other examples of DIFC’s fintech-friendly policies, pointing out that there are "close to 50" fintech companies already operating within the centre, and another 22 companies based in its accelerator, The Hive.

"All of that is designed to invest and put money where our mouth is and to recognise that the process by which money is going to be gathered and deployed is changing, and we are going to change with it," he said.

Jaffery also pointed to research commissioned by DIFC last year which stated that there is a funding gap for infrastructure investments in the Middle East, Africa and South Asia markets served by the centre that is estimated to be worth between $500 billion-$750 billion over the next 20 years by the region's young and fast-growing population.

“That presents long-term opportunities, and then the question is what is the form of capital and asset classes that funds and finances that?" Jaffery said. "There are a myriad of conversations on whether it should be PE (private equity), which will play a role but not fully, PPP [public-private parnterships], project finance etc," he said.

He argued that given such opportunities, "you have to be long this region".

"It's not a market for the impatient, it's not the market for investors necessarily moving in or out, but the business case for the region is very strong."

A publication issued by on Sunday the Institute of International Finance (IIF) on fintech in the region suggested that MENA is lagging other emerging markets in terms of investment.

"Excluding a single large deal in 2018, fintech investments (at all stages) in MENA amounted to only $120 million since 2010. As a comparison, in the same period, sub-Saharan Africa attracted $300 million and Latin America $1.7 billion, while emerging Asian economies (excluding China) captured $7.5 billion," the report said.

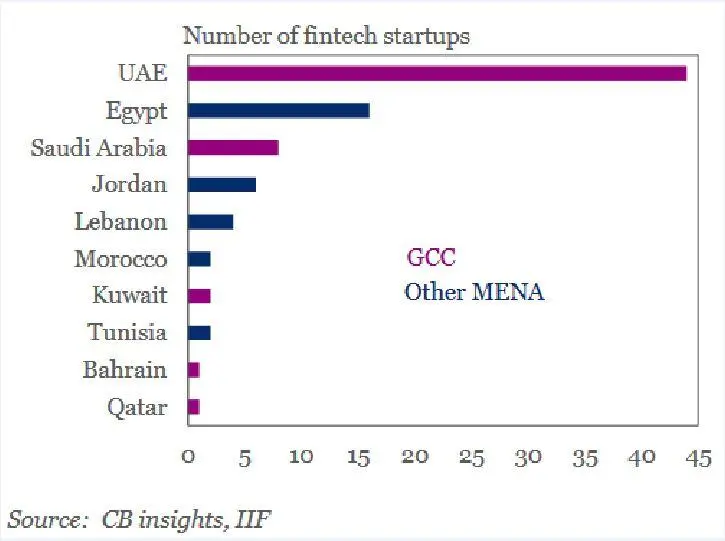

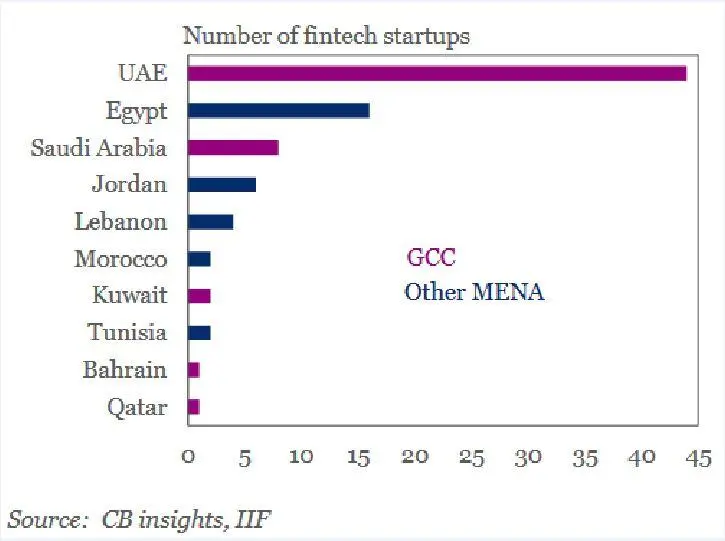

Despite this, it argued that the pace of fintech adoption in the region is accelerating, with the number of fintech companies in the MENA region growing from just 46 in 2012 to 145 at the end of 2016. The UAE was home to most of these, followed by Egypt and Saudi Arabia.

(Reporting by Michael Fahy; Editing by Shane McGinley)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018