PHOTO

- Indonesia jumped to second place in IFDI ranking backed by government knowledge initiatives

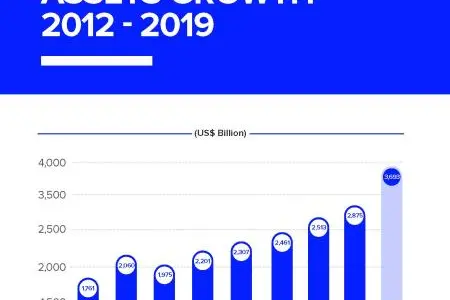

- Islamic finance assets increased 14 percent to US$ 2.88 trillion in 2019, the highest recorded growth for the industry since the global financial crisis

Saudi Arabia – Global Islamic Finance assets are forecast to reach USD 3.69 trillion by 2024, according to the 2020 Islamic Finance Development Report released today by Refinitiv and the Islamic Corporation for the Development of the Private Sector (ICD), the private sector development arm of the Islamic Development Bank (IsDB).

According to the report, global Islamic Finance assets increased by 14 percent year-on-year totaling USD 2.88 trillion in 2019. Islamic Finance assets of Gulf Cooperation Council (GCC) reached USD 1.2 trillion in 2019, followed by Middle East and North Africa (MENA) at USD 755 billion (excluding the GCC), and Southeast Asia at USD 685 billion.

The Islamic banking sector contributes the bulk of the global Islamic Finance assets. The sector grew 14 percent in 2019, equating to USD 1.99 trillion in global assets. This compares with just 1 percent growth in 2018 and an average annual growth of 5 percent over the period from 2015 to 2018.

According to the report, the top five developed countries in relation to Islamic Finance are Malaysia, Indonesia, Bahrain, UAE and Saudi Arabia. This year, Indonesia displayed one of the most notable improvements in the Islamic Finance Development Indicator (IFDI), moving into second place for the first time due to its high knowledge and awareness ranking.

David Craig, CEO of Refinitiv, said “A lack of relevant, actionable data has held back the Islamic finance industry for too long. That’s why the Islamic Finance Development Indicator is now such an important tool for policy makers and market participants. This market is worth nearly $3 trillion already and I’m excited about its future, particularly when it comes to Sukuk and because Islamic finance has so much in common with sustainable finance - one of the most significant trends in global business today.”

Ayman Sejiny, the CEO of ICD, said: “We believe that the analyses and information provided in this year’s report will serve as a vital reference point for the state of the Islamic finance industry during these difficult times and we remain convinced that Islamic finance can play a major role in alleviating the social and economic consequences of the COVID-19 pandemic.”

The report covers 135 countries and is based on five key metrics comprising of Quantitative Development, Knowledge, Governance, Awareness, and Corporate and Social Responsibility (CSR).

According to the report, Green and Socially Responsible Investments (SRI) increased in the UAE and Southeast Asia in 2020. The pandemic was a game changer as several Islamic banks reported losses and reduced profits throughout this year. The pandemic has also led to growth in some areas of the industry as some regulators turned to Islamic finance to mitigate the economic impact.

Corporate Sukuk issuance has also picked up after a cautious halt in the first quarter of 2020. The report indicates that companies are taking advantage of low borrowing costs to shore up their finances, while the pandemic continues to batter trade and economies.

Please click here to download the latest edition of the IFDI Report

Please click here to learn more about the indicator and the IFDI Database

Please click here to learn more about Refinitiv’s Islamic finance offerings

-Ends-

About Refinitiv

Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in over 190 countries. It provides leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community - driving performance in trading, investment, wealth management, regulatory compliance, market data management, enterprise risk and fighting financial crime.

About ICD

The Islamic Corporation for the Development of the Private Sector (ICD) is a multilateral development financial institution and is member of the Islamic Development Bank (IsDB) Group. ICD was established in November 1999 to support the economic development of its member countries through the provision of finance for private sector projects, promoting competition and entrepreneurship, providing advisory services to the governments and private companies, and encouraging cross border investments. ICD is Rated A2’ by Moody’s, ‘A’ by S&P and, A+ by Fitch. ICD establishes and strengthens cooperation and partnership relationships with an aim to establish joint or collective financing. ICD also applies financial technology (Fintech) to make financing more efficient and comprehensive.

About IFDI Islamic Finance Database

In addition to the report, Refinitiv Eikon offers accessibility to an exclusive Islamic finance database including over 1,400 Islamic financial institutions data covering $2.88 trillion Islamic finance assets. It includes the information of more than 400 Islamic banks, 300 takaful entities, 12,000 outstanding Sukuk, 1,300 Islamic funds and 500 other Islamic finance providers. It also includes information on the industry’s supporting ecosystem, consisting of more than 600 Islamic finance education providers, 800 Islamic finance institutions with corporate and Shariah governance data, 1,000 Shariah scholars data, 10,000 Islamic finance news titles and 400 Islamic finance events.

Contacts

Tarek Fleihan

Corporate Communications

Middle East, Africa, Central & Eastern Europe

Refinitiv

Office +97144536527

tarek.fleihan@refinitiv.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.