PHOTO

- Portfolio occupancy lower at 76%, robust in light of Covid-19 pandemic

- Annualised dividend of 11.2% of share price paid in July 2020

- Stable cash flows and a healthy cash position following FY dividend payment

- The REIT has taken advantage of lower interest rate environment to reduce cost of debt

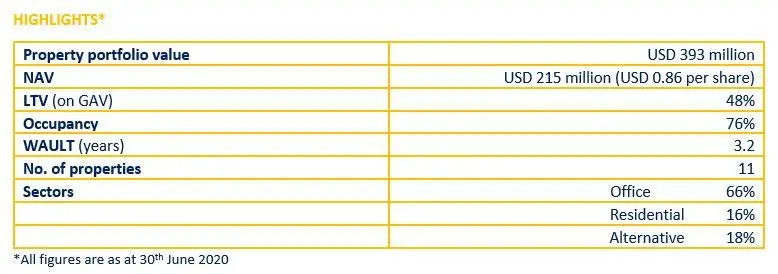

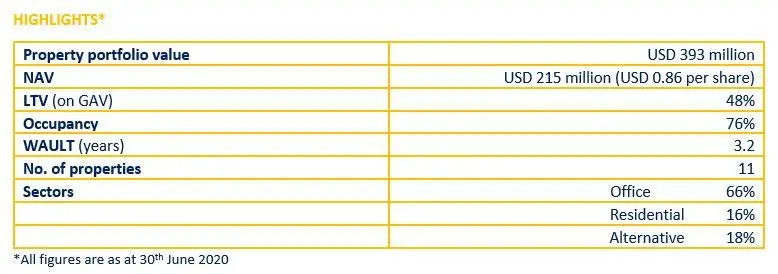

Dubai, United Arab Emirates: ENBD REIT (CEIC) PLC (“ENBD REIT”), the Shari’a-compliant real estate investment trust managed by Emirates NBD Asset Management Limited, has announced its Net Asset Value (“NAV”) for the first quarter ended 30th June 2020. ENBD REIT’s NAV stood at USD 215 million, as compared to USD 230 million for the previous quarter. The decline in NAV is largely attributed to pressure on portfolio valuations, mainly due to soft real estate market conditions and macroeconomic uncertainty around Covid-19. A leasing strategy to cater to tenants’ needs during the pandemic has helped to partially safeguard occupancy, but has not entirely mitigated the impact of challenging market conditions. As at 30th June, blended portfolio occupancy stood at 76%, declining from 82% in the previous quarter.

The REIT’s Loan to Value ratio (“LTV”) has increased to 48% from 44% in the previous quarter, following valuation losses and drawdown of USD 13.6 million (AED 50 million) earmarked for upgrades to certain assets in the portfolio. ENBD REIT remains fully in compliance with all its debt covenants, and recently secured a hedging agreement with Mashreq Bank – covering 56% of its total debt – to reduce and fix finance costs until June 2023. Despite market pressures, the REIT sustained stable cashflows throughout the first quarter, maintaining a sustainable cash position since payment of the USD 5.1 million final dividend in July 2020.

Anthony Taylor, Head of Real Estate at Emirates NBD Asset Management, said:

"Rental income from our portfolio is down on a year-on-year basis, mainly due to the relief measures that we have introduced for struggling tenants, along with lower occupancy in certain office and residential buildings. We have, however, been successful in managing down costs, with total expenses reduced by 20% compared to 30th June 2019, due to lower finance costs resulting from refinancing, reduced management fees, and active cost saving initiatives rolled out with service providers across our properties. Most recently, we have taken advantage of a lower interest rate environment to hedge our Shari’a-compliant debt facilities, fixing a significant portion of our debt, the REIT’s single largest cost, at lower levels for the future. We are now looking at important upgrades to certain assets, which will support our leasing efforts in 2020 and 2021.”

In response to the economic impact of Covid-19, ENBD REIT has been active in seeking solutions for tenants who are in genuine financial distress, thereby bolstering occupancy. To date, 71 tenants have engaged with management for rent relief, with USD 2.7 million (AED 9.8 million) offered as deferred payments. The impact of the pandemic on cash flow is anticipated to be in the region of 4-6% of the last financial year’s total revenue.

