PHOTO

Mitsubishi Pajero takes the top spot for most insured model for 2019 year

In 2018, the highest number of car insurance claims were made in June, while fewest claims made in January

Dubai: Data from InsuranceMarket.ae, the UAE’s leading digital-first insurance service, has revealed the latest insights on car insurance, giving users some fresh insight when planning on purchasing a used or new car.

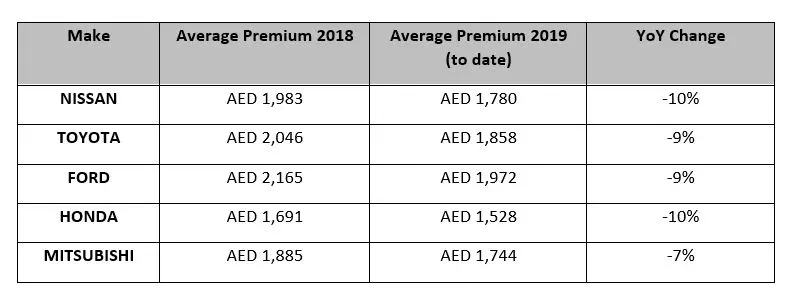

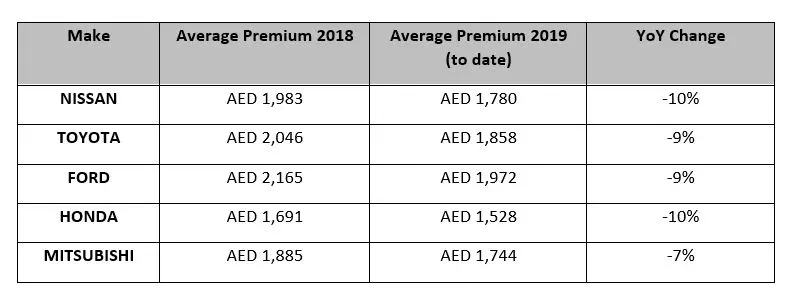

InsuranceMarket.ae released data showing Nissan, Toyota, Ford, Honda and Mitsubishi as the top five insured car brands in the UAE, with average premiums declining by an average of 9.5% in 2019 year-to-date, compared to the same period in 2018.

The Mitsubishi Pajero took the top spot for the most popular car model insured in the first half of 2019, overtaking the Nissan Tiida, and demonstrating the overwhelming popularity of SUVs in the UAE. In fact, three of the top five most popular car models insured so far this year are SUVs, with the Ford Edge and Ford Explorer being the fourth and fifth most popular models respectively. Toyota Corolla and Honda Civic make up the rest of the top five, as Nissan Tiida, Honda Accord and Nissan Sentra drop in popularity.

“Our data highlights an overall decline of 9.5% in premiums on average for car owners in the UAE. These cost savings likely reflect a reduction in traffic accidents this year as well as increasing efficiency in insurance distribution. Last year’s regulation from the UAE Insurance Authority introducing no-claims bonuses has also had an impact, as safer drivers begin to be rewarded with discounts on premiums for policyholders with claims-free records” commented Avinash Babur, CEO of InsuranceMarket.ae.

Other factors contributing to the decrease in premiums include market depreciation as new car sales slowed.

“As the process of purchasing used vehicles has become more accessible and convenient due to improved infrastructure, more people seem inclined to buy less expensive pre-owned cars, which in turn leads to lower insurance premiums” added Babur.

The study also revealed that the largest number of insurance claims are made over the summer months and during Ramadan. Last year 913 claims were made at InsuranceMarket.ae between May and August, and the least number of claims typically taking place in January with just 189 claims submitted.

Three quarters (75%) of InsuranceMarket.ae users opted for comprehensive insurance coverage rather than third party only insurance, recognizing the advantages of a policy that covers accidental damage to the policyholder’s own vehicle, as well as its liability to the public.

“As premiums continue to drop, we are seeing that customers are increasingly opting for comprehensive coverage to provide maximum protection and greater peace of mind. Comprehensive cover protects the policyholder against any damages caused due to theft, accident or fire in addition to providing cover against third-party insurance, meaning you may be covered for all car insurance eventualities,” said Babur.

“Generally, if you own a high-end car, whether new or used, it is a good idea to have a comprehensive cover. You can also choose additional optional covers such as agency-repair, which ensures the repair of vehicles being done by the manufacturer authorised workshops, helping to keep the resale value high and retaining the vehicle’s warranty.”

To find out more about car insurance, visit insurancemarket.ae to get your insurance in three easy steps.

-Ends-

All statistics are based on InsuranceMarket.ae customer data only

About InsuranceMarket.ae:

InsuranceMarket.ae is the market-leading digital proposition by AFIA Insurance Brokerage Services where individuals and companies can easily compare and buy all types of insurance through the assistance of personal shoppers and a seamless transaction process. Policyholders of InsuranceMarket.ae enjoy the lowest prices from all the leading insurers in the UAE along with a commitment to have their claim conveniently and professionally mediated by a dedicated claims manager in the unfortunate event of an insured incident.

© Press Release 2019

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.