The total dividend paid to shareholders for the year ended 31st March 2020 was USD 10 million – equivalent to an annualised dividend return of 4.35% of the cum-dividend NAV, and 11.2% of ENBD REIT’s share price. As at 30th June 2020, the REIT’s Gross Asset Value (“GAV”) stood at USD 410 million, with the portfolio’s Weighted Average Unexpired Lease Term (“WAULT”) at 3.2 years.

-Ends-

For more information:

ENBD REIT (Investor Relations)

Mona Zahooruddin

ENBDREITIR@EmiratesNBD.com

+971 (0) 4 509 3034

Company Secretary

Jean Kenny Labutte

JeanK@apexfunddubai.ae

Apex Fund Services (Dubai) Ltd.

+971 (0) 4 428 9221

Instinctif Partners (Public Relations)

George Allen

George.Allen@instinctif.com

ABOUT ENBD REIT

ENBD REIT (CEIC) PLC (“ENBD REIT”) is a Shari’a compliant real estate investment trust managed by Emirates NBD Asset Management Limited (the “Fund Manager”), listed on Nasdaq Dubai under ticker ENBDREIT. ENBD REIT is a closed-ended investment company that was incorporated by the Fund Manager to invest in a diversified Portfolio of Shari’a-compliant real estate assets in the UAE. ENBD REIT has an unlimited duration and was established in the DIFC by the Fund Manager on 18 July 2016 under the Companies Law with the name “Emirates Real Estate Fund Limited” and with registration number 2209. The Fund subsequently changed its name to “ENBD REIT (CEIC) Limited” and later ENBD REIT (CEIC) PLC in line with the new DIFC Companies Law. ENBD REIT is categorised under DFSA law and regulations as a Public Fund, a Domestic Fund, an Islamic Fund, a Property Fund and a Real Estate Investment Trust (REIT). ENBD REIT has been established with the main investment objective of generating income returns and capital appreciation from real estate assets. ENBD REIT plans to achieve its objectives through the following strategies: (i) prudent acquisitions with a focus on achieving diversification; and (ii) active asset management and enhancement. For more information, visit: www.enbdreit.com

PORTFOLIO

Office:

Al Thuraya 1 (Dubai Media City)

A G+29-story high rise commercial tower, located at a prime location in Dubai Media City with views over Barsha Heights and Palm Jumeriah.

Burj Daman (DIFC)

Two and a half floors (the fund fully owns the 10th and 14th floors and half of the 15th floor) in the commercial portion of the tower in the DIFC.

DHCC 49 (Dubai Healthcare City)

G+5-story commercial complex located in the Dubai Healthcare City free zone.

DHCC 25 (Dubai Healthcare City)

G+6-story commercial tower located in the Dubai Healthcare City free zone

The Edge Building (Dubai Internet City)

A G+6-story fully leased, prime grade A office building recently constructed and located in the Dubai Internet City free zone. Oracle is the largest tenant occupying 85% of the office space.

Residential:

Arabian Oryx House (Barsha Heights)

A residential tower with 128 units in the free zone Barsha Heights, Dubai. Mainly comprises units of one, two and four-bed apartments.

Binghatti Terraces (Dubai Silicon Oasis)

A residential tower with 201 residential and 5 retail units in Dubai Silicon Oasis, constructed by developers with an established track record.

Remraam Residential (Dubailand)

Two residential towers offering 105 units in mainly 1 & 2-bedroom apartments

Alternative:

Uninest Dubailand (Dubailand)

A 424-bed student accommodation property located close to Dubai Academic City, serving students attending university across the city. 100% leased to global student accommodation provider, GSA.

South View School (Remraam)

A 132,000 sq. ft. British curriculum primary and secondary school operated by Interstar Education.

Souq Extra Retail Centre Phase 1 (Dubai Silicon Oasis)

Community centre in Dubai Silicon Oasis with over 36,000 ft² of gross leasable area, comprising 25 retail units fully let to blue-chip tenants.

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.